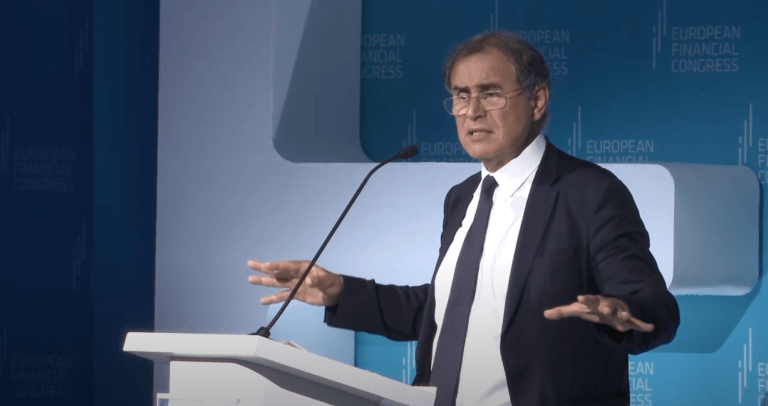

On April 5, 2024, Dr. Nouriel Roubini, a respected economist (though not in the crypto community due to his anti-crypto views), who is the Chairman and CEO of Roubini Macro Associates, provided a nuanced perspective on the global economic outlook, focusing on interest rate expectations, geopolitical risks, and the performance of the US economy. His comments were made during an appearance on Bloomberg TV’s “Bloomberg Markets Today” while speaking to Anna Edwards, Kriti Gupta, and Guy Johnson.

Interest Rate Outlook and Economic Performance

Roubini addressed the complex interplay between expected rate cuts, geopolitical tensions, and their implications for inflation and economic growth. He highlighted a scenario where baseline growth falls below potential, leading to gradual inflation decreases and anticipated rate cuts by the Fed. However, he underscored the existence of tail risks—particularly geopolitical tensions that could drive up commodity prices, thereby stoking inflation further and complicating the Fed’s rate decision-making process.

Geopolitical Risks and Market Perception

He emphasized that markets might be underestimating the potential impact of geopolitical risks on commodity prices and, by extension, inflation. Roubini pointed out a shift in market sentiment, with concerns now leaning towards higher inflation driven by either sustained growth exceeding expectations or the materialization of geopolitical threats due to the conflicts in Ukraine and the Middle East.

US Economic Outperformance

Roubini explored the factors underpinning the US economy’s relative strength, attributing it to a combination of fiscal measures and a reversal of negative supply shocks experienced during the COVID-19 pandemic. He noted the significant role played by immigration in moderating labor market tightness and the positive aggregate supply shocks that have enabled the US to maintain robust growth alongside moderating inflation.

China’s Global Economic Influence

Addressing China’s economic strategy, Roubini expressed concerns over the country’s return to export-led growth amidst faltering domestic demand. He warned of the global implications of China’s potential to flood markets with excess capacity in various sectors, suggesting this could exacerbate protectionist tensions not only in Western economies but also among developing nations.