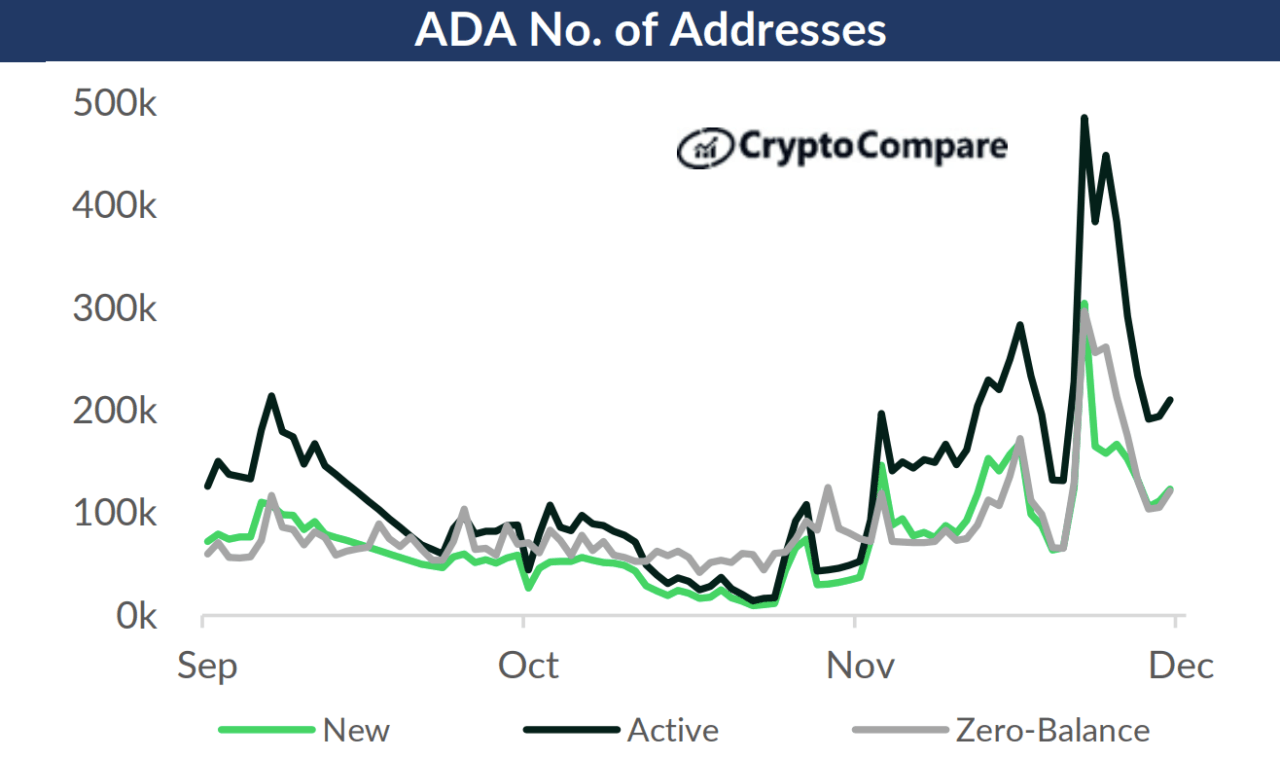

The number of active addresses on the Cardano ($ADA) Network quadrupled from October to November as on-chain activity picked up and transaction fees on the network dropped from $0.45 to $0.38 on average.

According to CryptoCompare’s recent Asset Report, in October there were 50,506 active addresses on the Cardano blockchain, while in November there were a total of 216,072 active addresses.

Activity on the Cardano blockchain has likely been moving up thanks to the upcoming launch of several decentralized finance (DeFi) protocols which include SundaeSwap, a “native, scalable decentralized exchange and automated liquidity provision protocol.”

CryptoCompare’s report details that monthly transactions on the Cardano blockchain grew 75.8% to 46.2 million in November, hitting a monthly all-time high. The average daily zero-balance addresses also rose by 82.1% from 66,000 to 120,000, the report details.

As CryptoGlobe reported, the number of addresses on the Cardano network staking ADA has grown to surpass the one million mark even amid a cryptocurrency market downturn that saw the space lose over $400 billion in market capitalization. Similarly, earlier this month the network hit a milestone after processing 20 million transactions.

Cardano’s price exploded earlier this year after it completed its smart contract phase “Goguen” and the ecosystem is now moving onto its “Basho” phase, which will focus on scaling the network. Block sizes are now going to be increased by 8 KB to 72 KB in anticipation of higher network traffic from the launch of new decentralized applications, CryptoCompare adds.

Notably, over 70% of ADA’s supply has been staked on the network, earning holders interest as they wait for new decentralized applications to be launched.

As reported, CryptoCompare’s report also revealed that the total value locked (TVL) on the decentralized finance ecosystem built on top of the Solana ($SOL) blockchain grew in November while Ethereum transaction fees hit a new all-time high that month, suggesting investors rotated to Solana over its cheaper transaction fees.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Unsplash