Altcoin Analytics

News ReporterSentiment is increasingly recognized as a factor in financial markets. Arguably this is even more true for cryptocurrency markets than for traditional markets. Guest contributor AltcoinAnalytics has provided an in-depth analysis of the social media sentiment in last weeks crypto market to help you make sense of the current market trends.

Articles by Author

How News Sentiment and Behavioral Economics Can Help Spot Upcoming Crypto Dips

- Altcoin Analytics

- /

- 30 Jan 2019

“Economists think about what people ought to do. Psychologists watch what they actually do.” Daniel Kahneman Since prices reflect what people actually do, behavioural economics can help us spot opportunities. One important phenomenon in behavioural economics is the availability heuristic.

Crypto Sentiment Bullish: More People Expect Market Cap to Rise Than Fall

- Altcoin Analytics

- /

- 8 Jan 2019

Positive cryptocurrency sentiment is increasing – more people believe that the cryptocurrency market cap will be higher in 6 months time.

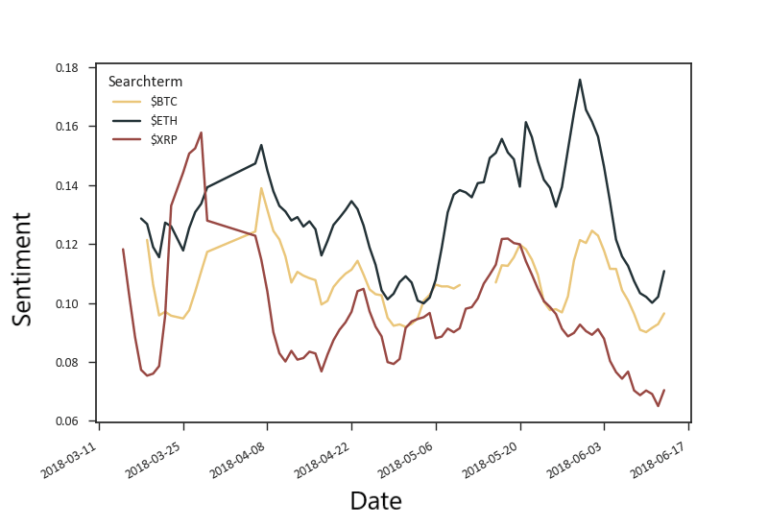

Beyond Conventional Indicators: A Study of Twitter Sentiment Versus Crypto Prices

- Altcoin Analytics

- /

- 8 Aug 2018

Social media are ever more present in everyday life, reflecting and influencing behaviour. This is being increasingly recognized with the traditional financial sector, as evidence is increasing that Twitter sentiment can forecast asset prices.

