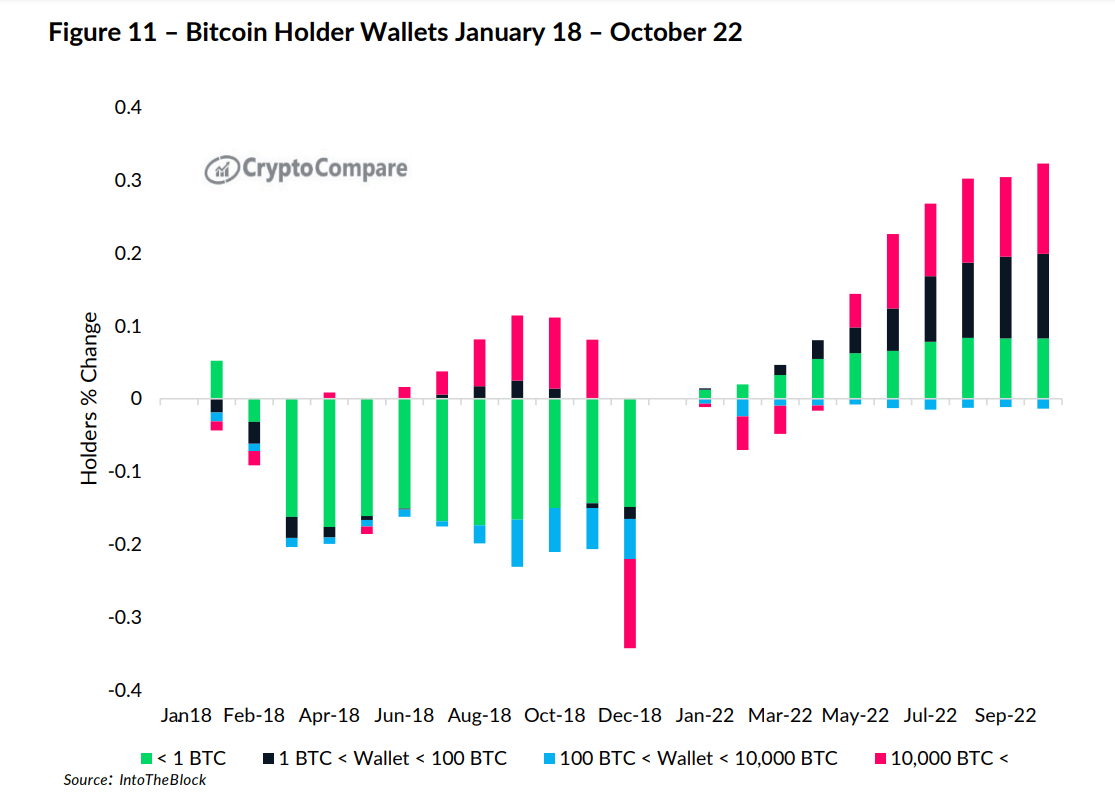

While during the last cryptocurrency bear market holders across different wallet sizes were panic-selling their assets, during this bear market, we are seeing a consistent accumulation in almost all accounts as $BTC holders are buying the dip.

According to CryptoCompare’s 2022 Outlook Report, Bitcoin users with over 10,000 $BTC in their wallets have also seen an increase, which is likely a result of growing institutional adoption, the report adds.

CryptoCompare’s report details that the accumulation trend is being seen at a time in which the flagship cryptocurrency and other digital assets have so far failed to act as an inflation hedge, bringing into question a long-proposed narrative by digital asset natives.

So far this year, both BTC and ETH have performed inversely to inflation and nominal interest rates. Bitcoin’s volatility has been steadily stabilizing in a bounded range compared to the last bear market. During the last bear market, in 2018, BTC’s average annualized volatility was 79%, while it’s now at 63%.

Per CryptoCompare, cryptocurrency holders are “placing increased importance on their characteristics as a risk-asset over their property as a finite-supply asset that could act as a hedge against inflation.” The move, the firm says, is “unsurprising, given the high amount of speculation in digital asset markets.”

The report adds that speculation is the primary reason behind derivative futures volumes not seeing “much of a decline” while spot volumes across the market have fallen much more significantly. In total, spot volumes fell 43.4% to $1.56 trillion from their peak in November, while futures volumes fell 23.8% to $2.91 trillion

Notably, the institutional accumulation trend was also hinted at by Nasdaq-listed cryptocurrency exchange Coinbase, which reported user numbers that topped analysts’ expectations in the third quarter of the year, even while missing estimates for revenue.

In its Q3 earnings report, the firm noted that “roughly 25% of the 100 largest hedge funds in the world” are onboarding into the cryptocurrency space through Coinbase.

In August of last year, Coinbase reported that 10% of the top 100 hedge funds were onboarding with the exchange. The Block editor Frank Chaparro noted that after a conversation with Coinbase’s head of investor relations, the firm noted some hedge funds are just “testing the waters in crypto” and could be gearing up to catch the market’s upside once the “winter thaws.”

In the third quarter of the year, Coinbase lost $2.43 per share, adjusted, compared to a $2.40 loss per share analysts expected. Its revenue was $590 million, below the $654 million analysts were foreseeing.

The Exchange’s user base has been declining throughout the bear market as well. Coinbase reported 8.5 million monthly transacting users (MTUs) during Q3, down from 0 million in Q2 and 9.2 million in Q1. Analysts were expecting 7.84 million users for the third quarter.

Image Credit

Featured Image via Unsplash