U.S. Economy

Trump’s Economic Plans Could Add $15 Trillion to U.S. Debt, Studies Warn: Report

- CryptoGlobe Writer

- /

- 7 Oct 2024

A pair of recent studies suggest that former President Donald Trump’s economic proposals may dramatically raise the U.S. debt and lead to higher costs for most Americans, according to a report by Andrew Duehren and Alan Rappeport for The New York Times (NYT). The Committee for a Responsible Federal Budget (CRFB) estimates that Trump’s plans […]

BlackRock’s Rick Rieder on Why the Fed Must Keep Cutting Rates Despite a Strong September Jobs Report

- Siamak Masnavi

- /

- 4 Oct 2024

The U.S. economy continues to surprise analysts, as the September 2024 jobs report showed far stronger-than-expected job growth. According to a report by CNBC, nonfarm payrolls surged by 254,000, surpassing the Dow Jones forecast of 150,000, while the unemployment rate fell to 4.1%. Despite this strong data, Rick Rieder, BlackRock’s Chief Investment Officer of Global […]

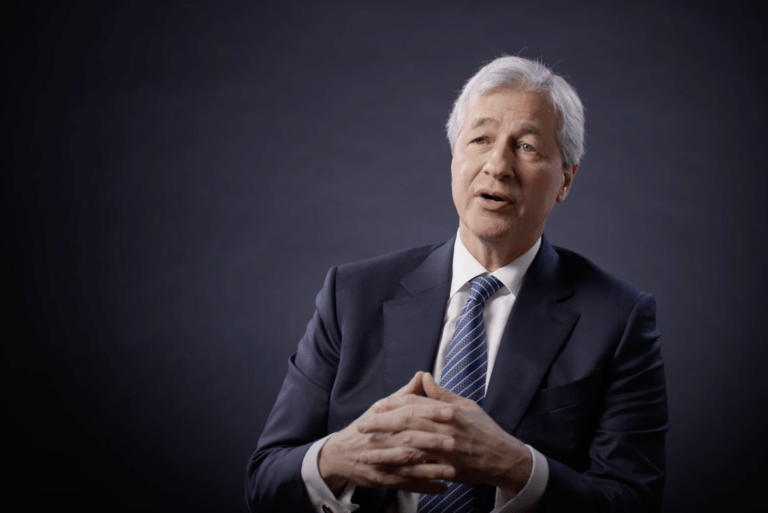

JPMorgan Chase CEO Jamie Dimon Says a Soft Landing for the U.S. Economy Is Unlikely

- CryptoGlobe Writer

- /

- 22 Sep 2024

At the Atlantic Festival held in Washington, D.C., on September 19-20, 2024, Jamie Dimon, Chairman and CEO of JPMorgan Chase, shared his thoughts on the current state of the economy and political climate. Dimon addressed a variety of topics, focusing on the broader economic environment, corporate responsibility, and the role of leadership in navigating uncertainty. […]

Was the Fed’s Large Rate Cut Designed to Gift Kamala Harris the U.S. Presidency?

- CryptoGlobe Writer

- /

- 21 Sep 2024

In the wake of the Federal Reserve’s recent decision to cut interest rates by half a percentage point, speculation has arisen among some Republicans over whether the move was politically motivated to favor Vice President Kamala Harris’s presidential campaign. Some have questioned whether the rate cut was timed to make the economy appear stronger and […]

Fed Chair Jerome Powell Announces Major Rate Cut as U.S. Inflation Drops Sharply; What Now?

- CryptoGlobe Writer

- /

- 18 Sep 2024

Federal Reserve Chair Jerome Powell, during his 18 September 2024 press conference, emphasized the Fed’s commitment to achieving its dual mandate of maximum employment and stable prices. Powell highlighted the significant progress the U.S. economy has made, particularly in reducing inflation, which has dropped from a peak of 7% to an estimated 2.2% as of […]

Billionaire Ray Dalio Warns of Soaring U.S. Debt, Geopolitical Tensions, and Tech Wars Between Nations

- CryptoGlobe Writer

- /

- 18 Sep 2024

At the Milken Institute’s Asia Summit in Singapore, billionaire hedge fund manager Ray Dalio outlined five key forces driving the global economy today, noting their cyclical and interconnected nature, according to a report by Lee Ying Shan for CNBC. Speaking ahead of the U.S. Federal Reserve’s much-anticipated interest rate decision, Dalio first highlighted concerns about […]

