Bitcoin (BTC) has again retested the important $4,000 price ceiling on 19-20 March, but is unable to remain above this level on non-Tether exchanges.

Instead it has continued to range in the same consolidation pattern that began after the 16 March breakout. This consolidation appears to be a bull flag, between roughly $4,000 and $3,940.

However, the price is holding at or above the 55 hour EMA, which has been trending upward. Respecting this line (below, in pink), appears to be another squeeze within the $4,000 resistance level. Volume was rising on the 19th, but has dropped off again today (20 March).

(source: TradingView.com)

(source: TradingView.com)

The support / resistance (S/R) zone in the low $3,900’s must be held in order to stay in this consolidation. Should it break, however, there is a strong knot of support at mid $3,800, as well as the Feb-March uptrend support (in green, below) to catch Bitcoin’s fall.

(source: TradingView.com)

(source: TradingView.com)

In the long term, the area between $4,100-200 remains key. At this scale, Bitcoin is consolidating within an ascending triangle pattern, which is bullish. There is plenty of elbow room to manoeuvre, but this pattern could continue for months. Should BTC break out, it would quickly be in striking distance of the critical 200 day moving average. Getting and staying above the 200MA could change the long term trend of Bitcoin and end the bear market.

(source: TradingView.com)

(source: TradingView.com)

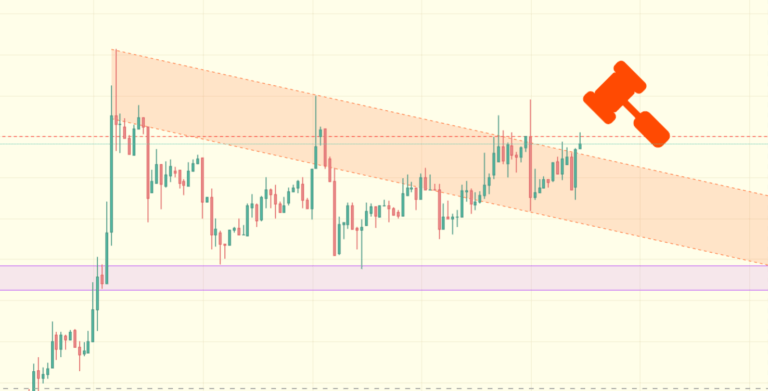

On the very long term (weekly chart), Bitcoin is approaching a level of downtrend resistance. A failure to break this could be problematic. What’s more, it is hard to ignore the possibility that on a very long term, Bitcoin has formed a bear flag, suggesting the possibility of (hopefully) a final capitulation to end the 2018 bear market in style.

(source: TradingView.com)

(source: TradingView.com)