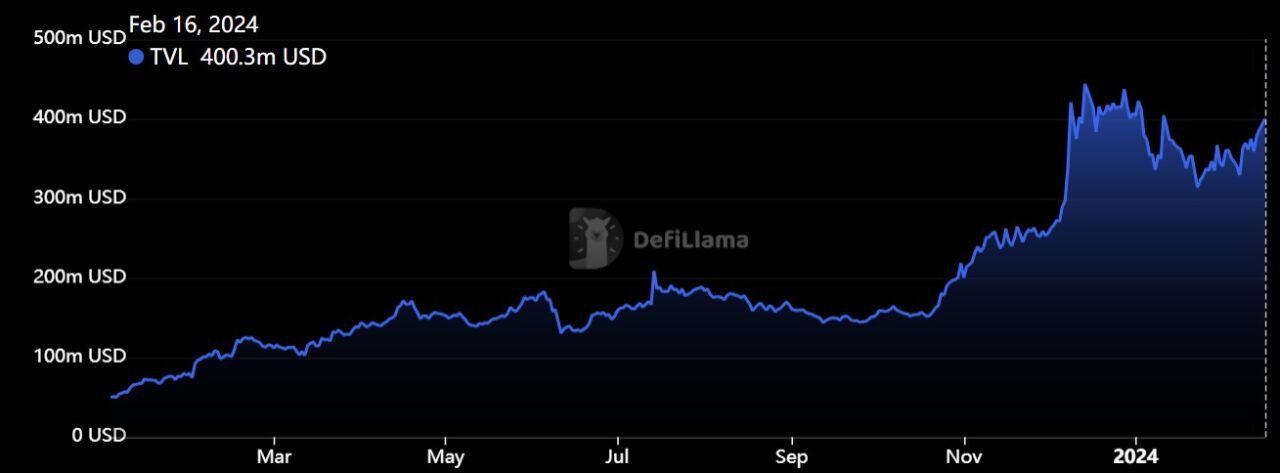

The Cardano ($ADA) ecosystem has been seeing significant growth, particularly in the realm of decentralized finance (DeFi), as the total value locked (TVL) on its decentralized applications keeps on surging.

According to a recent Messari report, the increase in Cardano’s total value locked was around 166% quarter-over-quarter and an impressive 693% year-over-year. This growth catapulted Cardano among other networks by total value locked, to have become the 14th largest network by the metric, behind Coinbase’s Base network, but ahead of Crypto.com’s Cronos.

In terms of total value locked the leading network is Ethereum, with $43.6 billion, followed by Tron and the BNB Chain, with $8.6 billion and $3.87 billion respectively.

Cardano’s DeFi landscape currently comprises 33 protocols, which collectively hold over $400 million in TVL, with the leading protocol being collateralized debt protocol Indigo with $98 million in TVL, followed by decentralized exchange Minswap and lending protocol Liqwid, with $90.8 million and $52 million respectively.

A key development in Cardano’s evolution has been the introduction of Hydra, a set of scaling protocols designed to enhance network efficiency by facilitating off-chain transactions. This innovation aims to boost Cardano’s scalability and transaction throughput, ensuring the network’s ability to handle increased activity without compromising stability.

Further advancements in core infrastructure projects such as SanchoNet and Mithril have been reported, indicating ongoing efforts to bolster Cardano’s scalability and innovation potential.

Cardano’s native token, ADA, has seen remarkable growth, with its value increasing by 127% in the fourth quarter alone, making it one of the fastest-growing cryptocurrencies by the year’s end. This surge in ADA’s value, coupled with an increase in daily transactions and active addresses, points to a vibrant and growing Cardano ecosystem.

Cardano’s native token is at the time of writing trading at $0.6 after moving up more than 10.5% over the past week amid a wider cryptocurrency market rally. As recently reported, Cardano-based investment products have been seeing significant inflows.

Featured image via Unsplash.