Billionaire Investor Predicts ‘Crash in the Markets’ if Harris’ Tax Plans Are Implemented

- CryptoGlobe Writer

- /

- 17 Sep 2024

Hedge fund billionaire John Paulson, renowned for his successful bet against the housing market during the financial crisis, recently warned that Vice President Kamala Harris’ proposed tax plans could lead to a financial market collapse and a recession, according to a report by Yun LI for CNBC. Paulson, a vocal supporter of former President Donald […]

JPMorgan Predicts Fed to Slash Rates by 125 Basis Points by December

- CryptoGlobe Writer

- /

- 16 Sep 2024

In an interview on Bloomberg Television on September 16, 2024, Joyce Chang, JPMorgan’s Global Research Chair, reiterated her expectation that the Federal Reserve will announce a 50 basis point rate cut at its upcoming meeting on Wednesday. Despite ongoing debates within the market, Chang noted that her team is holding firm on their projection, although […]

Billionaire Investor Peter Thiel Predicts Stagflation and Economic Turmoil in the U.S.

- CryptoGlobe Writer

- /

- 16 Sep 2024

In a recent interview with Jason Calacanis at the All-In Summit 2024 (held 8-10 September in Los Angeles), Peter Thiel discussed a wide range of topics, including the upcoming U.S. elections, the geopolitical tension between China and Taiwan, and the current state of artificial intelligence (AI). Thiel, known for his candid approach, shared why he […]

Market Analyst: Hyperinflation Has Begun and the Dollar Will Collapse by 2025, Prepare Now

- CryptoGlobe Writer

- /

- 15 Sep 2024

In a recent interview with Michelle Makori from Kitco News, Lynette Zang, Founder & CEO of Zang Enterprises, issued a stark warning about the global economy, focusing on the U.S. dollar and banking sector. Zang emphasized that the transition to hyperinflation has already begun. She asserted that the U.S. is moving towards a highly inflationary […]

Gold to Hit $10,000? Peter Schiff Warns of U.S. Dollar Collapse and Runaway Inflation

- CryptoGlobe Writer

- /

- 14 Sep 2024

In a recent interview with Kitco News, Peter Schiff, the chairman of SchiffGold and founder of Euro Pacific Asset Management, made bold predictions about the future of the U.S. economy. Schiff argued that the Federal Reserve’s upcoming actions will lead to severe consequences for the U.S. dollar and global financial markets. He suggested that the […]

U.S. Government Spends Over $1 Trillion on Interest Payments in 2024 Amid Surging National Debt

- CryptoGlobe Writer

- /

- 12 Sep 2024

For the first time in U.S. history, the government has spent over $1 trillion on interest payments, according to a report by Jeff Cox for CNBC that was published on 12 September 2024. This historic figure comes from the Treasury Department’s latest data, which shows that the government has spent $1.049 trillion servicing its $35.3 […]

Higher Than Expected U.S. CPI Raises Investor Concerns Over Fed’s Upcoming Rate Cut

- CryptoGlobe Writer

- /

- 11 Sep 2024

U.S. stocks tumbled on Wednesday as new inflation data shook trader expectations for a larger rate cut from the Federal Reserve next week. According to a CNBC report published earlier today, the S&P 500 dropped 1.1%, while the Dow Jones Industrial Average fell by 517 points, or 1.3%. The Nasdaq Composite also shed 0.6%. The […]

JPMorgan CEO Jamie Dimon Warns Something Worse Than Recession Remains a Risk for the U.S. Economy

- CryptoGlobe Writer

- /

- 10 Sep 2024

A recession is a period of economic decline typically marked by a drop in Gross Domestic Product (GDP), rising unemployment, and reduced consumer spending. It occurs when businesses cut back, production slows, and overall economic activity decreases. In a recession, inflation usually falls because demand for goods and services drops, which puts downward pressure on […]

Bitcoin Drops Below $55K Amid U.S. Jobs Report Miss and Recession Fears

- Siamak Masnavi

- /

- 6 Sep 2024

As of 2:50 p.m. UTC on 6 September 2024, Bitcoin is trading at $54,746, marking a 3.4% drop over the past 24 hours. This significant decline in Bitcoin’s value seems closely tied to the disappointing U.S. jobs data for August 2024, which was released earlier in the day. The broader cryptocurrency market, which typically follows […]

“We’re Seeing Recession Indicators Flashing Red,” Warns Rosenberg Research President

