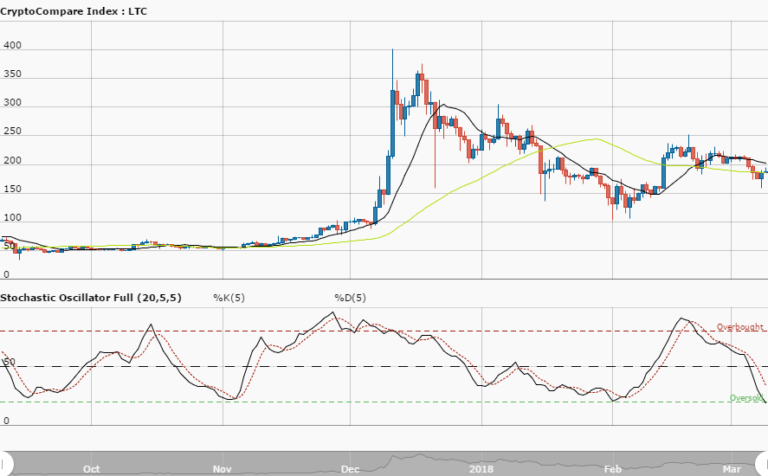

LTCUSD Long-term Trend – Bearish

Distribution territories: $120, $140, $160.

Accumulation territories: $70, $50, $30.

Litecoin hasn’t been able to convincingly rise against the US dollar. The cryptocurrency initially saw a series of price declines from July 18 to 23. On July 24, a sudden spike occurred, and its price, once again, moved up to touch the trend-line of the 50-day SMA.

On July 25, the cryptocurrency saw the bears lightly drive it south. Its price has been trading between the short space of the two SMA trend-lines. The 14-day SMA is a bit bent north below the 50-day SMA. The 50-day SMA is still above the 14-day SMA.

This shows the cryptocurrency is still suffering from the impact of the bearish trend. The Stochastic Oscillators had moved to touch range 60, but now seem to be pointing north-east. This suggests that neither the bulls nor the bears are currently taking control.

Currently, the accumulation territory of $70 will remain critical for the bears, who may find it hard to breach. As such, the bulls are expected to attempt to gain momentum when downward movements start weakening. Traders can be on the lookout for good buying entries.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.