On March 22, Fred Thiel, the CEO of Marathon Digital Holdings (NASDAQ: MARA), joined CNBC’s ‘Closing Bell Overtime’ to discuss with co-anchor Morgan Brennan the nuances of Bitcoin’s recent performance, including its volatility, and delve into the evolving dynamics of Bitcoin mining and its energy requirements.

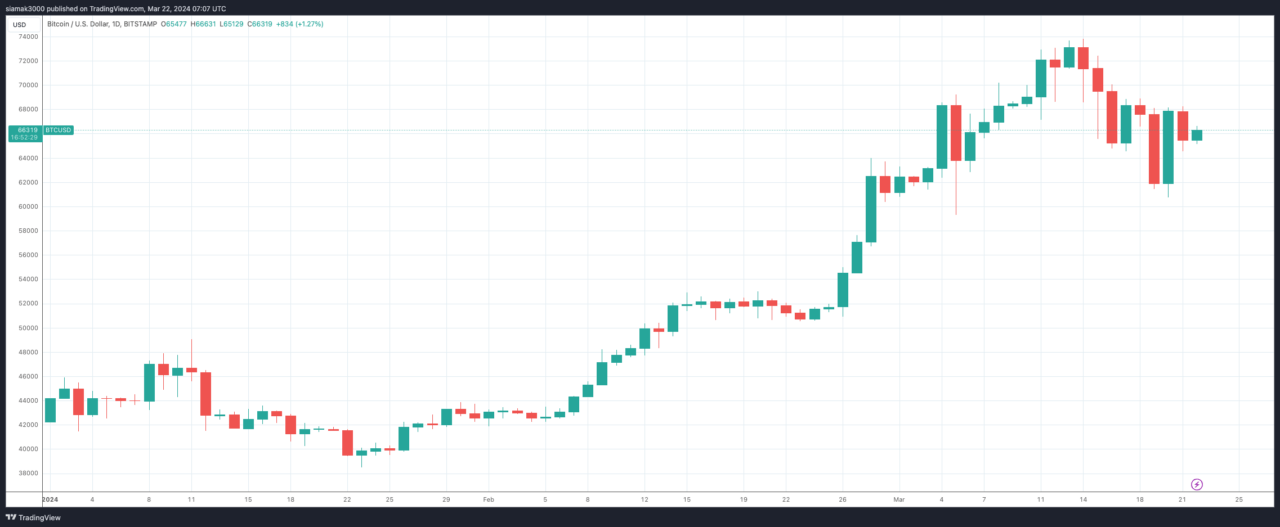

Fred Thiel began by addressing Bitcoin’s dramatic recent rally, which saw it hit an all-time high of nearly $74,000.

Thiel attributed this surge to a combination of factors, including pent-up demand for US-listed spot Bitcoin ETFs and a rotation out of miners into these funds. According to Thiel, these ETFs are yet to fully unleash their market potential, as they haven’t started significant marketing efforts to wealth advisors. This, Thiel suggests, indicates a forthcoming wave of investment into Bitcoin that could further drive its value. He also noted the role of economic uncertainties in bolstering Bitcoin’s appeal, emphasizing that the liquidity constraints introduced by substantial ETF holdings have contributed to Bitcoin’s volatility.

Discussing the anticipated Bitcoin halving (expected around 20 April 2024), Thiel offered insights into its potential effects on Marathon Digital and the mining sector at large. He forecasted that post-halving, smaller miners might face financial strain due to a lack of accessible credit and capital, unlike larger entities such as Marathon Digital. Thiel detailed Marathon’s strategy to capitalize on this environment through targeted acquisitions, bolstered by the company’s strong financial position, demonstrating a proactive approach to industry consolidation.

Thiel extensively discussed the power consumption dynamics of Bitcoin mining, especially in the context of competition with AI companies for energy resources. He highlighted Marathon Digital’s strategic advantage in utilizing stranded energy sources, such as solar and wind, which don’t have direct grid connections. Thiel pointed out the flexibility of Marathon’s operations to act as grid load balancers, contrasting with the constant energy demand from AI operations. This capability allows Marathon to contribute positively to grid management, particularly during peak demand periods, according to Thiel.

Under Thiel’s leadership, Marathon Digital is not just navigating the competitive landscape domestically but is also eyeing international expansion to leverage global opportunities. Thiel shared that Marathon is actively pursuing growth across three continents, emphasizing the company’s commitment to sustainable and strategic scaling in the face of burgeoning demand from both the Bitcoin mining and AI industries.

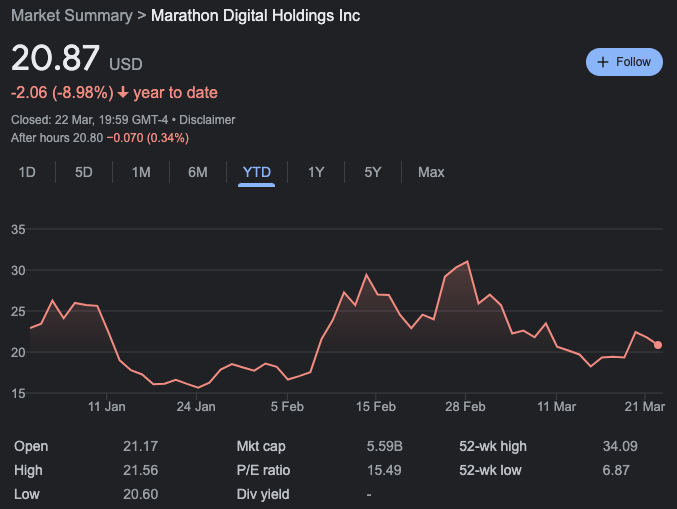

On Friday, the Marathon Digital share price closed at $20.87 (down 4.18% on the day). In the year-to-date period, MARA is down 8.98%.

Featured Image via Pixabay