The average daily trading volume of the XRP token has surged in the second quarter of the year, despite the ongoing legal dispute involving its largest player Ripple and the U.S. Securities and Exchange Commission (SEC).

According to an XRP market report published by Ripple, the daily trading volume of the cryptocurrency doubled to $4.49 billion per day on average, up from $2.26 billion recorded during the first three months of the year.

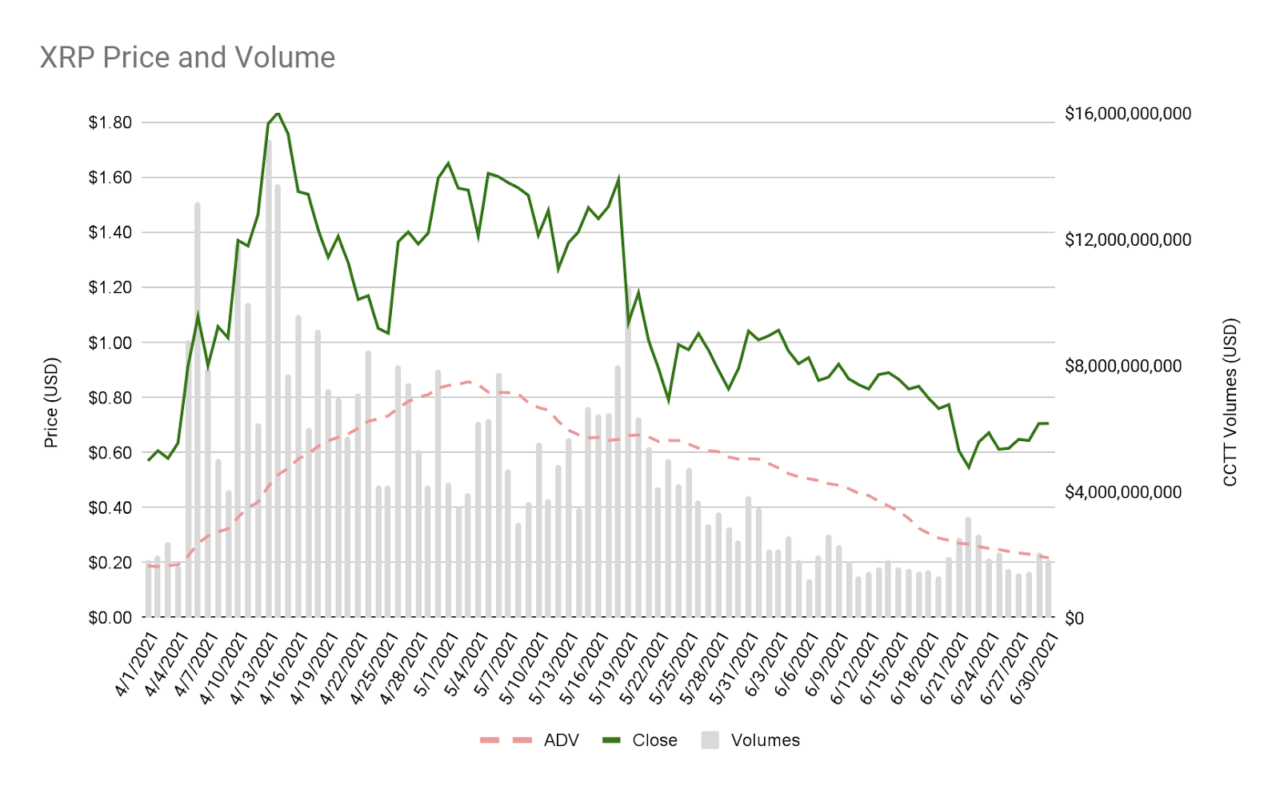

XRP’s trading volume surged during the quarter amid heightened volatility in the market, which saw the prices of most cryptocurrencies initially surge along with bitcoin, which hit a new all-time high near $64,000 earlier this year, before plunging to less than $30,000. It has since then recovered and is now hovering around $40,000.

Similarly, the price of XRP high a $1.83 high before plunging to a $0.5 low this quarter. The cryptocurrency’s price then recovered and is now trading at $0.72.

Ripple acknowledged that despite the trading volume increase, XRP’s price was rather volatile, as was the rest of the cryptocurrency market. Behind the volatility, Ripple pointed to an umber of events, including “ransomware attacks, environmental concerns, Elon Musk’s tweets and regulatory scrutiny, among others.

The firm sold a total of $157.92 million worth of XRP during the second quarter of the year, up from $150.34 million in the first quarter. Ripple pointed out that regulatory crackdowns from several jurisdictions impacted the cryptocurrency market, as did high inflation expectations in the economy.

The cryptocurrency’s price and trading volumes have been holding despite the SEC’s lawsuit against Ripple and two of its executives. The SEC’s lawsuit alleges they “raised over $1.3 billion through an unregistered, ongoing digital asset securities offering.”

It initially negatively impacted the price of XRP, as after the lawsuit was announced most cryptocurrency exchanges started delisting the token to avoid any repercussions, affecting its liquidity. Some exchanges, however, sided with Ripple on the lawsuit, arguing that the SEC’s move hurt XRP investors.

Ripple itself has argued the lawsuit “already affected countless innocent XRP retail holders with no connection to Ripple.” It added it “muddied the waters for exchanges, market makers, and traders.” The firm’s CEO Brad Garlinghouse has said the fintech firm is highly likely to go public after it settles its lawsuit with the regulator.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Pixabay