Last month, the price of Cardano’s native currency $ADA broke a six-month losing streak by ending the month with a positive return of 18.4%, at $1.19. The cryptocurrency’s price had been steadily dropping since hitting a new all-time high above $3.1 last year.

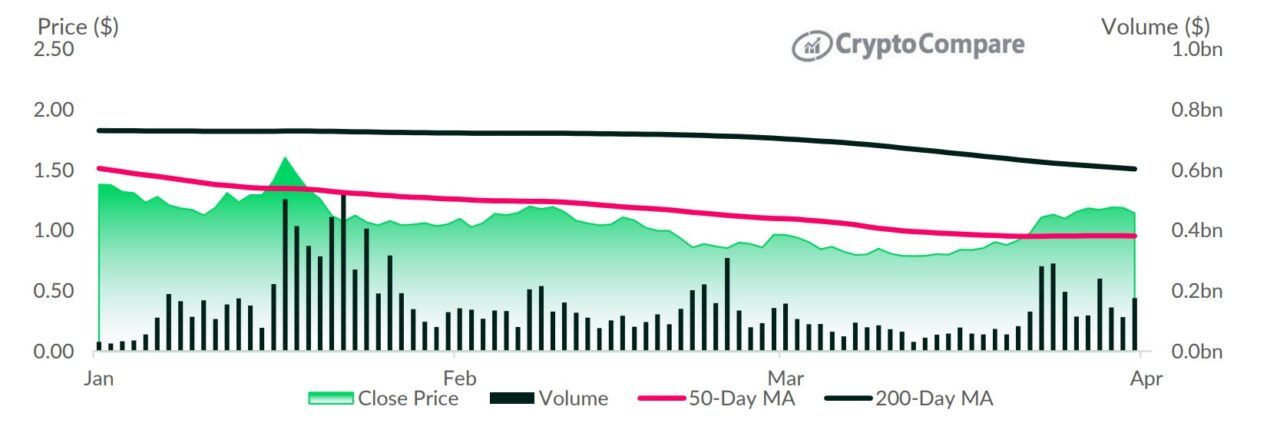

According to CryptoCompare’s latest Asset Report, ADA’s price performance means it finished the month above its 50-day moving average, but is yet to break through its 200-day moving average, with the former being at $0.95 and the latter at $1.51.

Despite the cryptocurrency’s positive price performance, its trading volumes against the U.S. dollar dropped 13% to $3.35 billion last month, while its volatility fell to 81%. Activity on the network, however, rose 13.2% to 3.09 million monthly transactions as the average transaction fee fell 12.5% to $0.42.

CryptoCompare’s report details that in March, average daily returns for ADA holders were 0.55%, up from -0.70% in January and -0-20% in February. The cryptocurrency’s annual inflation dropped below the 2% mark.

The number of daily active addresses on Cardano fell in March to an average of 123,000, while the average daily new address number fell 3.2% to 46,300. Notably, the report details Cardano’s long-term holders, those who have been HODLing onto their tokens for over a year, rose 29.5% to 529,000.

The number of cruisers on the network, on the other hand, rose 6.1% to 3.84 million, while the number of traders plunged 11.5% to 682,00. Notably, the number of traders has seemingly been in freefall since January, when it peaked above 1 million.

As CryptoGlobe recently reported, ADA’s falling price has seen 82% of the cryptocurrency’s holders be in a state where they are “out of the money,” meaning they bought their tokens, on average, below market prices.

According to data from on-chain analytics firm Santiment, while ADA is now down significantly from its all-time, whales holding over 10 million ADA tokens have “returned to their largest percentage of supply held in two years” at 46.6%.

Santiment noted that its metrics included the wallets of large cryptocurrency exchanges, which means the funds also represent the holdings of these platforms’ users.

Moreover, according to Kraken’s March 2022 crypto on-chain digest, on-chain indicators are suggesting “prospects are bright” for Cardano’s ADA as demand for it has been growing over time. Kraken’s report details ADA’s transaction fees have risen “about 51.5% from $0.33/tx [transaction] year-to-date.”

Per Kraken, transaction fees “are a proxy for network demand” and while “blockchain demand is beginning to rise after taking a hiatus this year,” Cardano is in the lead.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Unsplash