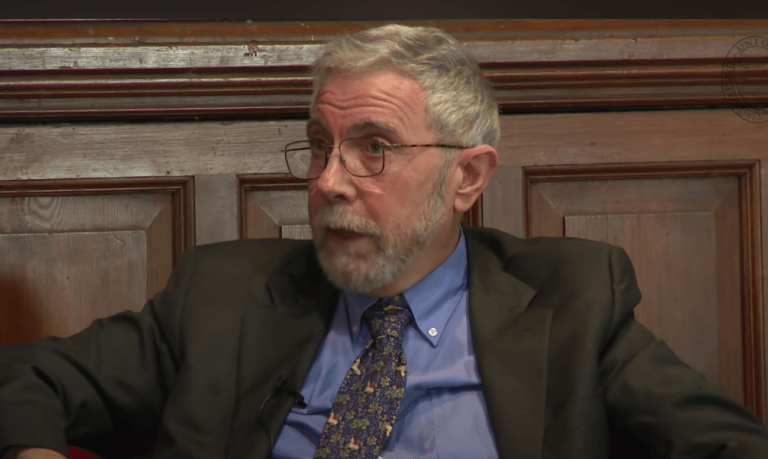

In a recent post on social media platform X, Paul Krugman shared his insights into the latest U.S. economic data, focusing on inflation rates.

Krugman is an American economist, distinguished professor, and author, known for his work in international economics and his commentary on economic policy. Born on February 28, 1953, Krugman has been a prominent figure in the field of economics for several decades.

He won the Nobel Memorial Prize in Economic Sciences in 2008 for his analysis of trade patterns and location of economic activity. Krugman’s work in this area, particularly his development of the “new trade theory” and “new economic geography,” has been influential in shaping understanding of international trade and economic geography.

In addition to his academic work, Krugman is also well-known as a columnist for The New York Times, where he writes on a wide range of economic issues including fiscal policy, international economics, and macroeconomic trends. His columns and books often discuss contemporary economic policy issues, and he is known for his liberal viewpoints.

Krugman has authored or edited over 20 books and has published more than 200 scholarly articles. His textbooks on economics are widely used in universities around the world.

Krugman’s conversation with a concerned businessman about the persisting inflation rate of 3.9% led him to present a series of numbers to contextualize the situation. He referenced the U.S. Core Consumer Price Index (CPI), which measures the changes in the price of goods and services, excluding food and energy. The Core CPI over the last 12 months stood at 3.9%, but more importantly, over the last six months, it was at 3.2%. This indicates a slight decrease in the rate of inflation recently.

Further dissecting the data, Krugman highlighted the Core CPI excluding shelter costs (which have their own legacy issues) over the last six months, which was only 1.6%. This significantly lower figure suggests that when removing the impact of shelter costs, the inflation rate is considerably less severe.

Additionally, Krugman pointed to market expectations, which predict the CPI for 2024 to be around 2.3%. This forward-looking estimate indicates that market participants expect inflation to continue to decrease.

From these observations, Krugman concluded that “inflation has been defeated,” implying that the recent higher rates of inflation are being brought under control in the U.S. and are expected to normalize.

If Paul Krugman’s assessment that U.S. inflation has been “defeated” is accurate, it could have significant implications for the Federal Reserve’s monetary policy and, consequently, for risk assets like cryptocurrencies and stocks.

- Implications for the Federal Reserve’s Policy:

- Potential Pivot in Monetary Policy: The Federal Reserve has been raising interest rates as a primary tool to combat high inflation. If inflation is indeed subsiding, the Fed might consider slowing down or halting its rate hikes. This could lead to a pivot from a tightening monetary policy (rate hikes) to a more accommodative stance (rate cuts or holding rates steady).

- Timing of the Pivot: The timing of this potential pivot would depend on sustained evidence of declining inflation and stability in other economic indicators. The Fed typically looks for consistent patterns over several months to make such decisions. If inflation rates continue to decrease, the pivot could happen sooner than anticipated.

- Impact on Risk Assets:

- Increased Attractiveness of Risk Assets: Higher interest rates generally make risk assets less attractive, as they increase the cost of borrowing and reduce liquidity in the market. A pivot from the Fed, indicating lower interest rates, could make these assets more appealing. Investors might return to riskier investments, seeking higher returns.

- Boost in Stock Market and Cryptocurrencies: Stocks and cryptocurrencies, often considered risk assets, could see a boost in prices. Lower interest rates can lead to more capital flowing into these markets, as investors seek higher yields than what is offered by safer assets like bonds.

- Reduced Appeal as Inflation Hedges: Part of the appeal of cryptocurrencies, particularly Bitcoin, has been their perceived role as a hedge against inflation. If inflation concerns diminish, this aspect of their appeal might lessen. However, other factors, such as technological advancements and broader adoption, could continue to drive interest in cryptocurrencies.

- Overall Market Sentiment:

- Increased Investor Confidence: A pivot from the Fed due to controlled inflation could lead to increased investor confidence and a more optimistic market outlook. This could stimulate investment and spending, contributing to economic growth.

- Need for Caution: However, investors would still need to be cautious. The transition from rate hikes to cuts can lead to market volatility, and other global economic factors could also influence market dynamics.

According to a CNBC report published on January 3, 2024, the Federal Reserve’s December meeting minutes revealed that officials anticipate interest rate cuts in 2024. However, the exact timing of these cuts remains uncertain. The Federal Open Market Committee, during the meeting, maintained the benchmark rate between 5.25% and 5.5%, with projections of three quarter-percentage point reductions by the end of 2024.

CNBC highlighted the Fed’s acknowledgment of the high uncertainty surrounding future policy changes. The minutes indicated that while the policy rate is likely at its peak for the current tightening cycle, any adjustments would depend on the evolving economic landscape.

The report by CNBC also noted the Fed’s recognition of progress in combating inflation. Supply chain issues, a major contributor to the mid-2022 inflation surge, have reportedly eased. Additionally, efforts to balance the labor market are underway, though this remains an ongoing process.

CNBC’s coverage of the Fed’s “dot plot” – individual members’ expectations – suggested a consensus for rate cuts over the next three years, aiming to bring the overnight borrowing rate closer to the long-run range of 2%. This aligns with the improvements in inflation outlooks shared by almost all participants.

However, CNBC underscored the Fed’s caution, citing the minutes’ mention of an “unusually elevated degree of uncertainty” in policy direction. Some members expressed the need to maintain higher rates if inflation persists, while others didn’t rule out further hikes depending on future conditions.

CNBC also reported the Fed’s emphasis on a data-dependent approach to monetary policy, stressing the importance of a restrictive stance until inflation sustainably decreases. Despite this cautious stance, market expectations, as per Fed funds futures trading, lean towards more aggressive cuts, potentially lowering the fed funds rate to between 3.75%-4%.

Richmond Fed President Thomas Barkin, as reported by CNBC, echoed this caution, highlighting the risks in steering the economy towards a soft landing. The minutes acknowledged “clear progress” against inflation, with some measures even dipping below the Fed’s 2% target, but also noted uneven progress across different sectors.

Finally, CNBC mentioned the Fed’s ongoing efforts to reduce bond holdings, with approximately $1.2 trillion already shaved off. Discussions about concluding this process are expected to start well in advance, ensuring public awareness.

Featured Image via OxfordUnion