The second-largest cryptocurrency by market capitalization Ethereum ($ETH) has seen demand for it skyrocket to its second-highest level on record, as permanent holders accumulated 298,000 ETH worth $1.04 billion, in a single day.

That’s according to CryptoQuant’s head of research Julio Moreno, who noted on the microblogging platform X (formerly known as Twitter) that it came close to the record daily buying, which occurred last September and saw permanent ETH holders accumulate 317,000 tokens.

The near-record buying spree came amid a wider cryptocurrency market correction and after Ethereum’s price plunged to a low below the $3,500 mark. CryptoGlobe has reported there has been ongoing Ethereum accumulating, with a “giant” ETH whale recently restarting their accumulation.

According to blockchain analytics firm SpotOnChain, this “giant whale” has recently withdrawn 7,000 ETH worth over $26 million from leading cryptocurrency exchange Binance at around $3,800 per coin, after withdrawing most of their ETH during last year’s bear market, and depositing it back onto the centralized exchange once the price rose.

The Ethereum buying activity exploded after U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler said in a budget hearing final approvals for spot Ethereum exchange-traded funds (ETFs) could be granted by summer’s end.

Speaking to a subcommittee of the Senate Appropriations Committee in a hearing on the regulator’s budget, Gensler said the approval process was “working smoothly” after the initial go-ahead given to a group of these ETFs, referring to the SEC clearing the path for these funds.

The SEC’s approval was met with optimism in the cryptocurrency space, with the price of ETH surging around 20% in a day after the decision was revealed, while the cryptocurrency market as a whole added over $200 billion to its market capitalization.

The approval marks a significant shift for the SEC, which has historically been cautious about cryptocurrency and had been investigating whether to deem the second-largest cryptocurrency a commodity or a security.

While the exchange applications were approved, individual ETF issuers including VanEck, ARK Investments, and BlackRock still need the SEC to greenlight their registration statements before trading can begin.

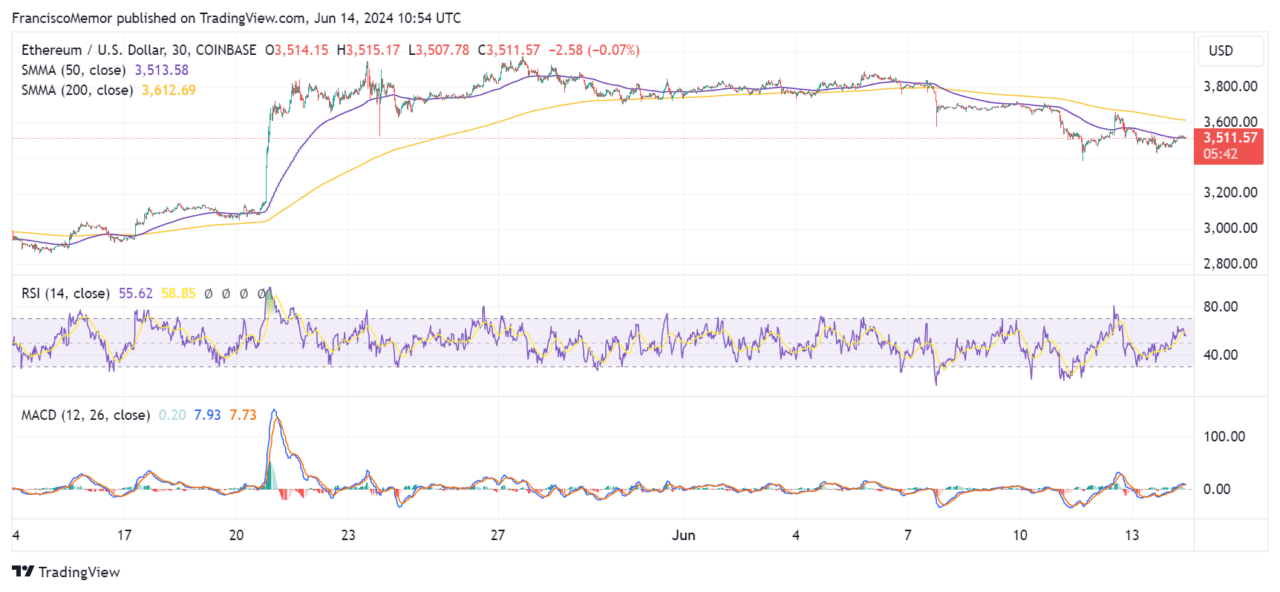

Ethereum Price Analysis

Ethereum is currently trading just above the $3,500 mark, near its 50 moving average, and below its 200 moving average which currently sits at $3,600 on the monthly chart.

This suggest that the cryptocurrency is currently in a bearish trend after the 50-SMA crossed below its 200-SMA to form a “death cross,” widely interpreted as a bearish signal.

The cryptocurrency’s relative strength index (RSI) is currently in a neutral zone and appears to be moving upwards in what appears to be short-term bullish momentum.

Its Moving Average Convergence Divergence (MACD) is meanwhile indicating a potential bullish signal, although its histogram suggests weak momentum for it.

Data suggests that Ethereum’s resistance levels are currently around $3,500 and $3,600 – the levels of its moving averages on the monthly chart – with an immediate support level near its recent lows of $3,200.

Featured image via Unsplash.