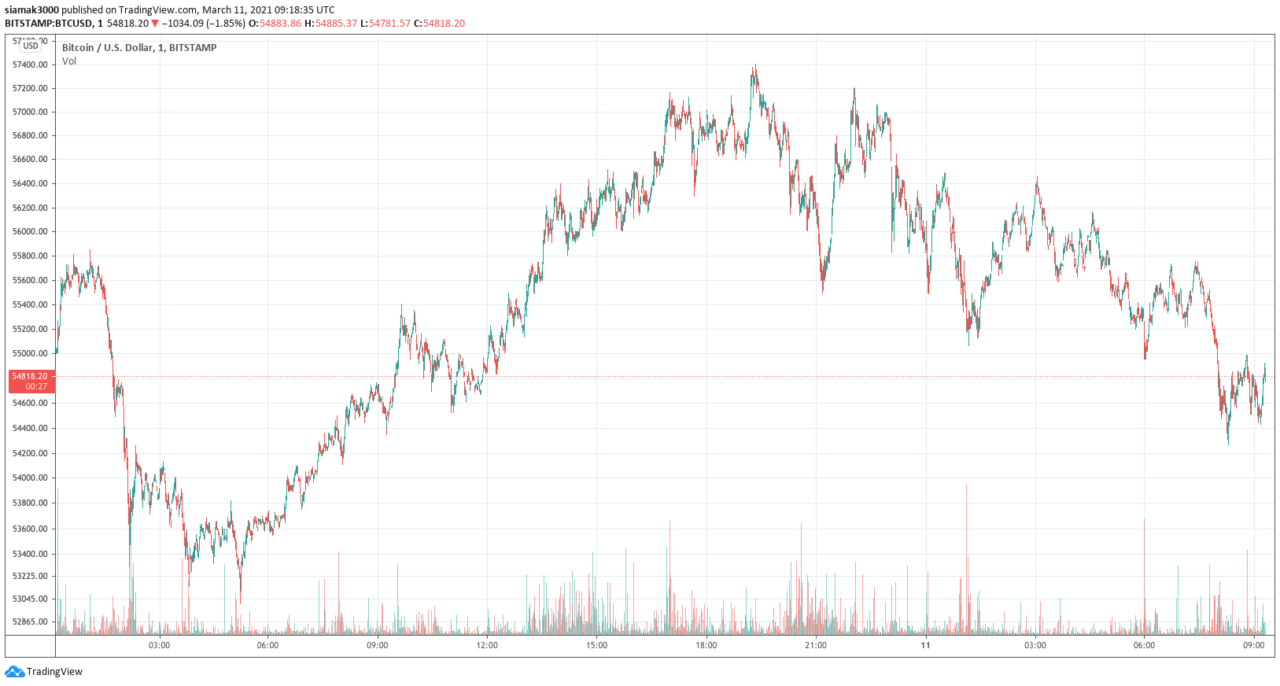

On Thursday (March 11), Bitcoin is consolidating around the $54,800 level, down around 0.85% on the day. In this article, we look at two potential explanations for the BTC price falling from around $57,400 (its intraday high on March 10).

Lower Than Expected U.S. Core Inflation Rate for February 2021

Here is a nice definition of core inflation by The Balance:

“The core inflation rate is the price change of goods and services minus food and energy. Food and energy products are too volatile to be included. They change so quickly that they can throw off an accurate reading of underlying inflation trends.“

As The Balance points out, core inflation is also known as “Consumer Price Index for All Urban Consumers Less Food and Energy” (CPI Less Food and Energy).

The exclusion of food and energy “makes the core rate more accurate than the headline inflation rate in measuring underlying inflation trends, and this accuracy is “why central banks prefer using the core inflation rate when setting monetary policy.”

According to a press release yesterday by the U.S. Bureau of Labor Statistics, the CPI for all items less food and energy “rose 0.1 percent in February,” which was less than what many economist were expecting to see. It went on to say that “the index for all items less food and energy rose 1.3 percent over the last 12 months, a smaller increase than the 1.4-percent rise for the 12 months ending January.”

