On April 27, TradingView featured a critical alert from crypto analyst Alan Santana, who outlined a stark forecast for Bitcoin in the coming days and months. According to Santana, Bitcoin is poised for a significant capitulation event, potentially dropping to around $30,000. This post explores Santana’s predictions, methodology, and the implications for investors.

Understanding the Capitulation Drop to $30,000

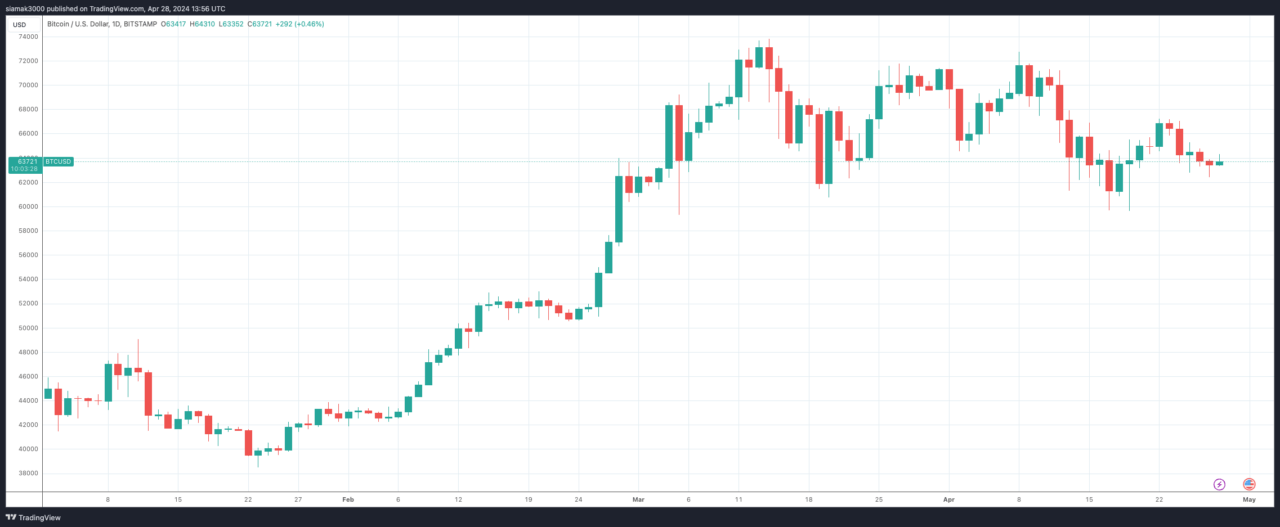

Alan Santana uses a straightforward calculation to predict the potential capitulation price for Bitcoin. By averaging Bitcoin’s trading range over the past month and a half, which he calculates to be approximately $66,600, and then halving this figure, Santana arrives at a potential capitulation point around $33,300. However, his broader prediction focuses on a drop to about $30,000.

The Timing and Impact of the Drop

Santana notes that May, typically a challenging month for cryptocurrencies following a peak, might witness this significant price adjustment. He attributes the likely timing to Bitcoin’s recent price behaviors—trading at all-time highs and entering a distribution phase lasting nearly two months. Despite the potential for such phases to extend up to six months, Santana believes the recent halving event will expedite the capitulation.

Market Indicators and Technical Observations

Santana highlights several technical indicators:

- Volume and RSI: He points out that volume continues to decrease while the Relative Strength Index (RSI) weakens daily, signaling a loss of bullish momentum.

- EMA Levels: Bitcoin’s failure to hold above the Exponential Moving Average (EMA) levels, particularly EMA10/21 and EMA50, supports his bearish outlook. As of April 24, Bitcoin moved back below EMA50, which Santana interprets as confirmation of a strong short-term bearish bias.

The Recovery and Bull Market Forecast

Despite the severe drop forecast, Santana is optimistic about Bitcoin’s long-term prospects. He predicts a rapid recovery post-capitulation, suggesting that Bitcoin could rebound by 30-50% from the flash crash lows before beginning a slow climb. This climb, starting around $45K, will manifest as gradual but sustained growth over 6-8 months, eventually accelerating in Q1/Q2 2025 towards new all-time highs.

Strategic Advice for Investors

Santana advises investors to prepare for both the capitulation and the subsequent bull market. He suggests that now is the time to plan, whether through financial calculations or mental preparation, for buying opportunities at the bottom and selling at the peak of the bullish wave. His analysis points to significant volatility but also significant potential for profit for those who are prepared.

At the time of writing (1:55 p.m. UTC on April 28), Bitcoin is trading at around $63,736, up 0.8% in the past 24-hour period.

Featured Image via Unsplash