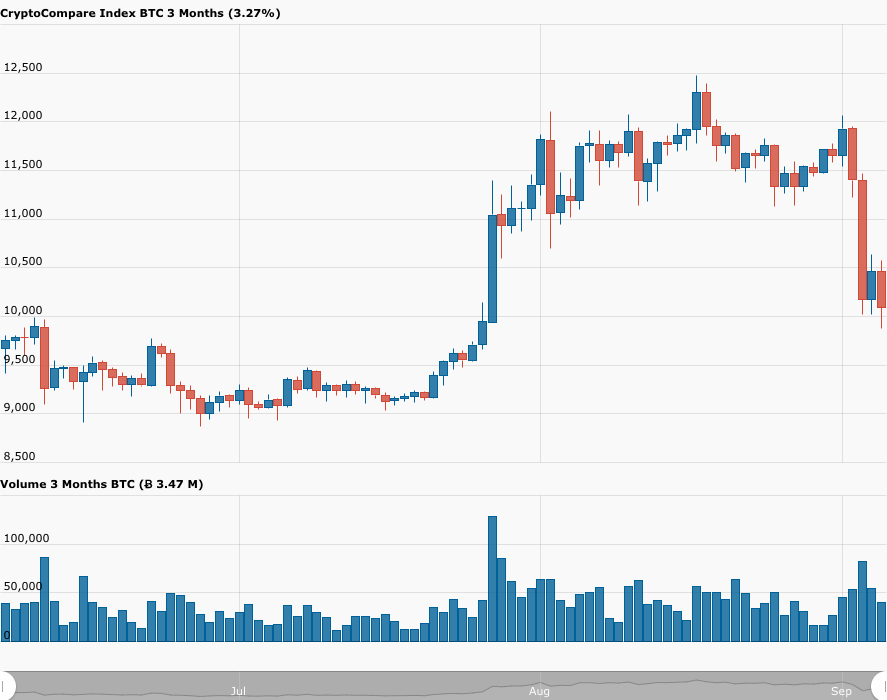

According to data from CryptoCompare, around 18:50 UTC on Saturday (September 5), the average Bitcoin price (across crypto exchanges) went below $10K for the first time since July 27, but it didn’t stay there very long.

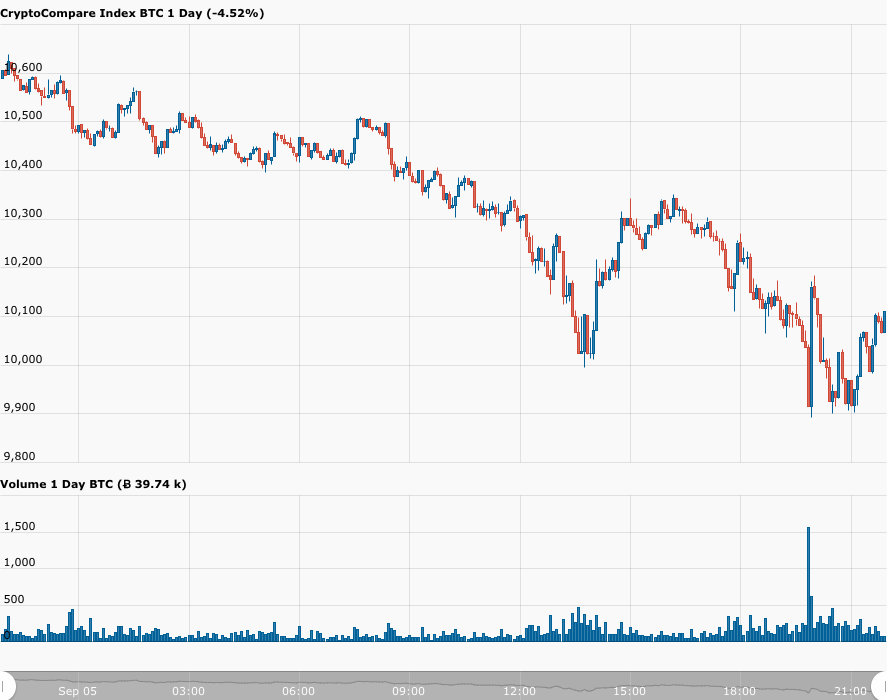

Here’s how the day has gone so far for Bitcoin.

Bitcoin started the day (i.e. 00:00 UTC on September 5) around $10,467. Then, between 06:35 UTC and 06:55 UTC, the Bitcoin price managed to stay mostly above $10,500.

Then at 18:50 UTC, the Bitcoin price fell below the $10,000 level for the first time since July 27, and kept falling until it reached $9,915. Five minutes later, the BTC price went below the $9,900 and reached $9,892.

Two hours later, Bitcoin has nicely bounced above the $10K level. Currently (as of 20:58 UTC on September 5), Bitcoin is trading around $10,100, up 2.1% in the past two-hour period.

As for the rest of the cryptocurrency market, with the exception of the fiat-backed stablecoins, it is currently impossible to find any top 50 (by market cap) cryptoasset in the green among, with several high quality popular coins/tokens suffering double-digit percentage losses against the dollar.

Here are a few examples:

- Ether (ETH): $328.29 (-15.42%)

- Polkadot (DOT): $4.13 (-22.46%)

- Cardano (ADA): $0.0889 (-13.36%)

- Aave (LEND): $0.505 (-20.55%)

- Yearn.Finance (YFI): $21,510.10 (-21.45%)

- UMA: $11.26 (-40.06%)

So, what are some of the most popular and respected crypto analysts, investors, and traders saying about the fire sale in the cryptocurrency market that we are currently witnessing?

Michaël van de Poppe:

Qiao Wang:

Cameron Winklevoss, Co-Founder and President of digital asset exchange Gemini:

It is, of course, impossible to predict in the short-term where the Bitcoin price is headed and potentially the price of any cryptoasset could go to zero, but it is worth pointing out that on-chain market intelligence startup Glassnode said in the 31 August 2020 issue of its “The Week On-Chain” newsletter that Bitcoin’s Network Health, Network Growth, and Network Activity remain “strong”.

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.