The cryptocurrency community is expecting the price of smart contract platform Cardano ($ADA) to drop during the month of April, even as its adoption keeps on growing and whales accumulate the network’s native token.

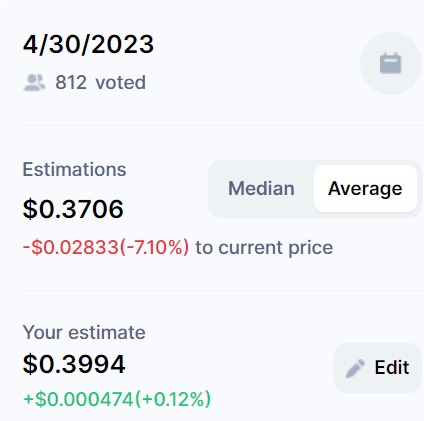

According to over 800 users on CoinMarketCap’s cryptocurrency price estimates, on average, respondents predicted that ADA would end the month of April trading at $0.37 per token, down around 7% from the token’s current price of around $0.3989.

The cryptocurrency community seems to become more bearish as time goes on, predicting a near 11% drop in May, to $0.355. It’s important to point out that the cryptocurrency community’s predictions may not come to life at all.

According to the platform, the community’s historical accuracy is of little over 59% with recent data showing it was at around 80% in January and February 2023 after being at 6.8% in December. In March, it was at 96.5%.

The negative outlook comes even at a time in which Cardano is seeing a surge in buying activity from large investors, colloquially referred to as whales. These large token holders have added a total of 150 million tokens over the past month.

According to data shared by crypto analyst Ali Martinez from IntoTheBlock, a blockchain analytics platform, Cardano whales holding between 1 million and 10 million ADA have been on a buying spree, collecting over $57 million worth of the smart contract platform’s native token in a few weeks.

As CryptoGlobe reported, data from Input Output Global (IOG), responsible for Cardano’s research and development, has revealed that the network has been widely adopted by developers, as it now has over 1,200 projects being developed on top of it.

Over 8 million native assets have been minted on top of the Cardano blockchain, nearly doubling the figure seen in May 2022 when there were 5 million. The Cardano network, it’s worth noting, started accommodating these assets on March 1, 2021.

According to data from pool.pm, there are now 8.03 million native assets on Cardano deployed across over 70,900 policies. Minting policies, according to Cardano’s documentation, are a “set of rules that govern the minting and burning of assets scoped under that policy.”

Native tokens themselves are bespoke assets that can be interacted with “right out of the box – without the use of smart contracts.” The network’s documentation notes native assets can “practically be treated as ada in every sense because the capability is already built-in.”

Meanwhile, as CryptoGlobe reported, the total value locked on Cardano’s decentralized finance (DeFi) ecosystem has recently hit a new all-time high of 382.8 million $ADA tokens, worth over $138.77 million at the time of writing. The total value locked on Cardano surged this year.

Image Credit

Featured Image via Unsplash