If you’ve been around the crypto realm for a while, you’ve surely come across the term Bitcoin mining. While an appealing practice, there are some factors to consider before you go and buy your first mining rig, including how much Bitcoin you can mine in a day.

Bitcoin mining, for some, is a painfully expensive task, or an appealing way to make profits by creating new bitcoins. Either way, this article will explain common questions, such as how much Bitcoin one can expect to bing in per day while mining, how expensive is it, and how does BTC mining work in depth.

That being said, how much BTC can you mine in a day, and how difficult is it? We’ll explore these questions and more below.

How Much Bitcoin Can You Mine in a Day?

Technically, you could mine as much as 900 Bitcoins per day taking into account the cryptocurrency’s current inflation rate. Bitcoin’s inflation rates halves every four year in a process known as the halving. That is, however, a limit that isn’t available to any miner, as it’s the total amount entering circulation every 24 hours.

Firstly, mining Bitcoin solo is an extremely difficult and expensive task; the computational power you’d need to mine a block in 10 minutes (which is the average BTC transaction time) translates to around 3000 mining rigs. Let’s break it down:

- Today, the average market price of an S19 miner, one of the most popular (and relatively accessible) mining machines, is around $3,000.

- An S19 has a hashrate of 110 TH/s —with a power draw of 3250W.

- The hashrate, the parameter that determines the computer power required to mine 1 BTC, is currently at 323.22 EH/s, and one exahash = 1 quintillion

- TH/s is one trillion hashes per second, therefore to reach 323.22, you would need around 3000 mining rigs, which could cost around $10 million.

Note that difficulty rates are adjusted automatically every two weeks.

Moreover, not only is it extremely expensive to mine 1 BTC per day —you’re also competing against a network of miners. We’re talking about tens of thousands of computers discovering a block every ten minutes. This is where BTC mining pools come into play.

Joining a BTC Mining Pool

Bitcoin mining pools are an alternative option to mine BTC. Instead of buying millions of dollars worth of mining equipment, you’d pay a commission fee (around 1% – 5%) to join the pool and collaborate with other miners.

BTC mining pools refer to a joint group of network computers who share processing power to mine a new block on the Bitcoin blockchain. No matter which miner discovers a new block, the rewards are distributed between the participants, who must share a proof of work to receive their respective percentage.

Joining a BTC mining pool with a single mining rig is still difficult; even pools with over thousands of mining rigs take one to two weeks to mine a block. Either way, joining a pool is considerably cheaper and can help you generate an extra income in the long-term.

Note that you receive rewards proportional to the amount of hashrate power, e.g., 1% of hashrate grants you 1% of block rewards.

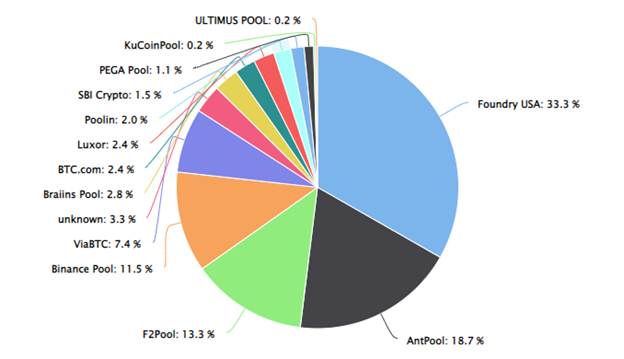

Currently, Foundry USA is the leading BTC mining pool with 33.3% of the total hashrate. This means the pool is responsible for mining 299.7 BTC of the 900 mined per day.

Understanding Bitcoin Mining

Bitcoin mining refers to the process of creating and validating new blocks in the blockchain, which ultimately results in the production of new bitcoins in circulation. This process is carried out by a global network of computers that solve mathematical puzzles.

The bigger the computer network, the more secure the network is since they can deter tampering from malicious actors. The computer, called miner, acts as a node that follows a set of rules to successfully validate blocks and keep the network running.

Also read: What Is XBT? Does It Differ From Bitcoin’s BTC Ticker?

Likewise, the miners that solve the math quiz are rewarded with a fixed amount of BTC, which is 6.25 BTC per block —but this will decrease with the next halving, scheduled for 2024. However, while the BTC supply is expected to sit below the max supply of 21 million due to BTC’s fractional system expressed in Satoshis, if the supply reaches that number, it’d cut miners fees, forcing miners to only earn transaction fees.

Closing Thoughts: Is it Profitable to Mine Bitcoin?

Mining Bitcoin, while a potentially rewarding job, has a fair share of difficulties and risks. Miners with ideal conditions – meaning low energy prices and/or a large amount of hashrate – can still reap a substantial amount of rewards despite the sturdy competition.

It’s important to consider every potential implication of mining Bitcoin before actually acquiring equipment. Bitcoin mining calculators may be helpful in understanding whether such a venture would be worth it.

Some miners, it’s important to add, accept small losses in their operations to help secure the network and to learn more about cryptocurrency.

FAQ

What is Proof of Work?

Proof-of-work (PoW) is a consensus algorithm in which a global network of miners compete to process new Bitcoin blocks into the blockchain. The concept was first applied in the cryptocurrency world at inception, with the creation of Bitcoin in 2009 by mysterious developer Satoshi Nakamoto.

What’s the Difference Between PoW & PoS?

PoW, next to PoS (Proof-of-Stake) are the two most popular consensus algorithms used by cryptocurrency networks. There are a few important differences between the two.

First, a PoW blockchain relies on a network of users providing computational hardware to process transactions. Meanwhile, a PoS blockchain will also rely on a network of individuals who, instead of connecting mining rigs, all have staked a portion of the blockchain’s native cryptocurrency to participate in the validation process. The process is less costly, and less energy-intensive, although not considered as secure as PoW.

Are there other ways to mine Bitcoin?

It’s also possible to take advantage of cloud mining to mine Bitcoin and other digital assets. Cloud mining essentially handles the mining task to a third-party, with the miner simply reaping the rewards generated by the hardware they purchase. Several large players offer cloud mining solutions, including Binance.

Featured image via Unsplash.