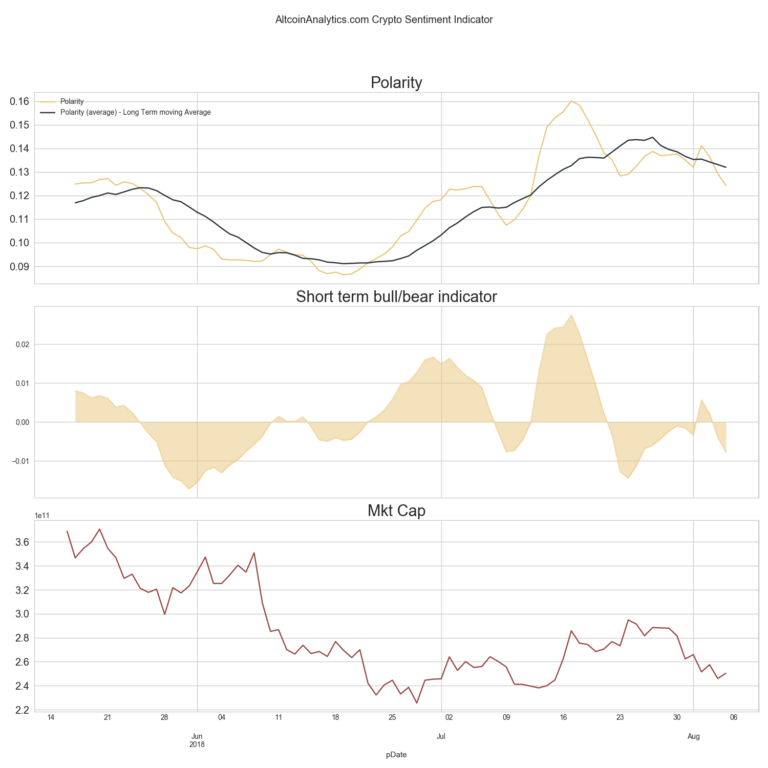

Crypto Sentiment Analysis: Long Term Polarity at 3 Month High

- Altcoin Analytics

- /

- 25 Jul 2018

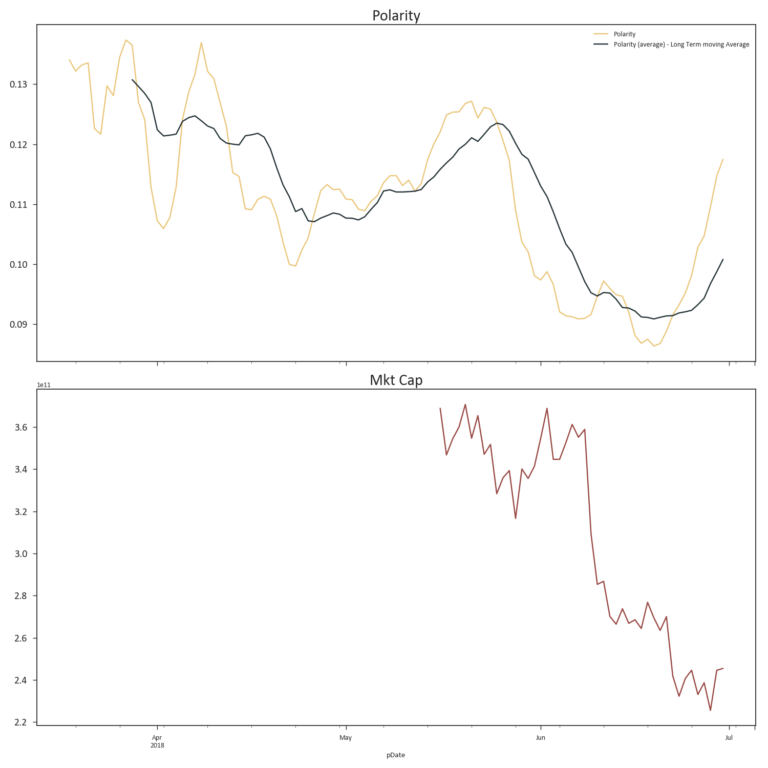

The long term moving average polarity indicator is at a 3 month high. However, short term sentiment polarity has dipped recently. Individual analysis on Bitcoin Cash suggest sentiment is bearish.

Crypto Sentiment Analysis: Twitter Indicator Bullish at 5-month High

- Altcoin Analytics

- /

- 16 Jul 2018

The sentiment indicator has shown a sharp and sustained increase over the past month, particularly the last 10 days which saw the sentiment climb to a 4-month high at 0.149. This suggests the crypto Twitter sentiment is very bullish, which has been reflected in the positive price action over the past 2 weeks.

Quantitative Sentiment Analysis: Crypto Market Rally to Slow but NEO is Bullish

- Altcoin Analytics

- /

- 10 Jul 2018

Quantitative sentiment polarity has decreased over the last few days which suggests the recent bullish action is coming to a close. Overall exposure of crypto related tweets continues to drop but may be due to Twitter deleting bot accounts. Individual sentiment analysis on NEO shows bullish sentiment.

