The price of $XRP, the native token of the XRP Ledger, has risen nearly 10% over the last few days on reports that the U.S. Securities and Exchange Commission’s (SEC) case against Ripple Labs, a major player in the cryptocurrency’s ecosystem, is now tilting in favor of the fintech firm.

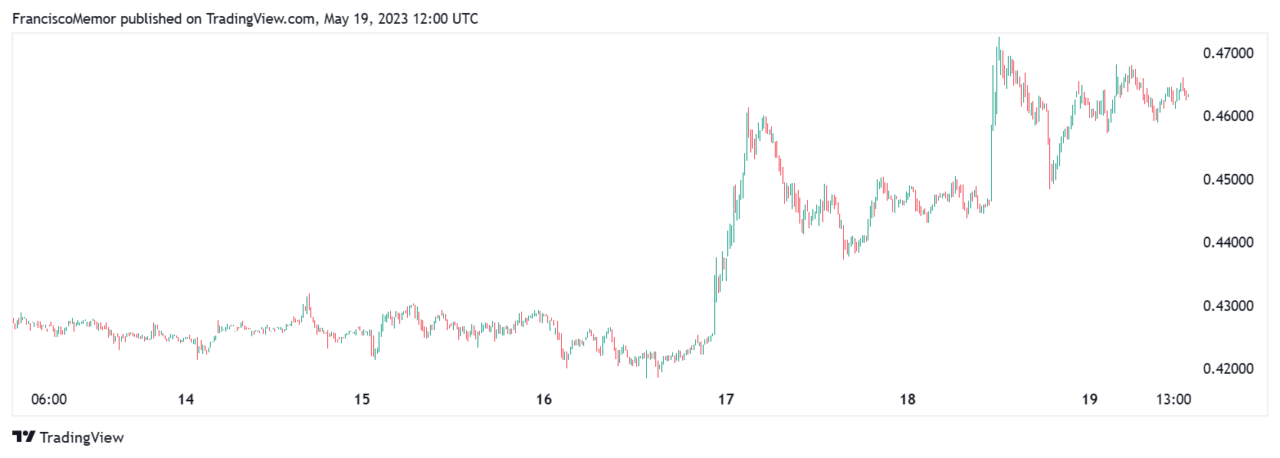

According to available market data, XRP is, at the time of writing, trading at $0.46 per token, up from around $0.42 earlier in the week, and from a $0.30 low seen earlier this year. Year-to-date, the cryptocurrency is up over 36.8%.

The SEC sued Ripple and two of its executives, who are also significant XRP holders, alleging they raised over $1.3 billion through an unregistered, ongoing digital asset securities offering,” back in December of 2020.

Earlier, federal judge Analisa Torres ruled that the regulator cannot keep documents related to a former official’s 2018 speech on crypto and securities confidential in its ongoing lawsuit against Ripple, the company associated with the XRP cryptocurrency.

The ruling pertains to documents linked to a speech by William Hinman, the former Director of Corporation Finance for the SEC. Hinman expressed his opinion that Ether (ETH) was not a security in that speech.

While the SEC will be allowed to redact the personal details of individuals referenced in the documents, Judge Torres maintained that these documents are pertinent to the legal process and should be accessible to the public.

Ripple had also sought to redact various documents, including contracts, financial information, and other data. Judge Torres permitted many of these redactions, but noted that some of the proposed redactions, including several tied to XRP, are “overbroad.”.

Access to the documentation can give Ripple lawyers information on how Hinman came to his conclusion, which could impact XRP’s potential classification as a security. As CryptoGlobe reported, Ripple CEO Brad Garlinghosue has recently anticipated a turning point in the company’s legal battle against the SEC.

He anticipated a resolution in the next two to six months. “The judge in the United States has been fully briefed. She has a decision on her plate. A federal judge can operate on whatever timeline she would like, but I’m optimistic we’re going to see a resolution, I believe, before the end of Q3,” he concluded.

Earlier this week, Ripple unveiled a tailored for central bank digital currencies (CBDCs). This unique platform, which is based on the $XRP Ledger, aims to empower central banks, governments, and financial institutions to create and manage their own digital currencies.

Image Credit

Featured Image via Pixabay