- CryptoGlobe Writer

- /

- 2 Sep 2024

In a recent interview on CNBC’s “Fast Money,” David Rosenberg shared his thoughts on the current economic landscape, expressing strong concerns that a recession is imminent. David Rosenberg is the Founder and President of Rosenberg Research & Associates Inc., an economic consulting firm he established in January 2020. The firm focuses on providing investors with […]

“Kamala Harris’s Plan To Give First-Time Homebuyers $25,000 Is Basically Theft,” Says Renowned Economist Professor Steve Hankle

- CryptoGlobe Writer

- /

- 1 Sep 2024

In a recent interview with David Lin, renowned economist Professor Steve Hanke offered his insights on various economic and political topics, including the Federal Reserve’s monetary policy, inflation, and the potential implications of Kamala Harris’s housing plan. Steve H. Hanke is a prominent professor of applied economics at Johns Hopkins University, where he also co-directs […]

Prominent Analyst Harry Dent Predicts Massive Market Crash: ‘I Bet My Career On It’

- CryptoGlobe Writer

- /

- 31 Aug 2024

In a recent interview, prominent financial analyst Harry Dent provided a stark warning about the future of the global economy, predicting a massive market crash within the next 6 to 12 months. Harry Dent, born on 12 May 1953, is a well-known American financial newsletter writer, economist, and author. He is widely recognized for his […]

‘A Rate Cut in September Is Not a Done Deal’, Says FOMC Member and Atlanta Fed President Rafael Bostic

- CryptoGlobe Writer

- /

- 27 Aug 2024

In a recent interview with Yahoo Finance’s Jennifer Schonberger, Federal Reserve Bank of Atlanta President Raphael Bostic shared his insights on the potential for interest rate cuts, the evolving labor market, and the broader economic outlook. Speaking during the Kansas City Fed’s Jackson Hole Economic Policy Symposium, Bostic provided a detailed explanation of the factors […]

Global Macro Investor Explains Why He Is So Bullish on Bitcoin and Ethereum in Current Macro Environment

- CryptoGlobe Writer

- /

- 24 Aug 2024

Dan Tapeiro sees a major market shift on the horizon, one that could redefine the balance between traditional assets like gold and emerging digital currencies. In his recent interview with CoinDesk, Tapeiro predicted that Bitcoin and Ethereum are poised for explosive growth, driven by global liquidity changes that are just beginning to unfold. Tapeiro begins […]

Is Hyperinflation Coming to the U.S.? Influential Stanford Professor Explains How It Could Happen

- CryptoGlobe Writer

- /

- 20 Aug 2024

On August 16, 2024, David Lin interviewed John Cochrane, a renowned economist and Senior Fellow at Stanford University’s Hoover Institution. Cochrane discussed a wide range of economic topics, including inflation, fiscal policy, and the prospects of hyperinflation. The Myth of Price Gouging and Inflation Cochrane began by addressing recent political rhetoric around price gouging, particularly […]

Renowned Investment Strategist Predicts a 25 Basis Points ‘One and Done’ Rate Cut in September by the Fed

- CryptoGlobe Writer

- /

- 20 Aug 2024

In an interview on CNBC on August 19, Ed Yardeni, the Founder and President of Yardeni Research, shared his thoughts on the Federal Reserve’s likely monetary policy moves as the September 2024 meeting approaches. Known for his keen market analysis and prescient economic forecasts, Yardeni presented a detailed perspective on why he expects the Federal […]

Goldman Sachs Cuts U.S. Recession Odds to 20% Amid Improving Economic Signals

- CryptoGlobe Writer

- /

- 19 Aug 2024

Goldman Sachs has revised its forecast for a U.S. recession, reducing the probability to 20% just after it had raised it earlier this month. According to a report by Jenni Reid for CNBC, this adjustment comes in response to recent labor market data, prompting a reassessment of the U.S. economic outlook. Per the CNBC article, […]

J.P. Morgan Raises Recession Risk to 35%, Predicts Major Fed Rate Cuts Amid Slowing U.S. Economy

- Siamak Masnavi

- /

- 19 Aug 2024

On 15 August 2024, J.P. Morgan Research published a report highlighting emerging signs of a slowdown in the U.S. economy following a year of unexpectedly strong growth. The report pointed to a softer-than-expected July jobs report, with the unemployment rate increasing for the fourth consecutive month. This data triggered a market sell-off and intensified concerns […]