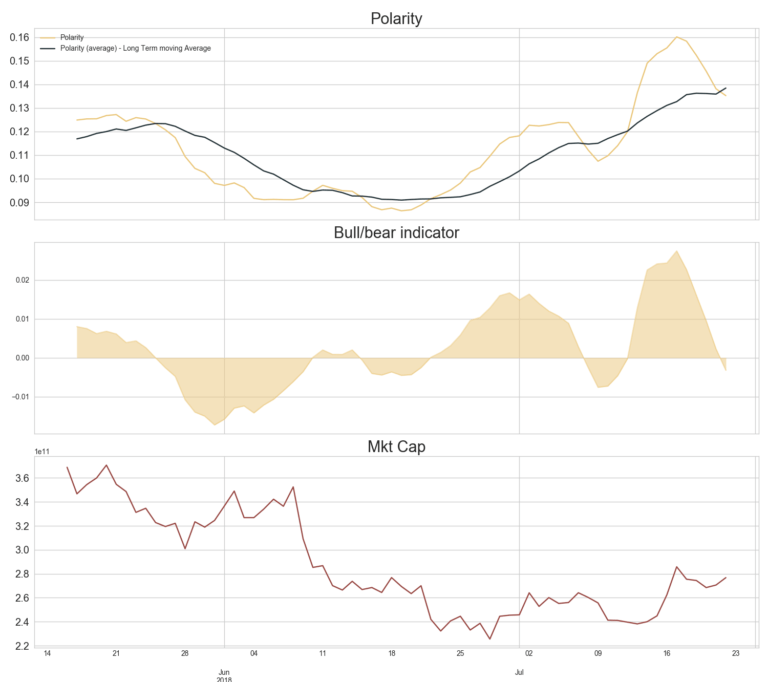

Quantitative Sentiment Analysis Suggests This Week Will be Bullish

- Altcoin Analytics

- /

- 2 Jul 2018

Quantitative sentiment polarity has increased significantly over the last week which suggests bullish action to come over the next week. Overall exposure of crypto related tweets has dropped slightly. Individual analysis of cryptoassets highlighted some impressive buy signals such as PoET.

Quantitative Sentiment Analysis Indicates June Bear Market

- Altcoin Analytics

- /

- 27 Jun 2018

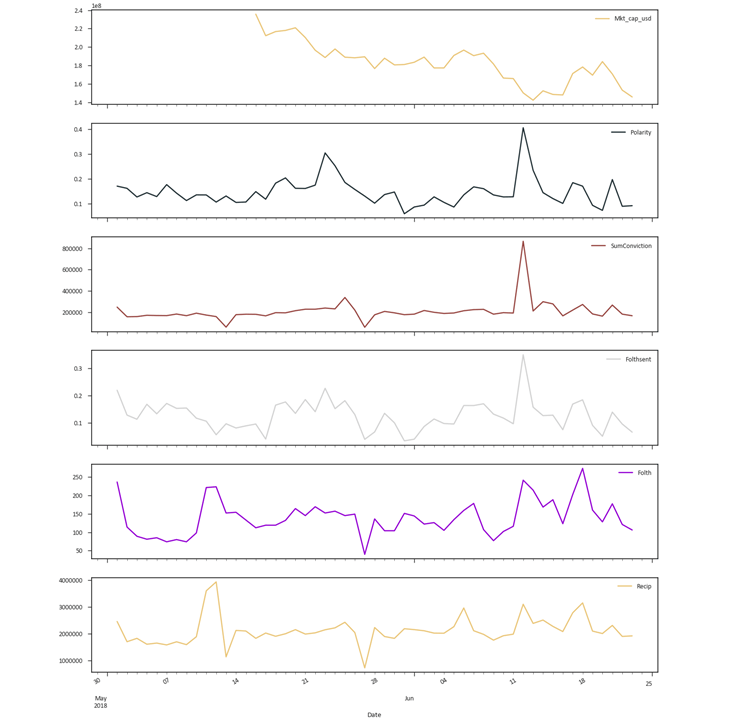

Last week’s analysis showed how sentiment data decreased significantly before the overall crypto market suffered price drops. Todays analysis will give an update on the overall market indicators along with how quantitative sentiment indicators behave on an individual level.

