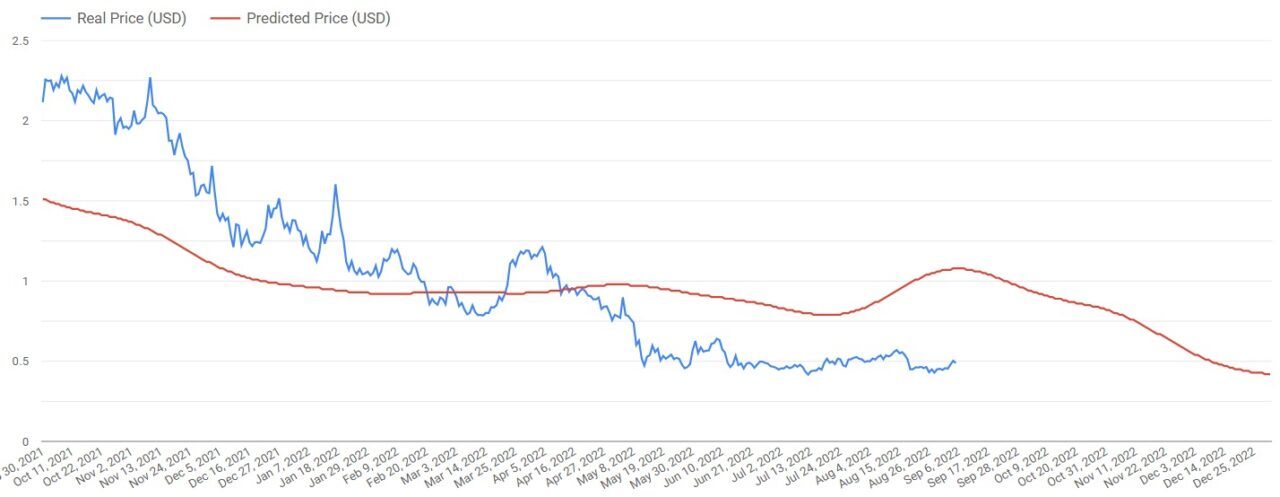

An artificial intelligence-based price prediction model is suggesting that the price of Cardano’s native token $ADA is going to surge to trade at $0.42 by the e of this year, representing a 35% increase from the cryptocurrency’s current price.

According to NeuralProphet’s PyTorch-based price prediction algorithm, which uses an open-source machine learning framework, Cardano’s price could surge to $0.42 by the end of December. The model, however, expected $ADA to trade above $1 in September, while in reality, the cryptocurrency was struggling to surpass $0.50.

The price prediction model uses data from 2017 and AI technology to determine where the cryptocurrency’s price is growing. The mode delivered somewhat accurate predictions from February 2021 until May 2022, when the Terra ecosystem collapsed and the crypto space entered a bear market.

As CryptoGlobe reported, the number of smart contracts deployed on the Cardano ($ADA) network has grown by more than 300% year-to-date as the cryptocurrency’s network keeps on growing, despite the ongoing bear market.

According to data from Cardano Blockchain Insights, there were 947 Plutus smart contracts on the Cardano network at the beginning of the year. That figure has now surged to surpass 3,790.

Plutus, it’s worth noting, is the “smart contract platform of the Cardano blockchain” that allows users to “write applications that interact with the Cardano blockchain.”

Cardano recently reached a new milestone with the launch of its first stablecoin. Other stablecoins are being created on the Cardano network. EMURGO, which is the commercial arm of Cardano, announced the planned launch of its new dollar-backed stablecoin USDA, which is “the first fully fiat-backed, regulatory compliant stablecoin in the Cardano ecosystem,” earlier this month.

Recently, popular crypto influencer Benjamin Cowen suggested that there is a “real risk” that the price of $ADA could still drop over 60% during the bear market, as he believes Cardano is facing a bear market resistance band that has rejected its advances, and could be in for more pain.

Image Credit

Featured Image via Unsplash