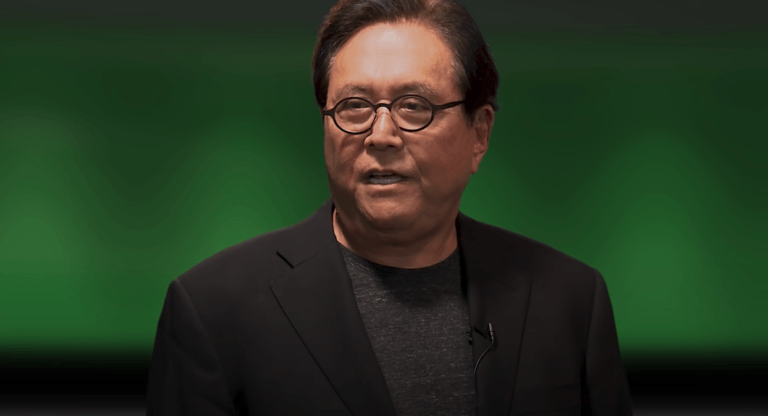

Robert Kiyosaki, the highly successful author of the “Rich Dad Poor Dad” series of personal finance books, says that the U.S. could be heading towards another economic depression and market “bust.”

“Rich Dad Poor Dad“, which is one of the top 10 personal finance books of all time, “advocates the importance of financial literacy (financial education), financial independence and building wealth through investing in assets, real estate investing, starting and owning businesses, as well as increasing one’s financial intelligence (financial IQ) to improve one’s business and financial aptitude.”

At various times during the current COVID-19 pandemic, Kiyosaki has been criticizing the Federal Reserve’s response to the resulting economic fallout and strongly urging his large following on social media platforms to protect themselves from what he feels is inevitable high inflation (and possibly hyperinflation) in the future by using their fiat holdings to buy silver, gold, and Bitcoin.

Episode #263 of Anthony Pompliano’s “Pomp Podcast”, which was released on 7 April 2021, featured an interview with Kiyosaki. During that interview, Pompliano asked for Kiyosaki’s thoughts on “traditional inflation hedge” assets.

Kiyosaki said:

“Gold and silver are God’s money. Bitcoin is open source people’s money.“

More recently, on April 8, during an interview with Daniela Cambone, Editor-at-Large and Anchor at Stansberry Research, he had this to say about inflation in the U.S.:

“Inflation goes up and the average American doesn’t have $1000 bucks. Forty percent of Americans don’t have $1000 bucks. So when inflation goes up, we’re going to wipe out 50% of the population, and that is when revolution starts.”

And when Cambone asked why he had recently added $SOL to his crypto portfolio, he replied:

“The best deals are always done early. When people say, ‘Do you invest in Bitcoin?’, [my answer is] yes, when it was $6,000. Solana is still early, and it’s got a possibility, it’s a long shot.“

Well, on April 25, Kiyosaki published a tweet warning that the markets were heading for potentially the biggest economic depression in history.

Kiyosaki claimed that he was concerned for the state of the markets, alluding to all major financial markets being caught in bubbles. He said that conditions could rapidly deteriorate into an “everything bust,” sparking the start of a massive economic depression.

Kiyosaki noted the impact of the high debt burden globally, in addition to the influence of Russia’s invasion of Ukraine and “lying leaders.” Kiyosaki also commented on Tesla CEO Elon Musk’s recent purchase of Twitter, claiming that “freedom of speech & truth in media” is the road back to “global prosperity.”

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.