ADAUSD Medium-term Trend: Ranging

Supply zones: $0.3000, $0.3200, $0.3400

Demand zones: $0.2000, $0.1500, $0.1000

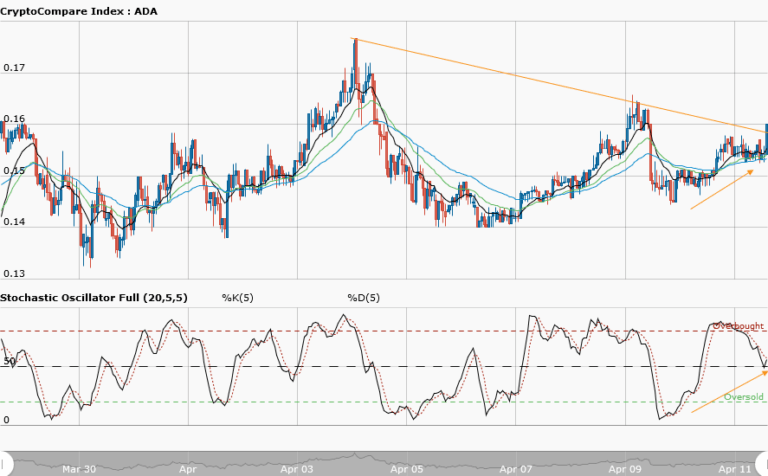

Cardano is ranging in the medium-term. The bulls lost momentum as they failed to push price beyond the $0.2600 supply zone. The bulls attempted to break this zone twice but were rejected by the bears. This created a triple top formation and the bears returned fully again. It was a manifestation of the fact that the bears are not yet done in the market. They were able to push the price down to the $0.2400 demand zone breaking the upward trendline that was drawn in yesterday analysis. This brought Cardano back into the range. The pair is consolidating between the upper supply zone at $0.2600 and the lower demand zone at $0.2300. The daily candle opened bearish below the three moving averages crossover at $0.2460. This was lower than yesterday’s opening of $0.2520. These suggest more bears presence and pressure. The stochastic oscillator is still in the oversold region with signal pointing down. This implies downward momentum in price as the bears’ pressure increases. A retest of the lower demand area likely in the medium term.

ADAUSD Short-term Trend: Bearish

Cardano is bearish in the short-term. The bears’ supremacy over the bulls was not over yet as they stage a return to the market. They were able to push price from the supply zone at $0.2600 down to the demand zone $0.2400. The bulls efforts were rejected as they tried pushing the price up at former demand areas – now turned support areas. The price is creating lower highs and lower lows that are characteristic of a down-trending market. As the bears’ pressure increases, Cardano may reach more lower highs and lower lows in the short-term.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research