On-chain indicators are suggesting “prospects are bright” for Cardano’s native token $ADA as demand for it has been growing up. Data shows that ADA’s rising demand comes as its decentralized finance (DeFi) space grows and a general decline in demand is seen among other cryptoassets.

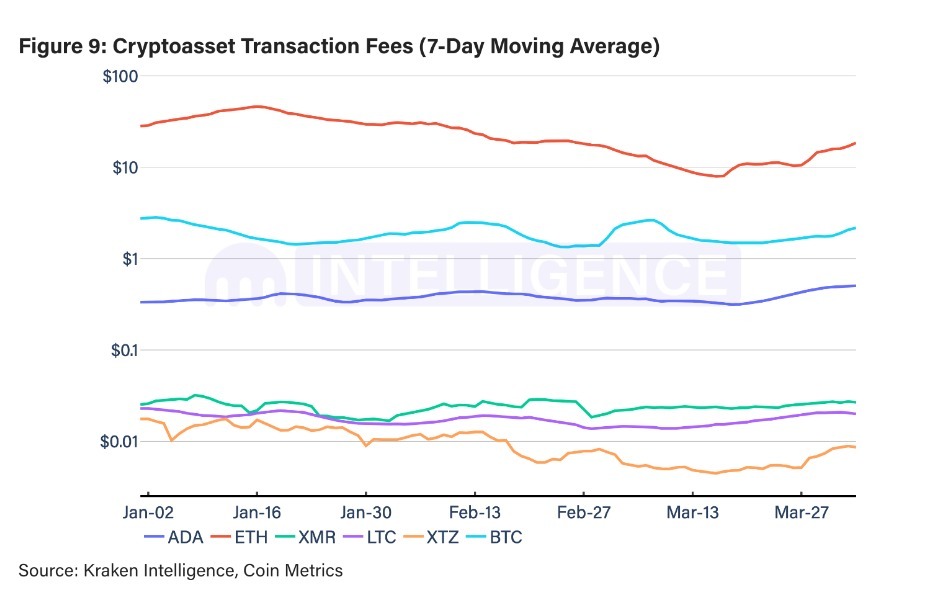

According to Kraken’s March 2022 crypto on-chain digest, as first reported by DailyHodl, ADA’s transaction fees have risen “about 51.5% from $0.33/tx [transaction] year-to-date,” with ADA’s fees rising 37% in March alone. In comparison, Tezos ($XTZ) transaction fees fell 48.5% this year, while Ethereum ($ETH transaction fees plunged 34.5% this year.

The only other cryptocurrency that saw its transaction fees rise was Monero ($XMR), a privacy-centric cryptocurrency. Its fees rose 8% from $0.025/transaction to $0.027. Per Kraken, transaction fees “are a proxy for network demand” and while “blockchain demand is beginning to rise after taking a hiatus this year,” Cardano is in the lead.

Similarly, Kraken notes that network transaction volume is “another good reference for network demand as it translates into the aggregated value of funds market participants are moving.”

ADA’s Adjusted Settlement Value, which measures the U.S. dollar value of the total transactions transferred on-chain, suggests “ADA prospects are bright ad demand is on the rise” The report details that the 7-day moving average of ADA’s adjusted transfer value volume “rose an astronomical +2,472% from $2.5 billion to $64.3 billion.”

Meanwhile, ADA’s transfer volume jumped nearly 186% in the last 30 days in an increase that “coincides with ADA’s rise in transaction fees.”

Kraken’s report adds that Bitcoin’s transfer value rose 19.4% since the start of the year, while ETH’s transfer value dropped by 13% over the same period. Other altcoins performed even worse, with 1INCH seeing its transfer value drop 64% and XTZ seeing a 31.3% drop.

The report comes shortly after data from the Cardano network revealed it has added over 500,000 ADA wallets year-to-date and at a time in which its total value locked on DeFi applications plunged from a $300 million high to around $233 million at the time of writing.

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Unsplash