We often hear the argument that BTC is the ultimate hedge against inflation since its supply is capped at 21 million and halving every four years. This has led to a misperception that cryptocurrencies without a supply cap are inflationary, meaning their value declines over time. This begs the question, does Ethereum (ETH) have a supply cap?

On April 1, 2018, Vitalik Buterin jokingly suggested that the total supply of ETH be capped at 120 million. His reasons? To guarantee a more stable and sustainable economy for Ethereum. While this was just an April Fool’s joke, it brings us to the inflationary vs. deflationary discussion surrounding the supply of cryptocurrencies.

The Supply of Ethereum

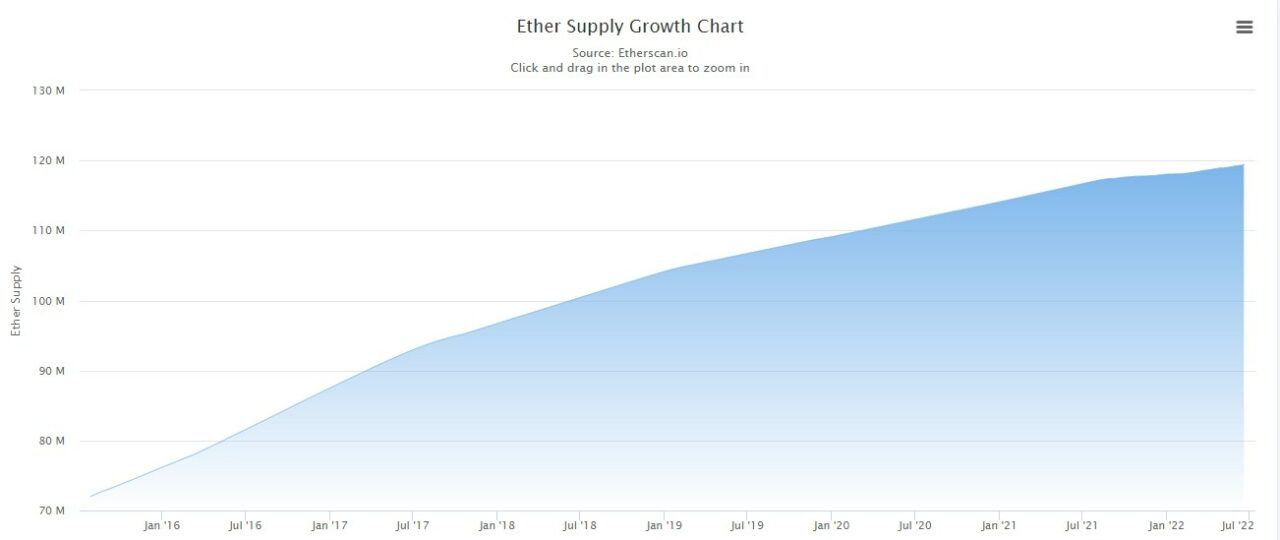

During the 2014 Ethereum ICO, the total supply of Ether was about 72 million; fast-forward eight years later to June 2022 and Ethereum’s total supply of ETH is a little over 121 million.

Ethereum doesn’t have a supply cap, but that doesn’t mean we’ll have billions of Ether in circulation. The number of ETH issued has been steadily declining, which means that inflation isn’t a major concern for Ethereum. It’s also important to note at this point that Ethereum and Ethereum Classic are completely separate protocols.

Apart from the yearly supply cap, the future supply of Ethereum heavily relies on its monetary policy.

Ethereum’s Monetary Policy

While capping a coin’s supply is an effective way to curb inflation, it’s not the only way. An argument could be made that capping supply may prove counterintuitive in the future as decentralized finance (DeFi) continues to grow. As used on Ethereum, monetary policies can be implemented to curb inflationary pressure without relying on capping the supply.

It’s worth noting that Ethereum doesn’t have a fixed monetary policy – its monetary policy is subject to changes depending on Ethereum Improvement Proposals (EIP). These EIPs have played a crucial role in determining Ethereum’s supply schedule. An EIP is the common way of proposing and bringing changes to the Ethereum network.

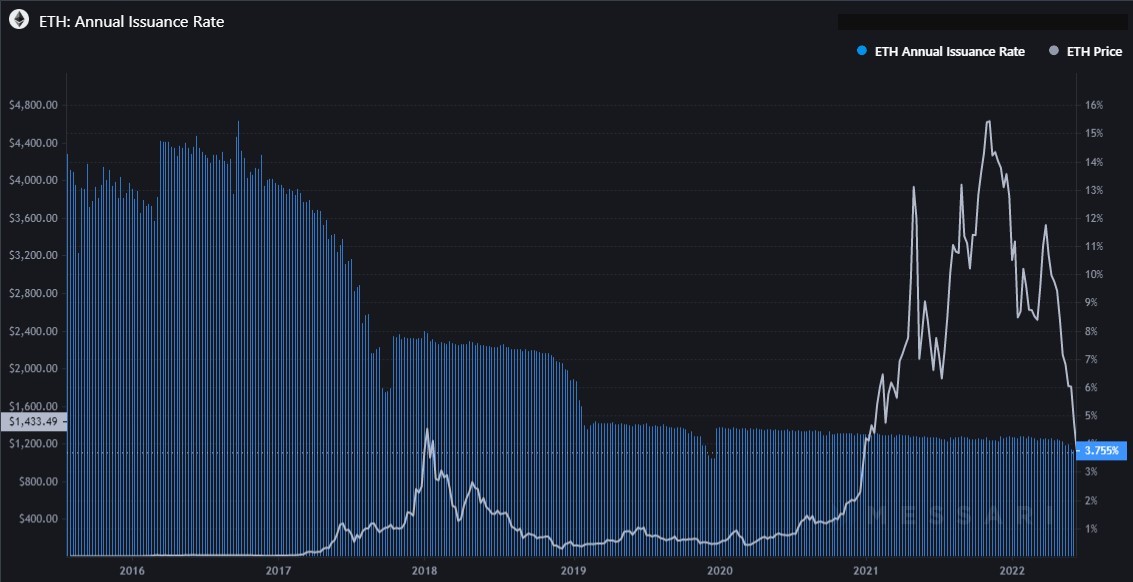

This monetary policy is best defined by the rewards paid on Ethereum at any given time. These rewards, which tend to increase the supply of ETH, include the Ether issued per block and the fees rewarded to the miners.

