The stablecoin sector has kept on declining over the month of July up until the 17th, marking its sixteenth monthly decline to its lowest level since August 2021, falling 0.82% to $127 billion.

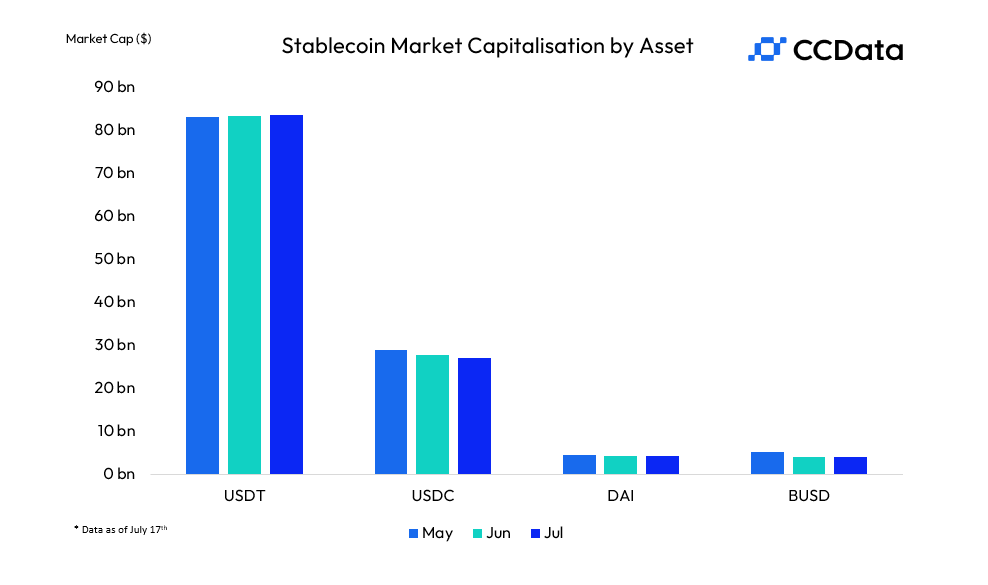

According to CCData’s latest Stablecoins & CBDCs report, this month USDT continued to remain the dominant stablecoin with a new all-time high mart capitalization of $83.8 billion, accounting for 65.9% of the stablecoins sector. In contrast, USDC and BUSD saw declines of 3.01% and 4.57% to $26.9 billion and $3.96 billion respectively.

USDC in particular has seen its seventh consecutive monthly decline, to now have its lowest market capitalization since June 2021. These declines saw the stablecoin market dominance of the cryptocurrency space fall from 10.5% in June to 10.3%.

Nevertheless, in June stablecoin trading volumes rose 16.6% to $482 billion after numerous traditional finance giants, including BlackRock, Fidelity and Invesco, filed to list spot Bitcoin exchange-traded funds (ETFs) in the United States.

The filings led to increasing optimism among investors, which translated into increasing trading activity. This was the first monthly stablecoin trading volume rise since March 2023, the report details.

The filings notably also saw the trading volume of fiat trading pairs rise 10.4% to $125 billion, while the market share of these trading pairs fell to an all-time low against stablecoin trading pairs by volume.

The stablecoin sector’s decline comes as cryptocurrency prices rise, with a recent landmark ruling in favor of the XRP token in the legal battle between the U.S. Securities and Exchange Commission (SEC) and Ripple also being seen as a tailwind for the market.

Featured image via Pixabay.