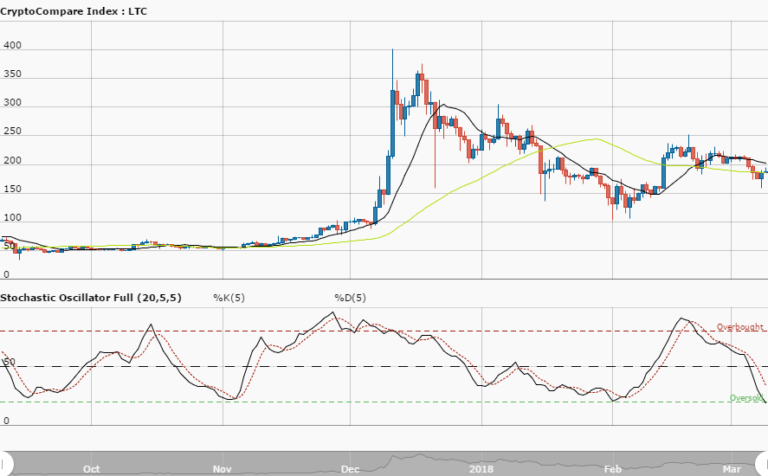

LTCUSD Long-term Trend – Bearish

Distribution territories: $100, $120, $140.

Accumulation territories: $45, $30, $15.

Litecoin has been under steady selling pressure since around May 21, while the 14-day SMA intersected the 50-day SMA from the top. Sales against the US dollar saw LTC get past its recent lowest price value at around the accumulation territory of $75 on August 4. Two days after, the crypto strived to push its price up.

On August 7, Litecoin’s price was forced southward towards the accumulation territory of $60 by the bears’ forces. Its price has now been hovering above said accumulation territory. The 50-day SMA is still above the 14-day SMA and both point south.

Stochastic Oscillators have dipped into the overbought zone and are currently consolidating within it. All these put together show the bears’ intense efforts aren’t stopping yet, meaning more downward movements are to be expected.

The market may only start a bullish trend by pushing LTC’s price past the two SMAs. It’s assumed investors may stay off the market for a while, but traders can continue to look out for a strong move in any direction, while properly managing their funds.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.