From Diamonds to Crackerjacks: Macro Analyst Luke Gromen on the Diminishing Value of U.S. Treasury Bonds

- CryptoGlobe Writer

- /

- 16 Aug 2024

In a recent interview on the “Back to the People” podcast, Luke Gromen, a renowned macroeconomic analyst, delivered a stark analysis of the U.S. economy. Speaking with Nicole Shanahan, an American lawyer and vice-presidential running mate to Robert F. Kennedy Jr., Gromen outlined the severe challenges facing the U.S. economy, from the imminent debt crisis […]

With 5 Important US Economic Indicators Due This Week, Analyst Says Crypto Holders Should Prepare for a Wild Ride

- CryptoGlobe Writer

- /

- 12 Aug 2024

On Sunday, 11 August 2024, well-known crypto analyst and influencer “MartyParty” took to social media platform X to highlight several crucial U.S. economic indicators scheduled for release this week. For those in the trading and investing world, these indicators are more than just numbers; they are essential data points that offer insights into the current […]

‘U.S. Dollar Is Moving Towards Becoming an Unhinged Paper Currency’, Says Renowned American Economist Dr. Arthur Laffer

- CryptoGlobe Writer

- /

- 9 Aug 2024

In a recent interview with Michelle Makori of Kitco News, renowned economist Dr. Arthur Laffer shared his thoughts on the future of the U.S. dollar, de-dollarization, global payment alternatives, and the current economic policies under the Biden administration. Arthur Laffer is an influential American economist best known for his development of the Laffer Curve, a […]

Gold Nears Record Highs Amid U.S. Economic Woes and Geopolitical Tensions

- CryptoGlobe Writer

- /

- 4 Aug 2024

Gold experienced a notable surge this week, driven by a combination of disappointing U.S. economic data, a dovish Federal Reserve stance, and rising geopolitical tensions, according to a report by Ernest Hoffman for Kitco News. Kitco reported that despite a sharp flash crash on Friday, the precious metal’s price rebounded, reflecting strong trader sentiment. Kitco […]

BlackRock’s Rick Rieder Criticizes Fed as U.S. 10-Year Treasury Yield Hits Lowest Level Since December 2023

- CryptoGlobe Writer

- /

- 2 Aug 2024

On August 2, in an interview with Bloomberg TV, Rick Rieder, the Chief Investment Officer of Global Fixed Income at BlackRock, shared his thoughts on the current state of interest rates, the U.S. economy, and his investment strategies. Interest Rates and Economic Consistency Rieder’s primary assertion during the interview was that the current pricing for […]

“The World’s Most Powerful Economic Indicator Is Signaling a Recession”, Says Prominent Macro Investor

- CryptoGlobe Writer

- /

- 2 Aug 2024

On July 27, Michelle Makori of Kitco News interviewed George Gammon, a macroeconomics expert and host of The Rebel Capitalist Show. In this detailed discussion, Gammon delved into various aspects of the current economic landscape, emphasizing that the world’s most powerful economic indicator is signaling an imminent recession. He expressed concerns that the ongoing banking […]

Goldman Sachs CEO David Solomon on the U.S. Economy, Federal Reserve Policies, and M&A Trends

- CryptoGlobe Writer

- /

- 30 Jul 2024

On July 30, David Solomon, Chairman and CEO of Goldman Sachs, appeared on CNBC’s “Squawk Box” to provide insights on various critical topics, including the state of the US economy, the Federal Reserve’s approach to inflation, interest rate projections, mergers and acquisitions (M&A) activity, the 2024 election, market trends, and the status of cryptocurrency. Below […]

What McDonald’s Q2 2024 Earnings Call Reveals About the U.S. Economy and the Global Economy

- CryptoGlobe Writer

- /

- 29 Jul 2024

McDonald’s Corporation’s Q2 2024 earnings call, which was held earlier today, provides a wealth of information about current economic conditions. From consumer spending patterns to the effects of global conflicts, McDonald’s performance offers a unique lens through which to examine both the U.S. and global economies. Here are the key economic indicators drawn from the […]

Americans’ Recession Perception Diverges from Economic Indicators: CNBC

- Siamak Masnavi

- /

- 29 Jul 2024

According to a recent report by Jessia Dickler for CNBC, despite favorable economic indicators, a substantial portion of the American population believes the U.S. is in a recession. A survey conducted by Affirm found that nearly 60% of Americans think the nation is experiencing an economic downturn. This perception is largely driven by the rising […]