Ethereum’s history is punctuated by instances of the reduction of the estimated minimum issuance. Note that Ethereum doesn’t have a fixed supply, unlike other altcoins such as Cardano, which is why its monetary policy can best be described as “minimum issuance to secure the network.” Currently, the yearly issuance on Ethereum is about 3.68% and has been decreasing steadily over time.

In the future, it’s impossible for Ether’s issuance ever to increase. This is thanks to the rollout of Ethereum 2.0, whose proof-of-stake is designed to lower the issuance, and the EIP-1559, which introduced burning, effectively guaranteeing that more ETH will be burned than created. Also, the upcoming Ethereum Merge will drastically reduce the issuance rate to below 1%. And this brings us to the question: Is Ethereum deflationary?

Is Ethereum Deflationary?

Ethereum could soon be deflationary. Ethereum has managed to keep inflation in check.With Ethereum using a Proof-of-Work consensus mechanism, two main factors are used to control inflation, block time and block rewards. But with the rollout of Ethereum 2.0, EIP-1559, and the upcoming Ethereum Merge, the network is expected to become deflationary.

Ethereum 2.0 introduced the PoS consensus mechanism, and is set to greatly reduce the issuance rate. The introduction of PoS rendered the mining rewards under PoW obsolete. Instead, it introduces a sliding scale between the amount of ETH staked by the network validators and the interest they will earn, giving miners even more incentive to mine ETH rather than PoW coins such as Litecoin.

What is EIP-1559?

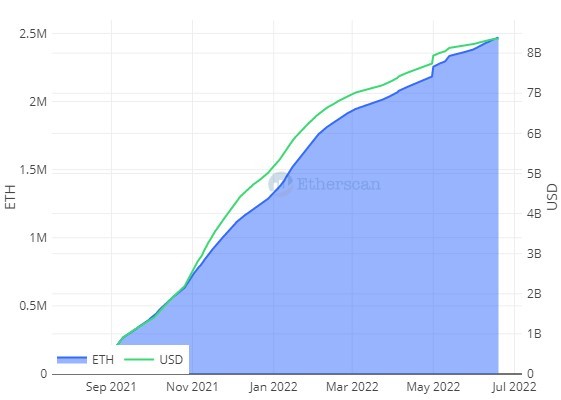

One of the most consequential EIPs in determining the supply of Ethereum is EIP-1559, which introduced a deflationary mechanism via the destruction of the basefee. It came into effect in August 2021 and introduced the mechanism for ETH burning.

Firstly, EIP-1559 introduced a basefee on all transactions, calculated depending on the network activity. Once the basefee has been paid, it is instantly burned. This means that miners are no longer incentivized to validate transactions with higher gas fees since they won’t receive these gas fees.

The EIP-1559 explains that if more ETH is burned on basefees compared to the mining rewards generated, then Ethereum will be deflationary. Post EIP-1559, Ethereum became deflationary on a number of occasions in which more ETH were burned than created. In this case, fee burning can be described as a scarcity mechanism dependent on the transactional utility of the Ethereum network.

This means that the overall supply of ETH decreases as more ETH are destroyed through the fee burn. Since the fee burning depends on the network activity, the more the transactions on the Ethereum network, the more ETH is burned and the lower the issuance.

The fee burn is designed to destroy the ETH basefees that users pay for transactions on the Ethereum blockchain. Note that the basefees are the minimum required for a transaction to be added to an Ethereum block. Typically, users can also pay priority fees for their transactions to be validated faster. However, only the basefees are burned.

Since EIP-1559 went live, more than 2.5 million ETH have been burned, as of July 2022.

The Ethereum Merge

The Ethereum Merge (EIP-3765) is the official switch from a proof-of-work to a proof-of-stake consensus. On March 15, 2022, the Ethereum Foundation announced that the Merge was ready to be deployed on Ethereum’s public Mainnet. It is expected to come into full effect in Q3 or Q4 of 2022. How does this impact the supply of the cryptocurrency and does it affect whether Ethereum has a cap?

The most significant aspect of the Merge is the triple halving of the ETH issuance – this is the equivalent of three Bitcoin halvings. The Merge represents the final stage of Ethereum becoming fully deflationary. It comes when the Mainnet fuses with the ETH2 Beacon Chain, effectively reducing ETH issuance by up to 90%.

It’s estimated that the daily issuance will drop from 15K ETH to about 1.5 ETH when the Merge is completed. This will cause a drastic drop in the yearly issuance rate to below 1%, and, in the longer term, it may drop to below zero.

Using the Ethereum Merge simulator on Ultra Sound Money, we can see that the yearly supply growth is about -1.9%.

Conclusion

So, does Ethereum have a supply cap? No. While Ethereum had been considered an inflationary crypto, a series of upgrades ranging from Ethereum 2.0, EIP-1559, and the upcoming Ethereum Merge make Ethereum deflationary. The EIP-1559 update is one of the most important in the Ethereum network. It introduces a deflationary mechanism via the destruction of the basefee. And the upcoming Ethereum Merge will drastically reduce the issuance rate to below 1%.

Image Source

Featured image via Unsplash.