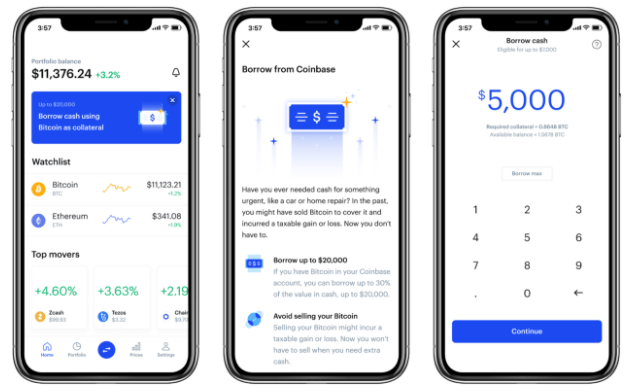

Coinbase has announced that eligible customers in 17 out of the 50 U.S. states will soon be able to get USD loans collateralized by their Bitcoin holdings.

Around 16:17 Pacific Time on Wednesday (August 12), Coinbase announced via a blog post that starting this fall/autumn, its U.S. customers in selected states would be able to borrow cash using Bitcoin held in their Coinbase accounts.

Product Manager Thorsten Jaeckel said in this blog post that Coinbase users in “eligible states” could now apply to be on the waitlist for the opportunity to “borrow up to 30% of their Bitcoin holdings.”

Jaeckel went on to mention that unlike traditional loans, its crypto-backed USD loans did not require going though a log application or a credit check, and that customers would receive the cash in a couple of days.

The eligible states are Alaska, Arkansas, Connecticut, Florida, Georgia, Illinois, Massachusetts, New Hampshire, New Jersey, North Carolina, Oregon, Texas, Virginia, Nebraska, Utah, Wisconsin, and Wyoming.

Here are the details:

- You can borrow USD up to 30% of the value of your BTC holdings.

- The maximum amount you can borrow using your BTC as collateral is $20,000.

- The annual percentage rate (APR) is 8%.

- You pay interest each month; the principal must be repaid within a year.

John Carvalho, COO at Swedish crypto startup Bitrefill, does not seem to be a fan of this new offering from Coinbase:

Featured Image by “Maklay62” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.