With the price of Cardano’s native $ADA token below the $1 mark, 82% of the cryptocurrency’s holders are currently “out of the money.” The price of ADA has been steadily dropping ever since it hit a $3.1 all-time high in November 2021.

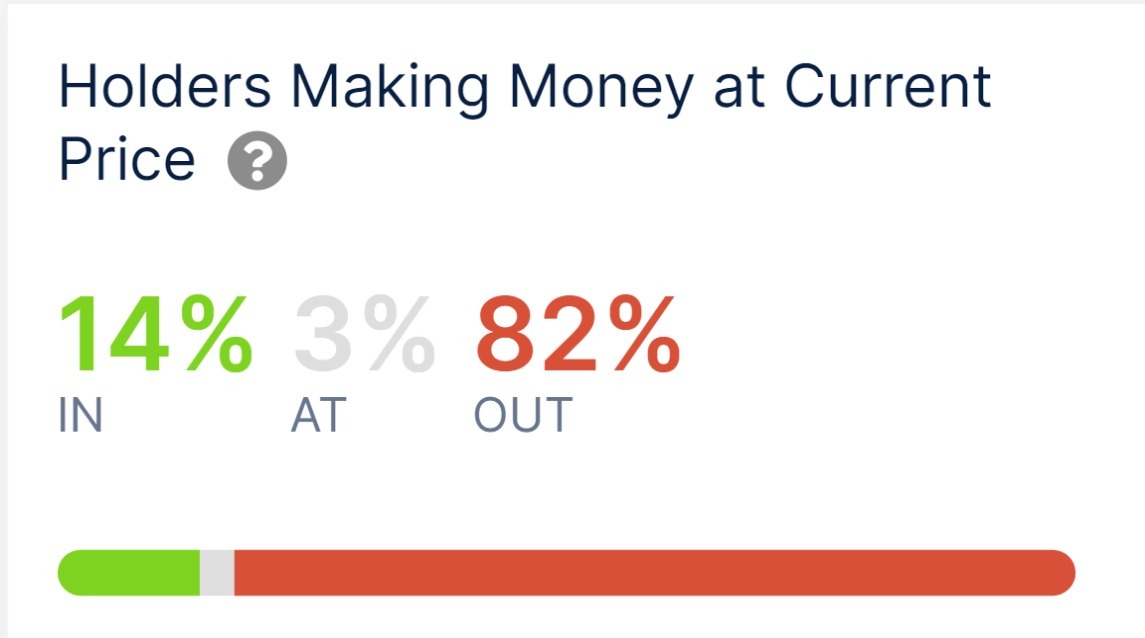

According to data from cryptocurrency analytics startup IntoTheBlock, 82% of Cardano token holders are now losing money over the prolonged decline of the cryptocurrency’s price, while 3% are breaking even and only 14% are in a state of profit.

IntoTheBlock’s indicator identifies the average cost at which tokens were purchased on-chain and does not include data from tokens being custodied on cryptocurrency trading platforms, for example.

The platform’s data shows that 76% of Cardano token holders have bought their Ada in the past 12 months, while 12% have bought it less than one month ago. This means that, according to IntoTheBlock data, only 11% of ADA token holders have been HODLing onto their holdings for over a year.

Despite Cardano’s price decline, the network has been growing steadily. According to Cardano blockchain insights shared on Google’s Data Studio by the Cardano Fans Stake Pool, the number of wallets on the cryptocurrency’s network stood at over 3.2 million in the first quarter of this year, compared to 186,000 in December 2020.

As CryptoGlobe reported, year-to-date the number of wallets holding ADA has grown by over 500,000, with 453,000 of those wallets being created in the first quarter of the year. The figures mean that, on average, 5,000 wallets were added to the Cardano network.

According to data from on-chain analytics firm Santiment, while ADA is now down significantly from its all-time, whales holding over 10 million ADA tokens have “returned to their largest percentage of supply held in two years” at 46.6%.

Santiment noted that its metrics included the wallets of large cryptocurrency exchanges, which means the funds also represent the holdings of these platforms’ users.

Moreover according to Kraken’s March 2022 crypto on-chain digest, on-chain indicators are suggesting “prospects are bright” for Cardano’s ADA as demand for it has been growing over time. Kraken’s report details ADA’s transaction fees have risen “about 51.5% from $0.33/tx [transaction] year-to-date.”

Per Kraken, transaction fees “are a proxy for network demand” and while “blockchain demand is beginning to rise after taking a hiatus this year,” Cardano is in the lead.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Unsplash