Analysts at Morgan Stanley have, in a research note titled “State of the Bear Market,” downplayed bitcoin’s 50% correction from its all-time high seen in November as the figures show the drop was within historical norms.

According to CoinDesk, the bank’s head of cryptocurrency research Sheena Shah pointed out that estimating the fair value of cryptocurrencies is difficult because they trade speculatively and were supported by the large availability of U.S. dollars and central bank liquidity.

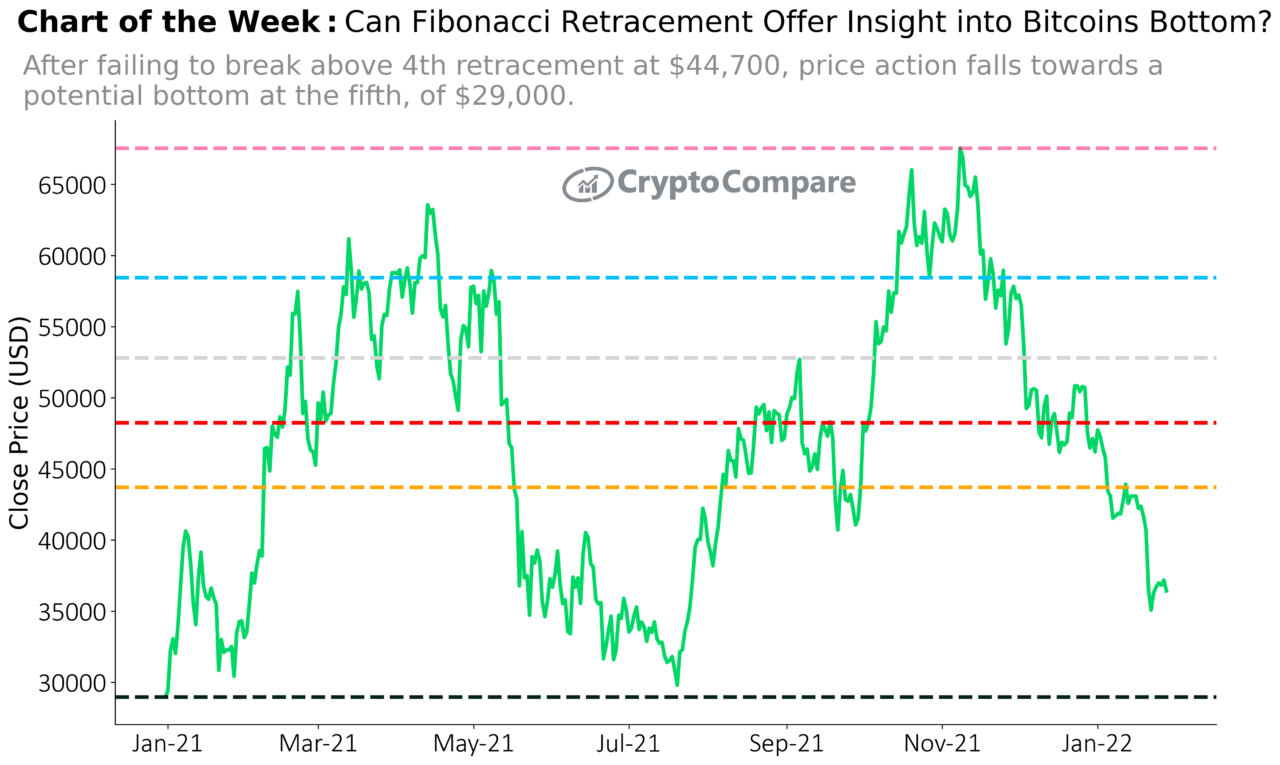

In the note, the analysts wrote that if the price of bitcoin drops below the $28,000 mark, the market may expect further weakness. On the upside, the $45,000 mark is the price to watch because it would suggest the current downtrend has turned around.

Notably, a chart from cryptocurrency data provider CryptoCompare has shown that BTC’s past downtrends have reversed after getting to its fifth Fibonacci retracement level, which should now be around $28,970.

Morgan Stanley, which started allowing its wealth management clients to access bitcoin funds last year, has seen its investment funds acquire millions of shares in the Grayscale Bitcoin Trust (GBTC), offering them exposure to the performance of the flagship cryptocurrency’s price.

The bank’s analysts have noted in their research that BTC has seen 15 bear markets since it was created in 2009, and added that the recent correction seen in recent months is within the range of its past performance.

Until bitcoin is commonly used as a currency for goods and services transactions (in the crypto or non-crypto world), it is hard to value bitcoin on fundamental demand beyond the asset speculation.

The analysts added that investors may need patience if we are in the middle of a wider risk market correction, with leverage in the market being necessary for a bullish trend to begin as central bank liquidity is removed.

The research notes that regulation, non-fungible tokens (NFTs) and stablecoin issuance are key areas to watch over the next few months.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Pixabay