The total assets under management across cryptocurrency exchange-traded products have increased to $58.7 billion while trading volumes and institutional flows slowed significantly.

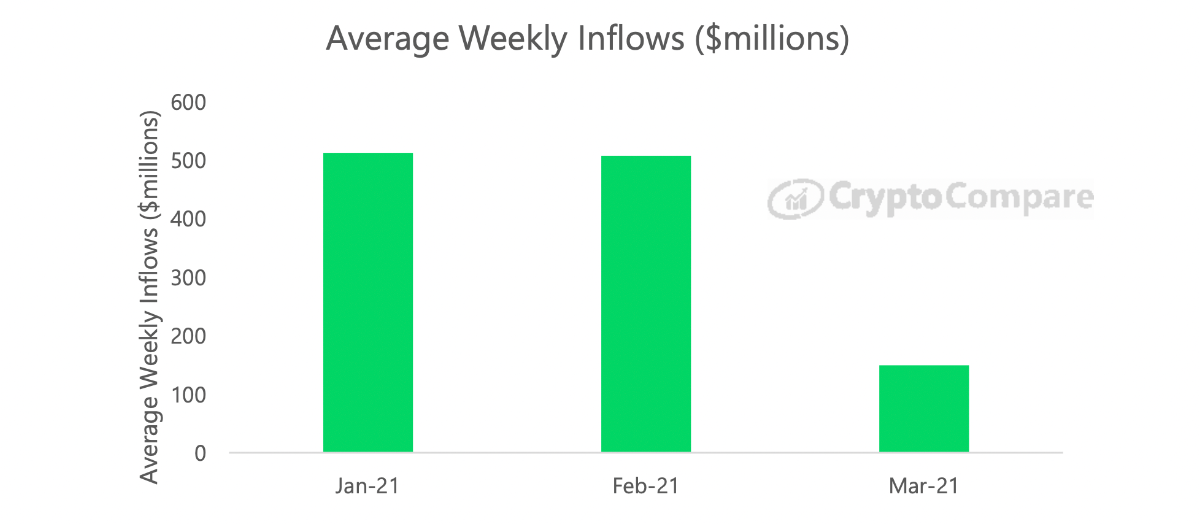

According to CryptoCompare’s latest Digital Asset Management Review, since the end of February, the total assets under management of digital asset investment products rose 8.76% but average weekly asset inflows across all major product providers plunged by 70.5% to $149.6 million.

Similarly, the aggregated daily trading volumes across all digital asset investment products decreased by an average of 17.6% this month, with average daily volumes now standing at $772 million. In February, the average daily trading volume was $936 million.

CryptoCompare report also looked at the performance of both bitcoin and ether exchange-traded products, and found that over the last 30 days the best performing BTC products by market price were XBT Provider’s Bitcoin Tracker Euro, which went up 16.5%, and Bitcoin Tracker One, which went up 18.7%. Both outperformed CryptoCompare’s CCCAGG BTC/USD Index, which moved up 13.7%.

MVIS’s MVDA Index, a market cap-weighted index that tracks the performance of a basket of the 100 largest cryptoassets by market capitalization, moved up 23.29% over the last 30 days. It outperformed every cryptocurrency exchange-traded product except for 21Shares’ BNB Tracker, which moved up 34.7%.

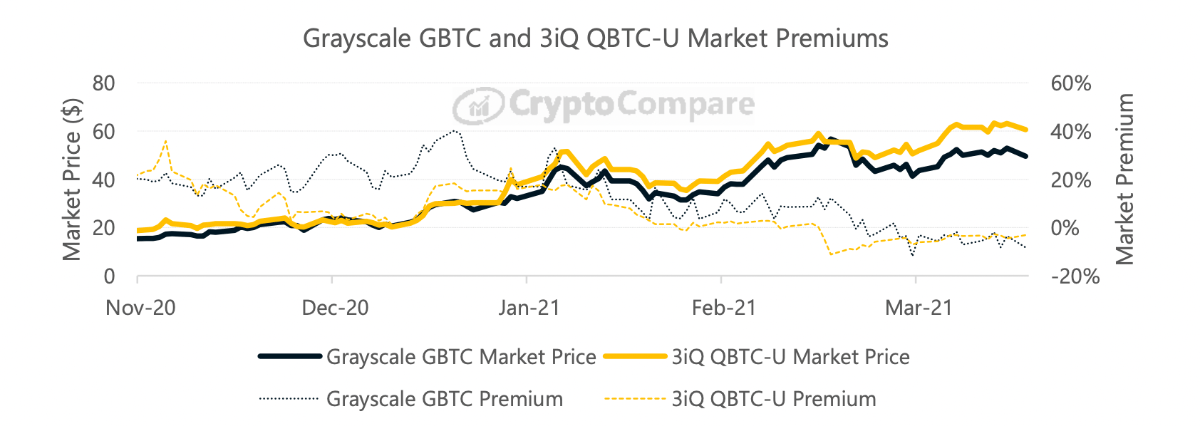

The report also looked into the declining premiums of Grayscale’s GBTC product and 3iQ’s QBTC. Since January, both of these products have seen their premiums plunge, and now both trade at a discount that’s on average between 4% to 5% of their net asset value.

It details Grayscale’s average premium dropped from 6.72% in February to 4.66% in March, while 3iQ’s QBTC saw its discount move from 1.88% to 4.34%. The discounts may be related to competition from other products, including bitcoin exchange-traded funds (ETFs) launched in Canada and Brazil.

As reported, the billionaire has revealed he expects the U.S. Securities and Exchange Commission (SEC) to approve a bitcoin ETF within the next 12 months. To Novogratz, a bitcoin ETF would be a much better Bitcoin investment vehicle for U.S. retail investors.

Featured image via Pixabay.