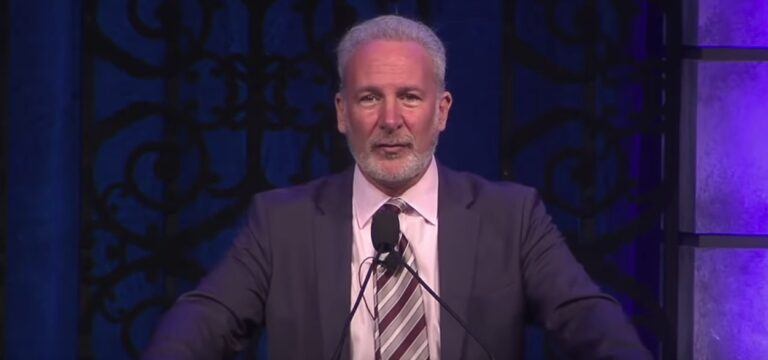

In a recent episode of “The Peter Schiff Show,” Peter Schiff, the CEO of Euro Pacific Capital and a long-time critic of Bitcoin, issued a stark warning about the current economic landscape. Schiff also holds multiple positions in different financial services firms, such as Euro Pacific Asset Management, an autonomous investment advisory firm; Schiff Gold, previously known as Euro Pacific Precious Metals, a dealer in precious metals; and Euro Pacific Bank, a bank that operates on a full-reserve basis.

According to Schiff, the U.S. economy is teetering on the brink of a significant collapse, primarily due to the relentless rise in interest rates. His comments come at a time when the economy is burdened with trillions of dollars in debt, making it ill-equipped to handle even moderate interest rate hikes.

Based on SchiffGold’s blog post about this episode, Schiff was explicit in stating that a major financial crisis or stock market crash is not just a possibility but an inevitability. He emphasized that nothing can prevent this crisis in the long term. While Federal Reserve Chairman Jerome Powell could temporarily stave off the crisis by hinting at interest rate cuts, Schiff was clear that such measures would only serve as a short-term postponement. He likened the current economic situation to standing at the edge of a precipice, uncertain of how much time remains before a fall but sure that the fall is inevitable.

Schiff says one of the primary catalysts for the impending crisis is the ongoing rise in interest rates, exacerbated by a collapsing bond market. He noted that bond yields have reached their highest levels since before the 2008 financial crisis, with the 10-year Treasury yield approaching 5%. This is particularly alarming when compared to the national debt, which has ballooned from $3.3 trillion in 2001 to over $33 trillion today. The increased debt makes the current scenario far more precarious than previous debt cycles.

Schiff also criticized the mainstream financial media for their lack of awareness and understanding of the gravity of the situation. He emphasized that the entire economy, including various levels of government, has been built on the shaky foundation of cheap money. For nearly 15 years, interest rates have been held close to zero to stimulate borrowing and spending. However, this has led to excessive leveraging, which is now proving to be a disastrous mistake.

Not just bond yields, but all forms of interest rates are on the rise, according to Schiff. Mortgage rates are nearing 8%, and the average credit card interest rate is close to 21%. Additionally, credit card debt has surged to well over $1 trillion. Schiff warned that an economy built on the premise of easy borrowing cannot sustain itself once that easy money dries up.

He said:

“Every day, we’re getting closer to a major stock market crash, or a financial crisis, or both.”

Schiff also delved into the yield curve dynamics, stating that long-term yields remain surprisingly low given the current short-term rates. He argued that the yield curve should be positively sloped under normal economic conditions. He claims that the current abnormality in the yield curve, where long-term yields are not aligning with short-term rates, serves as another indicator of the underlying issues plaguing the economy.