Bitcoin whales are seemingly still buying the BTC price dip as the cryptocurrency’s price drops below the $30,000 mark for the first time in one month, as on-chain data suggests they aren’t selling, but instead buying more.

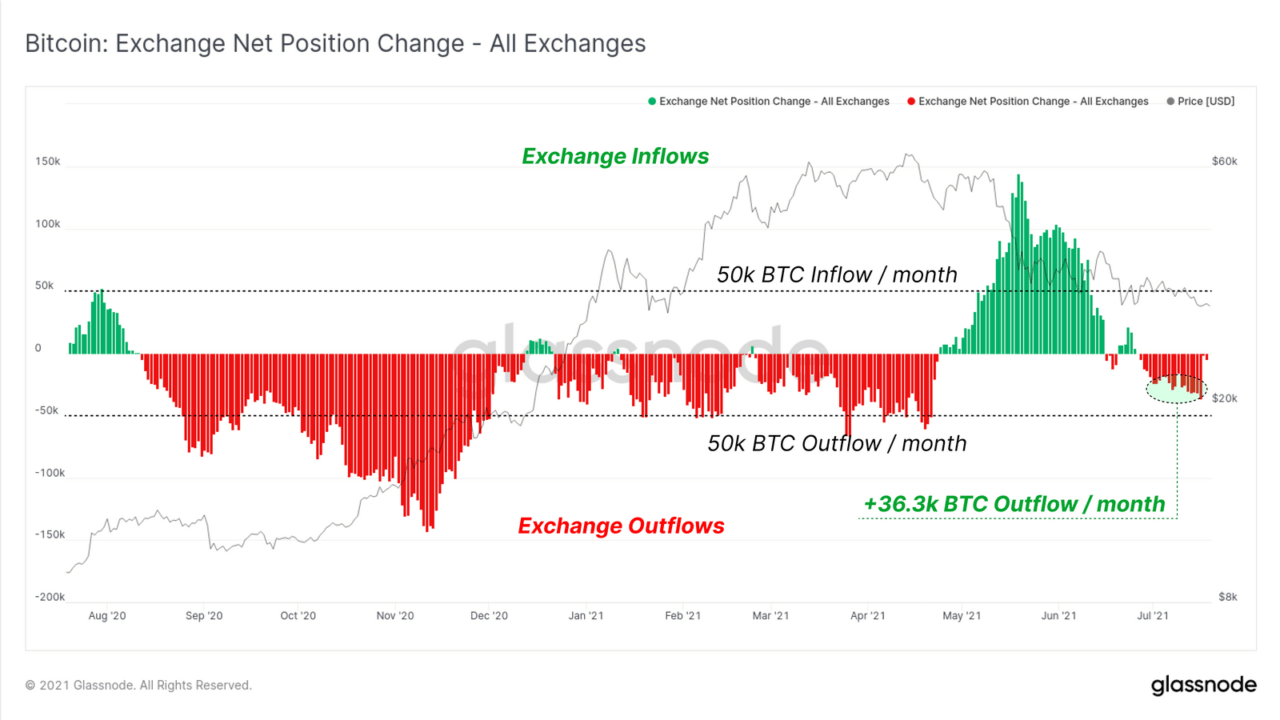

According to data from Glassnode’s “The Week On-Chain” report, Bitcoin reserves on centralized cryptocurrency trading platforms have been steadily dropping even as the market ticks downward. An average of 36,000 BTC has been leaving exchanges every month.

To the firm, the amount of BTC being held by cryptocurrency exchanges is steadily dropping as large investors are moving their funds into secure cold wallet storage instead of leaving them on exchanges where they would be ready to sell their funds.

Glassnode also noted that the number of entities holding bitcoin since May has increased, from roughly 250,000 to nearly 300,000. These entities are described as unique clusters of addresses belonging to one individual or organization.

Similarly, the number of entities selling coins has fallen from 150,000 to 100,000, while the number of entities accumulating BTC increased significantly, going from 190,000 to 250,000. Data shows whales may be leading the accumulation.

Moskovski Capital’s Chief Investment Officer Lex Moskovki pointed out on social media that the BTC supply held by whales – defined as clusters of addresses with between 1,000 and 10,00 BTC belonging to the same entity – has risen back to levels seen when bitcoin was trading at $57,000.

In its report, Glassnode noted that while signals suggest accumulation is ongoing, a heavily divided market sentiment points to “a likely expansion of volatility” in the near future. As Cointelegraph reports, it adds miners are now also accumulating, as the miner net position change metric shows they accumulated over 3,300 BTC this month.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Pixabay