Russel 2000: Fundstrat’s Tom Lee Predicts a 40% Rally by the End of the Summer

- Siamak Masnavi

- /

- 22 Jul 2024

On July 22, during an interview on CNBC’s “Squawk on the Street”, Tom Lee, co-founder and head of research at independent financial research boutique Fundstrat Global Advisors, shared his insights on the current U.S. stock market dynamics, focusing on small-cap stocks, the potential impacts of political shifts, and the economic outlook. Short-term vs. Long-term Influences: […]

U.S. Stock Market Has a ‘Ticking IT Valuation Timebomb,’ Warns Societe Generale Global Strategist

- CryptoGlobe Writer

- /

- 20 Jul 2024

Renowned economist Albert Edwards warns of an imminent tech stock correction, citing overvaluation and historical parallels. Edwards is a well-known economist and market strategist, particularly recognized for his bearish outlook on the global economy. He has been a prominent figure at Société Générale, a major French multinational investment bank and financial services company, where he […]

U.S. Stock Market Warning: The ‘Greatest Bubble in Human History’ Could Be About to Burst, Claims Investment Guru

- CryptoGlobe Writer

- /

- 19 Jul 2024

According to an article by Spencer Jacob for the Wall Street Journal (WSJ), investment expert Mark Spitznagel is concerned about the potential upcoming bursting of the “greatest bubble in human history.” Spitznagel is an American investor and hedge fund manager best known for founding Universa Investments, a hedge fund that specializes in tail-risk strategies. These […]

BlackRock CEO Larry Fink: ‘I Am a Major Believer That There Is a Role for Bitcoin in Portfolios’

- CryptoGlobe Writer

- /

- 15 Jul 2024

On July 15, 2024, BlackRock Chairman and CEO Larry Fink appeared on CNBC’s “Squawk on the Street” to discuss the company’s latest quarterly financial results, the economic outlook, the failed assassination attempt on former U.S. President Donald Trump, the current investing landscape, the state of capital markets, and the evolving role of cryptocurrency in financial […]

Americans Feel the Squeeze as High Prices Persist Despite Slowing Inflation, Report Finds

- CryptoGlobe Writer

- /

- 14 Jul 2024

Inflation in the United States is slowing, but prices remain high, creating persistent challenges for consumers. While the economy is expanding with a lower rate of price growth and a robust job market, the overall cost of living remains elevated. According to a recent report by Jessica Dickler for CNBC, despite a broad pullback in […]

The End of the Petrodollar? Andy Schectman Warns of Potential Total Financial Collapse in the U.S.

- CryptoGlobe Writer

- /

- 12 Jul 2024

The term “petrodollar” refers to the practice of pricing and trading oil in U.S. dollars. This system began in the early 1970s when the U.S. made an agreement with Saudi Arabia to price all of its oil sales in U.S. dollars. In return, the U.S. provided military and economic support to Saudi Arabia. This agreement […]

Wells Fargo’s Scott Wren on Shifting from Tech After S&P 500’s Worst Session Since April 30

- Siamak Masnavi

- /

- 12 Jul 2024

On July 11, Scott Wren joined CNBC’s “Closing Bell Overtime” to discuss the day’s U.S. stock market action. Scott Wren is a senior global market strategist at Wells Fargo Investment Institute (WFII), a registered investment adviser and wholly owned subsidiary of Wells Fargo Bank, N.A. WFII focuses on providing top-tier investment expertise and advice, helping […]

A 32% U.S. Stock Market Crash Is Coming in 2025, Predicts BCA Research’s Chief Global Strategist

- Siamak Masnavi

- /

- 11 Jul 2024

According to a recent note from Peter Berezin, the U.S. stock market is expected to experience a significant downturn. Berezin is a financial analyst and strategist, serving as the Chief Global Strategist at BCA Research, a firm specializing in global investment research. He focuses on offering strategic investment advice and economic analysis, covering global economic […]

iCapital’s Chief Investment Strategist Explains Why She Is Concerned About U.S. Tech Sector Stocks

- Siamak Masnavi

- /

- 10 Jul 2024

On July 9, Anastasia Amoroso, iCapital’s Chief Investment Strategist, joined CNBC’s “Squawk Box” to share her insights on the latest market trends, the state of the economy, and the health of the consumer. Amoroso is the Managing Director and Chief Investment Strategist at iCapital Network, where she advises on private and public market investment opportunities. […]

