August 5 was an interesting day in the equities, precious metals, and crypto markets, with Nasdaq and gold setting new all-time highs, silver almost reaching an eight-year high, and Bitcoin surging over 4% against the dollar to break $11,750.

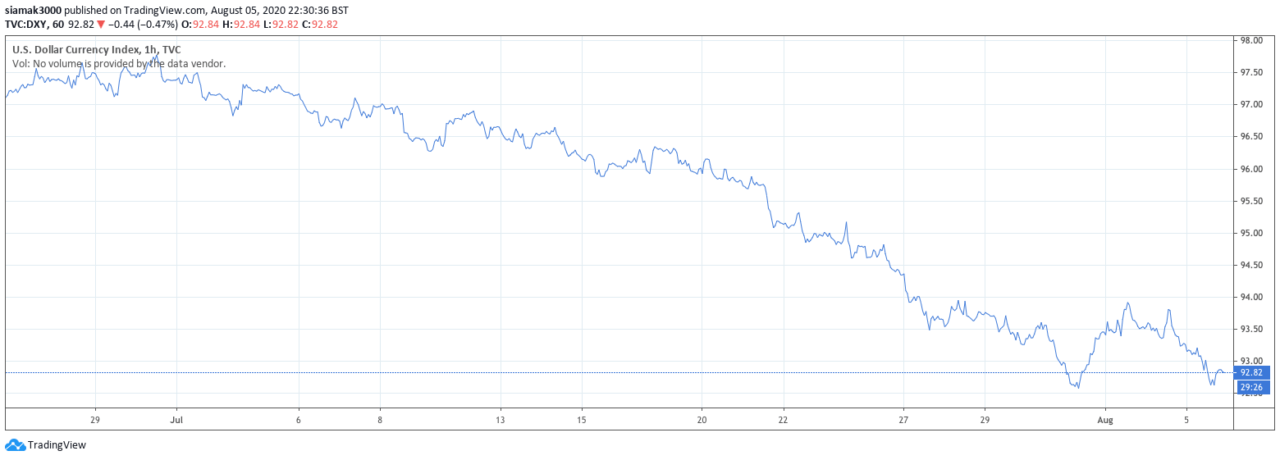

Let’s start with the U.S. dollar.

As MarketWatch reported earlier today, the “U.S. Dollar Index” (DXY)—which is “designed, maintained, and published by ICE (Intercontinental Exchange, Inc.)”—is “an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies”. These other currencies are EUR, GBP, JPY, CAD, SEK, and CHF.

As you can see in the chart below from TradingView, the U.S. dollar index fell around 4.16% in July (closing the month at 93.38), which was its largest monthly drop in almost 10 years. And today, DXY fell 0.57 (or 0.61%) to 92.82.

Shortly after the COVID-19 pandemic reached the U.S., everyone was in a panic and the safe haven asset of choice was U.S. Treasuries. On March 20, when the Dow fell more than 4.55%, the dollar index reached the intraday high of 102.99, which was the highest it had been since 19 December 2016.

So, why should we care about the U.S. dollar index?

MarketWatch’s report says:

“Some analysts see the subsequent unwind as merely a sign investors are more confident in the outlook for global economic growth, while others fear the greenback’s weakness could mark a step toward eroding its status as the world’s premier reserve currency.”

And crypto enthusiasts see the decline in the value of the U.S. dollar as a sign that one day the world might be ready to accept Bitcoin as the main reserve currency.

Why is the U.S. dollar falling?

Well, there are many factors involved, but three potential explanations are:

- The realization that a lot more in the way of monetary and fiscal stimulus is going to be needed to rescue the U.S. economy in the face of the continuing fight against the economic impact of the COVID-19 pandemic.

- The struggle the White house, the Senate Republicans, and the House Democrasts are having in reaching consensus on a fiscal stimulus package that can adequately address the needs of both individuals and businesses.

- Weaker than expected U.S. economic data (such as U.S. construction spending).

So, how does a falling U.S. dollar affect asset prices?

Well, traditionally (at least, going back as far as 1988), the U.S. dollar has demonstrated some negative correlation with the S&P 500 Index (SPX). As the dollar goes down, large U.S. multi-national corporations, which tend to get a larger percentage of their total revenue from outside the U.S., should benefit, and so their share prices should go up.

On Wednesday, the Dow extended its winning streak to four days, ending the day at 27,201.52, up 373.05 points (or 1.39%).

The Nasdaq broke 11,000 at 14:45 Eastern Time (or 18:45 UTC), which is a new all-time high (ATH), and closed at 10,998.40, up 57.23 points (or 0.52%).

The S&P 500 closed at 3,327.77, up 21.26 points (or 0.64%); as Bloomberg reporter Katherine Greifeld pointed out, this is roughly just 2% below its ATH.

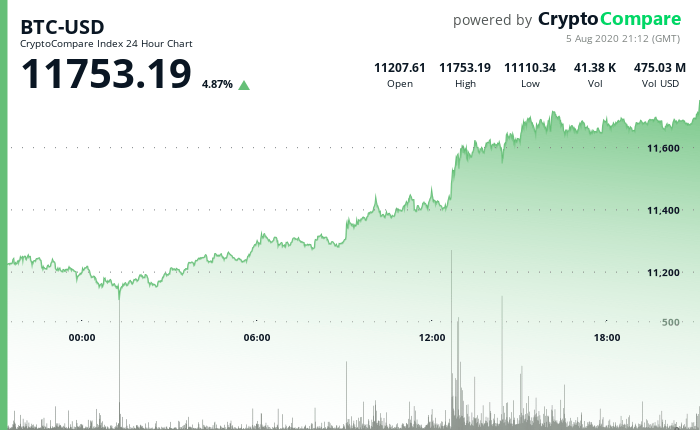

As for commodities such as gold, silver, and Bitcoin, the decline in the value of the U.S.dollar, as well as concerns over geopolitical tensions (such as the increasingly heated words coming out of Washington and Beijing) and future high inflation, is motivating investors to look for alternative stores of value, which helps to push up the prices for all three of these assets, especially gold and Bitcoin.

As for the precious metals, gold reached an intraday high of $2,055.76, which is yet another new ATH. Meanwhile, silver reached an intraday high of $27.133, which is almost an eight-year high.

Finally, with regard to Bitcoin, according to the CryptoCompare Index, at 21:10 UTC on August 5, Bitcoin broke past the $11,750 level to reach an intraday high of $11,757:

Featured Image by “WorldSpectrum” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.