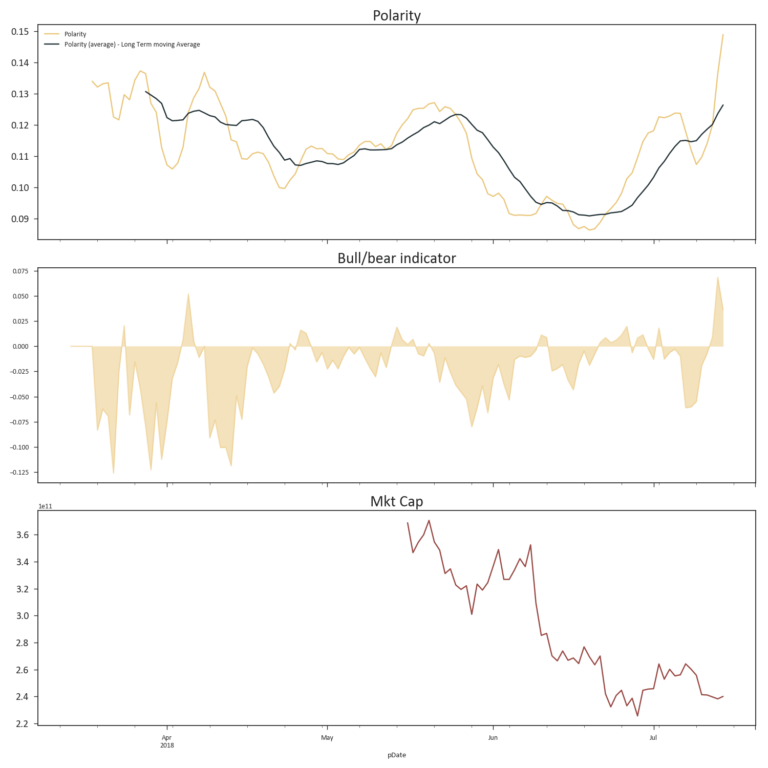

Quantitative Sentiment Analysis: Early Indicator for Market Movements?

- Altcoin Analytics

- /

- 20 Jun 2018

Although mainstream media attributes the poor performance over the last couple weeks to the Coinrail hack and the general continuation of the bear market, sentiment indicators showed a large decrease in sentiment weeks preceding the decline. Can average textual sentiment analysis for 100+ cryptocurrencies give you an edge in the market?

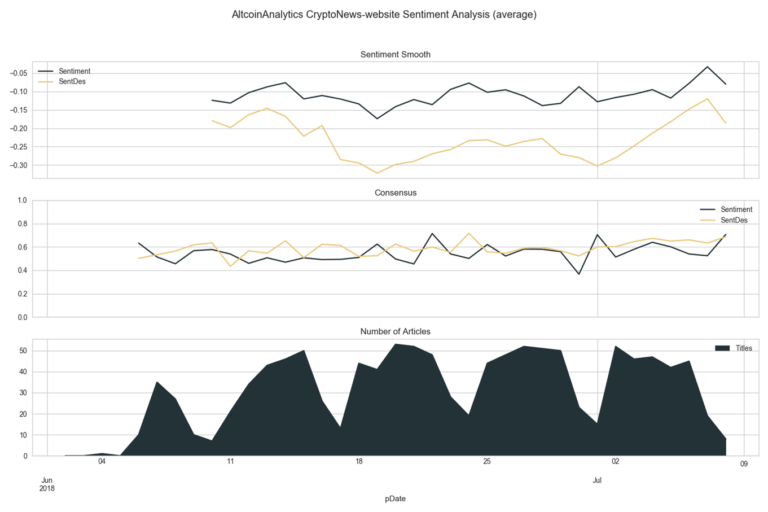

Altcoin Analytics: Last Weeks Crypto Social Sentiment

- Altcoin Analytics

- /

- 11 Jun 2018

Sentiment is increasingly recognized as a factor in financial markets. Arguably this is even more true for cryptocurrency markets than for traditional markets. Combined with the vast amount of data that is available nowadays this offers some interesting opportunities for looking at cryptocurrencies in a non-traditional way.