U.S. Economy Could Come to a ‘Virtual Standstill’ in Next 6 Months, Warns Rockefeller International Chairman

- CryptoGlobe Writer

- /

- 10 Jul 2024

On July 9, Ruchir Sharma, Chairman of Rockefeller International, shared his insights on CNBC’s “Closing Bell Overtime” regarding the emerging opportunities in global markets, particularly as the U.S. economy shows signs of deceleration. Rockefeller International, part of Rockefeller Capital Management, provides a range of financial services, including wealth management, asset management, and investment banking. The […]

Why Altcoins Are Crashing and What’s Next, Reveals Prominent Crypto Analyst

- CryptoGlobe Writer

- /

- 16 Jun 2024

In a video released earlier today, crypto analyst Michaël van de Poppe, also known as “Crypto Michaël,” delved into the reasons behind the ongoing crash in altcoin prices and offered insights into the future of the cryptocurrency market. Michaël started by acknowledging the significant downturn in the altcoin market, with some major altcoins dropping by […]

Why America’s $34 Trillion Debt Isn’t as Scary as It Seems, Explains Renowned Economist Paul Krugman

- Siamak Masnavi

- /

- 10 Jun 2024

Paul Krugman highlights the significant national debt of $34 trillion in his latest opinion piece for The New York Times (NYT), emphasizing that while it appears daunting, the historical and international context diminishes its perceived threat. Paul Krugman is a renowned American economist and public intellectual, known for his influential work in international economics and […]

The Future of the Federal Reserve Under a Potential Trump Presidency

- Siamak Masnavi

- /

- 23 May 2024

As the US 2024 presidential race heats up, the potential impact of a Donald Trump victory on the Federal Reserve is a topic of growing interest among financial experts and political observers. Trump’s tumultuous relationship with the Fed during his previous term, characterized by frequent criticism of the central bank’s policies and its chair, Jerome […]

Stanley Druckenmiller Unplugged: A Billionaire Investor’s Take on the Fed, AI, and Global Opportunities

- Siamak Masnavi

- /

- 22 May 2024

In a recent CNBC interview, billionaire investor Stanley Druckenmiller shared his thoughts on a wide range of topics, including the Federal Reserve’s monetary policy, inflation, artificial intelligence (AI), and his global investment strategies. Stanley Druckenmiller is highly regarded for his consistent and impressive investment performance, particularly during his tenure at the Quantum Fund with George […]

Federal Reserve Officials Express Concerns Over Persistent Inflation, Remain Cautious on Rate Cuts

- CryptoGlobe Writer

- /

- 22 May 2024

Federal Reserve officials have grown increasingly worried about the stubborn nature of inflation, as revealed in the minutes from the April 30-May 1 policy meeting of the Federal Open Market Committee (FOMC). The minutes, released on Wednesday, indicated that policymakers lacked the confidence to move forward with interest rate reductions due to the lack of […]

$BTC: QCP Capital Expects ‘Bullish Momentum’ to Bitcoin Price to Its All-Time High in Coming Weeks

- Siamak Masnavi

- /

- 16 May 2024

The release of softer-than-expected U.S. inflation data has ignited bullish sentiment for riskier assets, with Bitcoin (BTC) leading the way. According to CoinDesk, Singapore-based QCP Capital said in a recent note to clients that favorable market conditions might push Bitcoin prices toward the $74,000 mark soon, driven by growing institutional demand. The U.S. Consumer Price […]

Crypto Market Surges After Better Than Expected U.S. Inflation Data Increases Chances of a Fed Rate Cut Later This Year

- Siamak Masnavi

- /

- 15 May 2024

According to CNBC, in a much-anticipated report from the Labor Department’s Bureau of Labor Statistics, the consumer price index (CPI) showed a modest increase of 0.3% in April compared to March. This figure was slightly below the Dow Jones estimate of 0.4%, indicating a minor easing of inflationary pressures. However, the year-over-year CPI still rose […]

“Trump-Stalgia” Is “A Powerful Force”, Says Renowned Economist Paul Krugman

- CryptoGlobe Writer

- /

- 5 May 2024

In a recent opinion piece for The New York Times, economist Paul Krugman revisits the question once posed by Ronald Reagan: “Are you better off than you were four years ago?” Krugman is a renowned American economist, a Nobel Prize laureate, and a prominent public intellectual. He’s known for his expertise in international trade and […]

