China has loaded up its reserves with almost 100 tons of gold since it started buying back in December 2018. It’s no coincidence this accumulation of bullion arrives at a time where the economic uncertainties are rife; for China, many of these uncertainties are centered around their own economy.

Gold on the rise

It’s not just China who is buying bullion in bulk; Russia too is hoarding the yellow metal, in order to combat US sanctions.

The combination of central banks around the globe cutting interest rates, an increase in demand, and the worsening economic climate, is driving the price of gold up past a six-year high.

Currently, gold cites an approximate year to date increase of 17%, fetching a cool $1506 per ounce, a price point not seen since April 2013.

Speaking to Bloomberg, John Sharma, an economist at National Australia Bank Ltd, noted this impressive rise, attributing it mainly to economic instability:

With increasing political and economic uncertainty prevailing, gold provides an ideal hedge, and will, therefore, be sought after by central banks globally.

What About Bitcoin?

There is, of course, another player pegged as a safe haven asset. Bitcoin is becoming more and more accepted for its usefulness as a hedge against macro risks. Scores of analysts, experts and commentators have been quick to point this correlation out. Fundstrat’s Tom Lee was among the first to note this, telling CNBC's Fast Money, last month, that similarly to gold, bitcoin is inversely correlated to the global equities markets; giving credence to its utility as a hedge asset.

I think Bitcoin is proving itself this year to be a hedge against global risks. I think that makes an authentic institutional source of diversification.

It’s isn’t just the likes of Lee propagating this theory. Federal Reserve chair, Jerome Powell, relayed his belief that bitcoin is “a speculative store of value, like gold.”

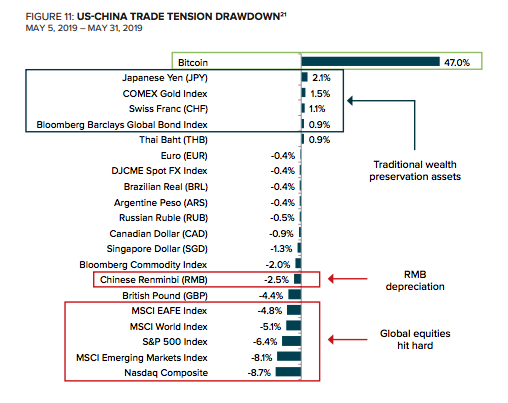

Moreover, a study conducted by Grayscale investments revealed that bitcoin rose significantly more than gold, following Trump’s tariff increase on Chinese imports back in May.

Percentage gain in hedge assets following a US increase on chinese import tariffs | Source: Grayscale Investments

Percentage gain in hedge assets following a US increase on chinese import tariffs | Source: Grayscale Investments

So why then, does China not load up on Bitcoin instead?

Well, according to Blockchain.com’s research director, Garrick Hileman, they may do. Speaking to Bloomberg, Hileman suggested that a premium on bitcoin exchanges within china reveals a lot about the damnd from investors within the county.

There’s corroborating evidence for this, in that people in Asia were paying more for Bitcoin than elsewhere when the yuan fell. You can see it in the premium price paid sometimes for Bitcoin in exchanges like Huobi that primarily cater to Chinese.

So while China’s government and the central bank focus on gold, it sees their citizens have their eyes on a not-so-different safe-haven asset.

Featured Image Credit: Photo via Pixabay.com