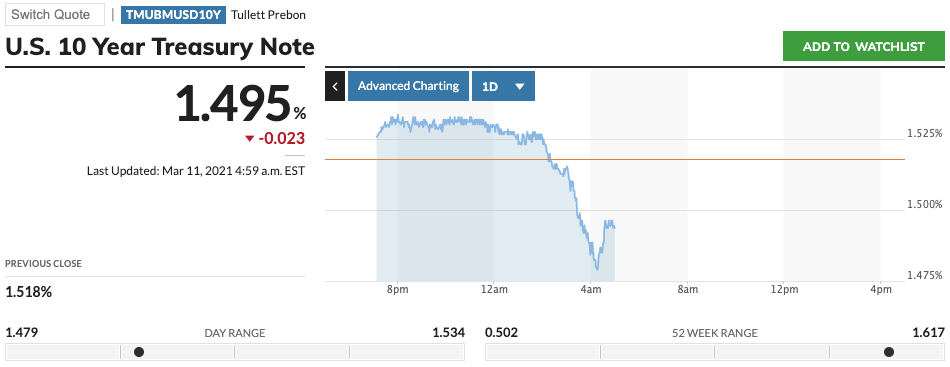

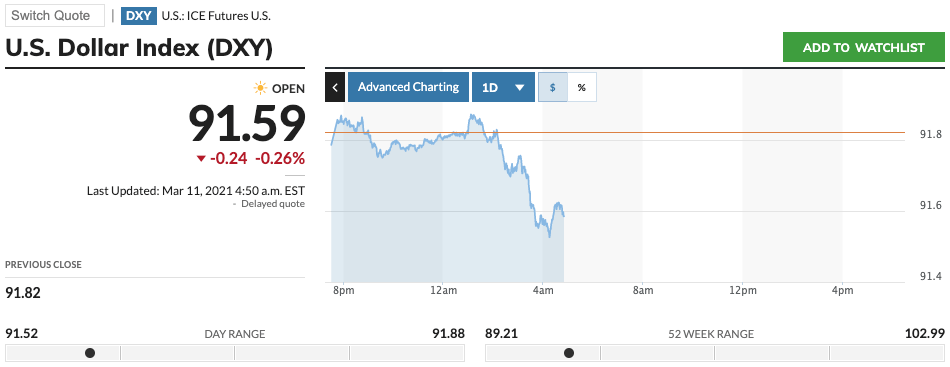

Holger Zschaepitz, Senior Editor at the Economic and Financial desk of the German daily Die Welt and its Sunday edition Welt am Sonntag, offered a market update earlier today, in which he said that this “tame US inflation report helped to keep Yields & Dollar in check.”

And in fact, as of 10:00 UTC on March 11, according to data by MarketWatch, both the U.S. treasury yields and the U.S. dollar index (DXY ) are slightly down today.

A report by Reuters published yesterday blamed the fall in DXY on “a tame U.S. inflation report and a tepid auction of benchmark 10-year Treasury notes.” The report went on to say:

“U.S. Treasury yields slid following the data, as market participants had hoped for a more upbeat outlook on consumer prices.

“The dollar index has closely tracked a surge in Treasury yields this year, both because higher yields increase the currency’s appeal and as the bond rout shook investor confidence, spurring demand for safe-haven assets.“

Axel Merk, president and portfolio manager at Merk Hard Currency Fund in Palo Alto, California, told Reuters:

“Bonds are getting stronger, which means the dollar relatively speaking, may be less attractive,” said Axel Merk, president and portfolio manager at Merk Hard Currency Fund in Palo Alto California.

“Bonds had quite a sell-off and many would have argued that it may have been overdone.“

In short, a lower inflation rate increases the appeal of U.S. treasurys, which makes their prices go up and their yields go down. Lower bond yields increase the attractiveness of risk-on assets such as Bitcoin and stocks. However, currently, Bitcoin’s primary use case is to act as a hedge against higher inflation, and so lower inflation reduces the need to buy Bitcoin, which could have helped to push its price lower.

Oracle Corporation Does Not Mention When Reporting Q3 FY2021 Results

Yesterday, Oracle Corporation (NYSE: ORCL) announced its fiscal 2021 Q3 results, and contrary to rumors that had been floating around in the crypto community (possibly started by Bitcoin advocate Max Keiser) in the past few weeks, the company or its CEO Larry Ellison did not mention any investment in Bitcoin, unlike Tesla and Elon Musk.

Many people were expecting Ellison to follow his friend Elon Musk’s example and use some of Oracle’s cash to buy Bitcoin for use as a treasury reserve asset. There were two reasons for this. First, the Oracle CEO, who is a friend of the Tesla CEO, owns a large amount of Tesla stock. Second, Ellison has a member of the Board of Directors of Tesla since December 2018. According to a report by CNBC published on 13 February 202, Ellison “disclosed his ownership of 3 million shares in Tesla at the end of 2018 before joining the board.”

The quashing of this rumor could have made those people who had recently bought Bitcoin based on this rumor to sell once it became clear that the rumor was not true.

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.