Shrinkflation is a subtle strategy adopted by companies where they reduce the size or quantity of their products while maintaining or slightly increasing the price. This approach effectively makes consumers pay the same amount or more for fewer products.

Reasons behind the practice of shrinkflation include:

- Escalating Costs: Faced with rising costs for materials, production, or shipping, companies may choose to decrease the product size as an alternative to direct price hikes.

- Profit Margin Preservation: To safeguard profit margins in the face of rising expenses, businesses often resort to shrinkflation.

- Consumer Perception: The reduction in product size is generally less perceptible to consumers than an overt increase in price, making it a preferred strategy for price adjustments.

Illustrative Examples of Shrinkflation:

- A once 16-ounce bag of chips now measures just 14 ounces.

- Toilet paper rolls feature fewer sheets than before.

- Chocolate bars that have shrunk in size.

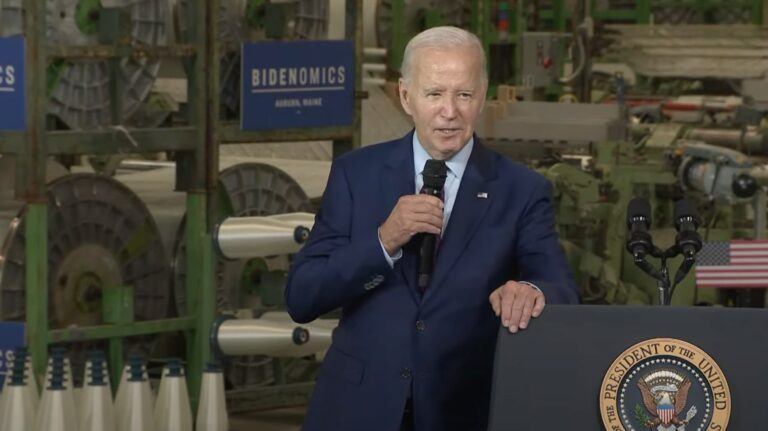

In an enlightening article by Jim Tankersley for The New York Times (NYT) published on February 26, President Joe Biden’s recent critique of “shrinkflation” was brought to the forefront of economic discussions. Tankersley’s reporting sheds light on a video released by the White House on Super Bowl Sunday, where President Biden, amidst snacks and drinks, criticized companies for downsizing products without reducing prices, a phenomenon known as shrinkflation.

According to Tankersley’s piece in The New York Times, this issue has been on consumer advocate Edgar Dworsky’s radar for over a decade. Dworsky, who has briefed Mr. Biden’s economic aides on two occasions, has played a pivotal role in bringing the issue of shrinkflation into the administration’s economic narrative. The President’s video, which showcased products that have been subject to shrinkflation, is a testament to Dworsky’s influence and the administration’s willingness to tackle this issue head-on.

Tankersley’s reporting for The New York Times also explores the broader economic context within which President Biden’s comments were made. Despite a decrease in overall inflation, the high cost of groceries continues to be a sore point for American consumers. This economic pressure has impacted President Biden’s approval ratings, prompting a strategic pivot towards addressing corporate practices that contribute to the financial strain on households.

In his NYT article, Tankersley highlights the potential policy responses being considered by the Biden administration. These include executive actions aimed at curbing shrinkflation and legislative efforts to empower the Federal Trade Commission against corporate price gouging. The involvement of Senator Bob Casey, as noted by Tankersley, underscores the political momentum behind addressing shrinkflation, with Casey’s office releasing a report on the impact of product downsizing on consumer prices.

Tankersley says that the debate over the causes of inflation and the role of corporate practices is complex. While some Democrats have pointed to corporate greed as a driving factor, others caution against oversimplifying the issue. President Biden’s nuanced approach, he claims, aims to resonate with public sentiment without painting all corporations with the same brush.

On February 23, Paul Krugman took to social media to tackle a common narrative suggesting that grocery prices have skyrocketed, with some claims going as far as to say they have doubled.

Using a chart from the Federal Reserve Economic Data (FRED), maintained by the Federal Reserve Bank of St. Louis, Krugman pointed out that the actual increase in U.S. food prices, especially those for groceries bought for home use, has been substantial but not as extreme as some have portrayed.

FRED provides a wealth of economic statistics, including the Consumer Price Index (CPI) for All Urban Consumers, which is a key indicator of inflation. Within this index, there’s a specific category for “Food at Home” prices in U.S. cities, which tracks the price changes of groceries over time, offering insight into the impact of food price trends on household expenses.

Krugman’s referenced chart covers the last four years, a period characterized by significant economic disruptions, including the COVID-19 pandemic and its recovery stages. The data shows that the CPI for “Food at Home in US City Average” increased from about 301 in January 2023 to 307 in January 2024. This rise, though reflective of inflation in grocery prices, disputes the exaggerated claims of prices doubling or spiraling uncontrollably.

The modest uptick in the “Food at Home” CPI reveals several important points:

- The discrepancy between public perception and the actual data, which shows that while there has been a price increase, it is not nearly as dramatic as some narratives suggest.

- The acknowledgment of inflationary pressures on grocery prices, evidenced by the steady increase over the past four years, yet at a rate that indicates a degree of stability and challenge within the U.S. food supply chain.

- The economic turbulence of the period, impacted by the pandemic’s effects on supply chains, labor markets, and consumer demand, has not led to an extreme surge in grocery prices, hinting at successful interventions and adjustments by the food industry and government bodies.

While the FRED “Food at Home” CPI data helps debunk overstated claims about grocery price inflation, it’s crucial to understand that even slight inflation can burden household finances, especially for those with lower incomes. Additionally, factors such as regional price differences and global events affecting commodities like wheat and oil can alter grocery expenses. Therefore, while the national average provides an overarching view, individual grocery shopping experiences may differ.

Featured Image via YouTube (White House Channel)