The cryptocurrency derivatives market has seen its market share of total trading volume reach a new all-time high in January after derivatives volumes remained steady at $2.86 trillion for the month, whilst spot volumes dropped 30.2% to $1.81 trillion.

According to CryptoCompare’s January 2022 Exchange Review, as a result, the derivatives market has reached an all-time high in market share of 61.2%, breaking its previous all-time high of 57.3% seen in November 2020.

The report details that the growing derivatives market suggests an “increase in hedging and speculation in cryptocurrency markets in the month of January, as participants shift to trading futures and options.” Despite the gain in market share, derivatives market volumes remain below their all-time highs seen in May 2021, of $4.96 trillion.

Binance was the leading derivatives exchange in January with 51.6% of the market share, totaling $1.5 trillion in volume. It was followed by OKEx’s $559 billion volume and FTX’s $346 billion. Next came Bybit with a derivatives trading volume of $219 billion.

Derivatives exchanges, the report adds, traded a daily maximum of $181 billion on January 21, an intra-month high 3.4% lower than the one seen in December of $188 billion.

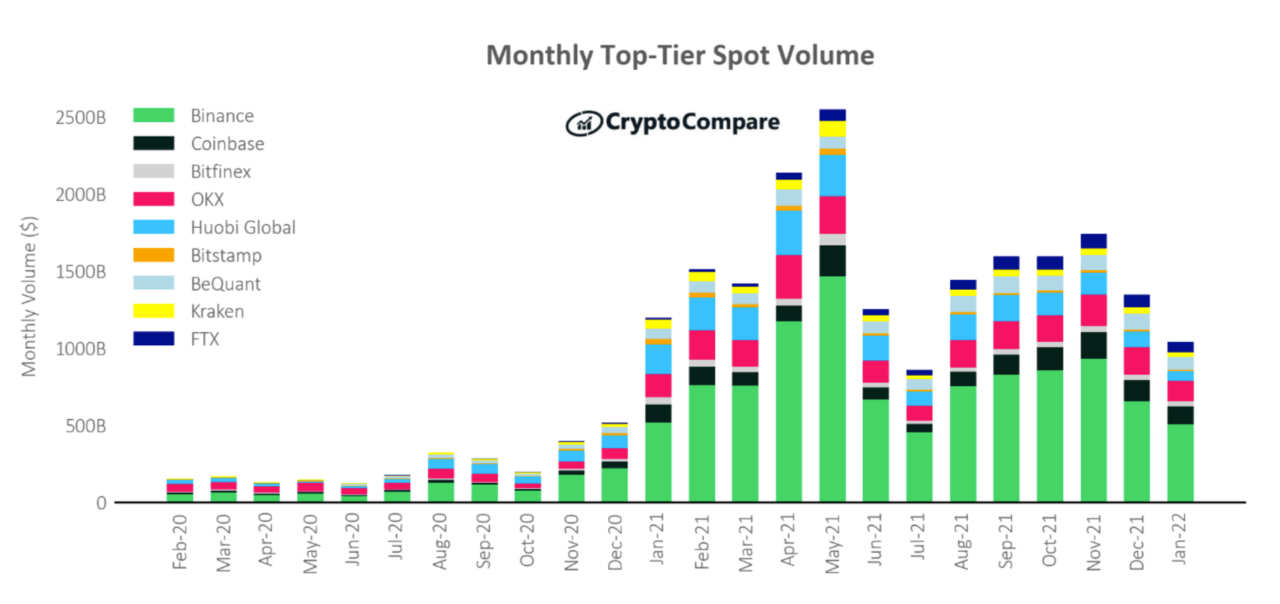

As far as spot volumes go, top-tier cryptocurrency exchanges endured a 21.2% drop in trading volume, while lower-tier exchanges experienced a 66.3% drop in their volume. Top- and lower-tier exchanges are determined according to CryptoCompare’s comprehensive Exchange Benchmark.

Top-tier exchanges, the report adds, now account for 90.3% of all spot volumes, with daily total spot volume seeing an intra-month high of $91.1 billion in January, down 47.5% from the intra-month high seen in December.

While spot and derivatives volumes dropped, BTC options contracts on the Chicago Mercantile Exchange saw their trading volumes rise 28.6% in January to 1,882 contracts, CryptoCompare’s report details.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Pixabay