In the first quarter of the year, regulatory authorities stepped up their efforts to regulate the cryptocurrency space with acts that were seemingly beneficial for decentralized cryptocurrency exchange Uniswap ($UNI) and detrimental to centralized exchanges and service providers that are facing increased scrutiny.

According to CCData’s Q2 2023 Outlook Report, the first quarter saw digital assets rally significantly, with the flagship cryptocurrency Bitcoin ($BTC) rising 72.3% to $28,477 in the first three months of the year, and continuing its uptrend to now trade above the $30,000 mark.

The report adds that monthly trading volumes for the quarter average $932 billion, showing a 16.8% decline from the 2022 monthly average of $1.12 trillion, even after rising 23.2% compared to the last quarter of the past year.

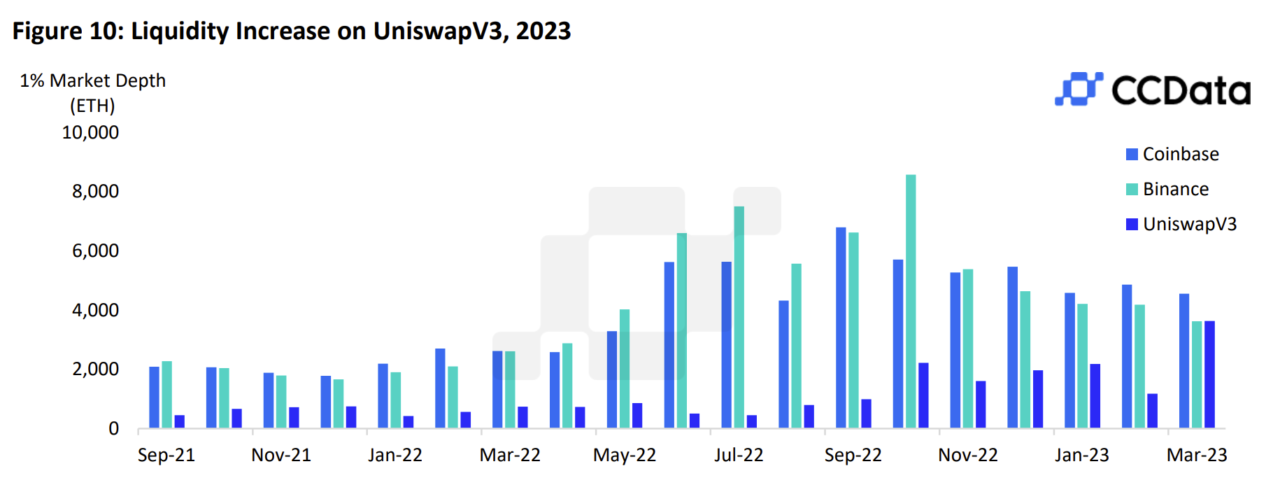

The report adds that liquidity on traditional centralized exchanges such as Coinbase and Binance has decreased, while in contrast UniswapV3, the largest decentralized exchange, has witnessed a staggering 208% growth in liquidity.

Coinbase and Binance have, meanwhile, seen declines of 6.35% and 13.4%, according to the firm. The liquidity boost, CCData notes, could be attributed to market participants looking to capitalize on USDC losing its peg and adding liquidity to pools such as ETH-USDC on the decentralized exchange.

By adding liquidity to pools such as ETH-USDC, savvy traders have managed to exploit the shifting financial landscape to their advantage. Decentralized exchanges like UniswapV3 offer a viable alternative to traditional platforms, as they provide users with increased control over their assets.

The report notes that the market landscape saw a consolidation of trading volumes in the first quarter, with the top 8 exchanges now accounting for 70.5% of total volumes, up from January 2022’s 62.7%.

This consolidation has proven beneficial for larger exchanges, such as Binance, which saw its market share increase substantially from 33.2% in January 2022 to 50.3% in March 2023. While average yearly volumes have declined, a comparison between Q1 2023 and Q4 2022 reveals a 23.2% increase in centralized exchange monthly volumes, rising from an average of $7.57 billion to $9.33 billion.

Decentralized exchanges have recorded an average monthly volume of $97.0 billion, compared to $76.1 billion in Q4 2022, marking a 27.6% increase. This increase came during the quarter in which the financial world dealt with the depegging of the USDC stablecoin and the collapse of the Silicon Valley Bank (SVB).

Image Credit

Featured Image via Pixabay