Billionaire veteran investor Mark Mobius, founding partner of Mobius Capital Partners, has recently explained Bitcoin’s recent price surge amid an ongoing Russian invasion of Ukraine that has shaken equities markets.

Speaking on CNBC’s “Capital Connection,” Mobius noted that he would normally not be a BTC buyer, unless he was Russian, in which case he would be betting on the flagship cryptocurrency.

Mobius’ comments come after the price of BTC rose sharply from a sell-off seen on February 24, the day Russian President Vladimir Putin announced a “special military operation” in Ukraine that turned out to be a full-scale invasion of the country. The announcement saw BTC drop to around $34,000, but it quickly bounced back.

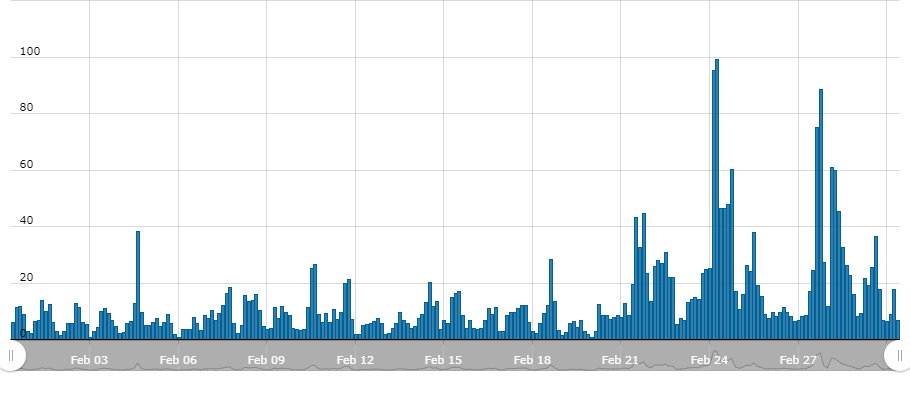

CryptoCompare data saw BTC surged to now trade close to the $44,000 mark, with Bitcoin trading volumes denominated in the Russian ruble, the country’s fiat currency, exploding last week. Data has shown that RUB denominated BTC volumes jumped as the ruble’s value plunged.

Mobius noted that Russians having a “way of getting their money out, getting their wealth out,” may be the reason BTC’s price has shown strength over the last few days. In response to Russia’s invasion, sanctions were imposed on the country’s institutions, including banks, which led to significant drops in the value of the ruble and even of Ukraine’s hryvnia.

Ukrainian cryptocurrency exchange Kuna notably saw its trading volume explode after Russia’s invasion was launched. On average the exchange’s trading volume was hovering around 45 million Ukrainian hryvnias per day. On the day Russian forces entered Ukraine, its trading volume exploded to 150 million UAH, equivalent to around $5 million.

Over the weekend western nations agreed to cut off key Russian banks from the interbank messaging system SWIFT, which connects over 11,000 banks and financial institutions across over 200 countries and territories.

Russians, Mobius said, would be “really in trouble with all the closures of the different avenues for them to transfer money out,” if it wasn’t for BTC.

Bitcoin Won’t Be a Solution for Sanctions

CNBC also notes that Ari Redbord, the head of legal and government affairs at blockchain intelligence firm TRM Labs, said Russia will turn to cryptocurrencies in a bid to evade the sanctions imposed on it.

The analyst noted, however, cryptoassets won’t be a solution as there’s “just not the liquidity there to really make a dent in terms of what Russia is facing right now.” Per his words, most of the liquidity in the cryptocurrency market is in large centralized exchanges with “robust compliance controls” to monitor transactions and file suspicious activity reports.

Mobius concluded by advising investors to diversify their portfolio and even include exposure to gold, as it’s “very important to have some physical gold.” The precious metal is seen as a safe haven in times of uncertainty, and saw its price rise 6% last month.

As CryptoGlobe reported, BTC whales have seemingly been buying the cryptocurrency’s price dip shortly after its price bottomed out around the $34,700 mark last Thursday, as data has shown BTC holders with between $100,000 and $1 million in their wallets quickly moved funds in reaction to Russia’s invasion of Ukraine in “massive transactions.”

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Unsplash.