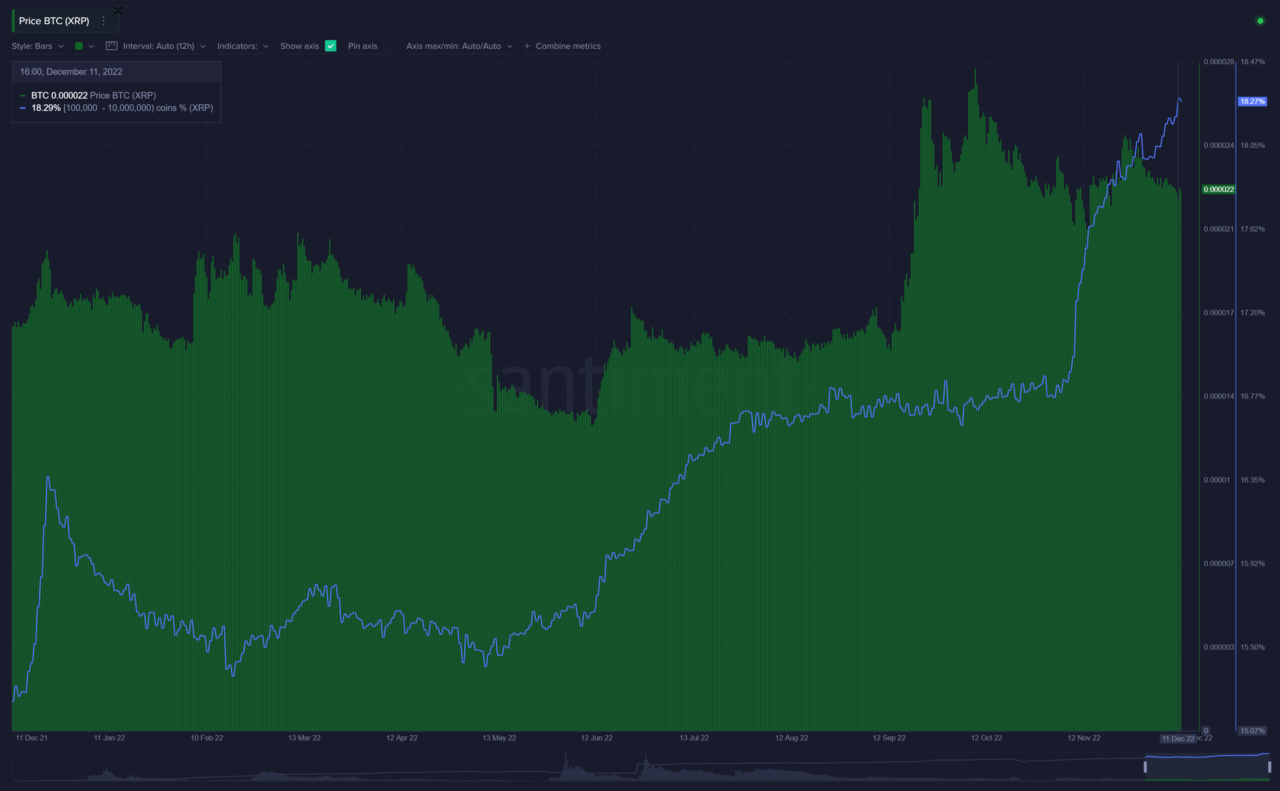

Whale addresses on the $XRP Ledger, holding between 100,000 and 10 million tokens (between $39,000 and $3.9 million) have increased their holdings rapidly over the last five weeks, going from 16.7% of the cryptocurrency’s supply to 18.3%.

According to on-chain analytics firm Santiment, XRP whales started adding to their holdings at the end of September and early October, when the price of the cryptocurrency started surging as both the U.S. Securities and Exchange Commission (SEC) and Ripple Labs started looking to end their legal battle.

The SEC sued Ripple and two of its executives in 2020, alleging they sold unregistered securities when they issued $1.3 billion worth of XRP tokens. Ripple denies XRP is a security.

Earlier this year, Ripple’s CEO Brad Garlinghouse noted that he believed the company would prevail in its legal battle against the regulator. Over the past few weeks, a number of influential cryptocurrency firms, including Coinbase and the Blockchain Association, filed to support Ripple.

In a recent reply in support of a motion for summary judgment, Ripple’s lawyers argued that the regulator has failed to show that any offer or sale of XRP was an investment contract under federal securities laws.

Ripple’s lawyers added that even for transactions “that involved an exchange of money,” the SEC failed to “show that purchasers invested that money in a common enterprise” rather than “simply buying an asset,” as the Howey test requires.

Analysts believe that XRP investors increasing their holdings could precede a significant run for the cryptocurrency’s price both as a larger portion of its supply leaves the market and as the SEC’s case comes to an end.

As CryptoGlobe reported, cryptocurrency investment products offering exposure to XRP have seen seeing significant inflows as the SEC’s case against Ripple has started being seen as “increasingly fragile” by investors.

Ripple settling the lawsuit could lead to an XRP supply shock, which presumably would lead to a price surge as demand would remain the same, while supply plunged. That’s according to legal expert and XRP supporter Jeremy Hogan, who has been following the case.

Hogan has recently weighed in on a ruling by the United States District Court in favor of the SEC against blockchain-based file-sharing network LBRY. The court LBRY violated securities laws by selling its native LBC tokens without registering with the Sec. Per Hogan, the results could make their way into the SEC’s final brief in the Ripple case.

Image Credit

Featured Image via Pixabay