The Ripple Effect of Crypto Wealth on the U.S. Economy and Housing Market

- Siamak Masnavi

- /

- 5 May 2024

The rise of cryptocurrencies has not only created a new asset class but has also given birth to a new generation of wealthy individuals. As reported by Bloomberg News, a group of researchers has delved into the fascinating world of crypto wealth and its impact on the US economy. Their findings shed light on how […]

“Unlikely” Next Move Will Be Rate Hike, Says Federal Reserve Chair Jerome Powell

- CryptoGlobe Writer

- /

- 1 May 2024

On Wednesday, the Federal Reserve concluded its latest FOMC meeting by keeping interest rates unchanged, maintaining the target range at 5.25% to 5.5%. This decision was widely anticipated by market participants and came as a relief to investors, who had been closely monitoring the central bank’s stance on monetary policy. According to a report by […]

Renowned Economist Paul Krugman Analyzes U.S. Q1 2024 GDP: Not as Disappointing as It Appears

- Siamak Masnavi

- /

- 27 Apr 2024

In a recent analysis, economist Paul Krugman shared his thoughts on the United States’ economic performance following the release of the first quarter GDP report for 2024 by the Bureau of Economic Analysis. Paul Krugman is a Nobel Prize-winning American economist known for his influential work in international trade theory and economic geography. A prominent […]

In Times of Geopolitical Turmoil, Gold Should ‘Vastly Outperform’ Bitcoin, Says Jared Dillian

- Siamak Masnavi

- /

- 23 Apr 2024

Recently, Michelle Makori of Kitco News engaged in an insightful discussion with Jared Dillian, a seasoned financial expert and author. Jared Dillian is a financial writer, investment strategist, and former Wall Street trader. He is well-known for his expertise in financial markets and for writing in a way that makes complex investment topics accessible to […]

Bitcoin Price Falls as Fed Chair Powell Expresses Caution on Rate Cuts

- Siamak Masnavi

- /

- 17 Apr 2024

On Tuesday, Federal Reserve Chair Jerome Powell indicated that interest rate cuts might be postponed longer than initially expected due to ongoing high inflation readings. Speaking at a panel alongside Bank of Canada Governor Tiff Macklem at the Wilson Center in Washington, Powell highlighted the unexpected continuation of high inflation rates and suggested that the […]

Bitcoin Eyes $100,000 Milestone as It Decouples from Traditional Markets, Says Santiment’s Brian Quinlivan

- Siamak Masnavi

- /

- 12 Apr 2024

In a recent analysis, market intelligence firm Santiment has spotlighted an emerging trend that could be pivotal for Bitcoin’s price trajectory: a diminishing correlation with traditional stock markets. According to Santiment’s latest observations, this trend may set the stage for Bitcoin to achieve unprecedented price levels, potentially reaching as high as $100,000. Santiment is a […]

Has the Highly Expected 2024 Rate Hike by the Fed Now Become a Matter of If Rather Than When?

- Siamak Masnavi

- /

- 11 Apr 2024

According to a report published in The Wall Street Journal on April 10, the Federal Reserve faces new challenges in its ongoing battle against inflation, complicating its path to securing a soft economic landing. The WSJ article highlights an inflation report that surpassed expectations, posing significant implications for the Fed’s interest rate policies. The article […]

JPMorgan Chase CEO Jamie Dimon Warns of Economic Perils Lurking Beneath U.S. Resilience

- CryptoGlobe Writer

- /

- 8 Apr 2024

On April 8, financial services giant JPMorgan Chase & Co. (NYSE: JPM) published its 2023 Annual Report, including letters to shareholders from its Chairman and CEO — Jamie Dimon — and other business heads. As of December 31, 2023, JPMorgan Chase reported possessing assets totaling $3.9 trillion and stockholders’ equity amounting to $328 billion. In his […]

Roubini Warns: The Fed May Halt Rate Cuts or Hike Rates Amid Geopolitical-Driven Inflation

- Siamak Masnavi

- /

- 5 Apr 2024

On April 5, 2024, Dr. Nouriel Roubini, a respected economist (though not in the crypto community due to his anti-crypto views), who is the Chairman and CEO of Roubini Macro Associates, provided a nuanced perspective on the global economic outlook, focusing on interest rate expectations, geopolitical risks, and the performance of the US economy. His […]