This article takes a brief look at five decentralized finance (DeFi) lending and borrowing protocols built on top of Cardano smart contracts: Aada; ADALend; Liqwid; MELD; and Paribus.

Aada ($AADA)

Here is an overview of this project:

“Aada is crypto assets lending platform. Smart contract allows to deposit assets and collect interests or borrow assets and perform financial actions.

“Aada is a decentralized money market protocol that enables users to lend and borrow cryptocurrencies in a trustless manner. There is a wide variety of cryptocurrencies to choose from. With addition of Cardano ERC20 converter, Aada will bring must-have functionality to DeFi ecosystem.

“Cardano ERC20 converter will bring massive asset amounts into the cheaper-to-transact Cardano blockchain. The converter will allow issuing organizations and their users to handle ERC20 token migration to Cardano.

Users can convert their Ethereum tokens in just a few clicks, and when moved across, these tokens will be ‘translated’ into a special native token on Cardano that has the same value and works just like an ERC20.“

The Aada team says that since “building a lending platform” takes up “a lot of resources and time”, they “decided to issue AADA tokens which will be used in Aada utilities.”

The Aada platform will generate various fees that will get distributed to $AADA holders. Also, once the team has finished building a building decentralized autonomous organization (DAO), $AADA will serve as the governance token.

ADALend

The team says that the ADA Lend protocol will “power the new wave of flexible financial markets by serving as a foundational layer for instant loan approval, automated collateral, trustless custody and liquidity.”

Here are its main features:

- Permissionless: “Lend on any pairing. Our governance will ensure that the best offers are available and that only the safest oracles are used.”

- Incentivised Liquidity: “Liquidity is predicated on having enough assets in each pool in order to facilitate lending. ADALend addresses this requirement by incentivising users to deposit assets and provide liquidity.”

- Community Governance: “Token holders can establish consensus by voting on governance proposals or introducing new proposals for a vote.”

- Ecosystem Foundation Layer: “Attract assets and build incentives that can empower an ecosystem of financial products.”

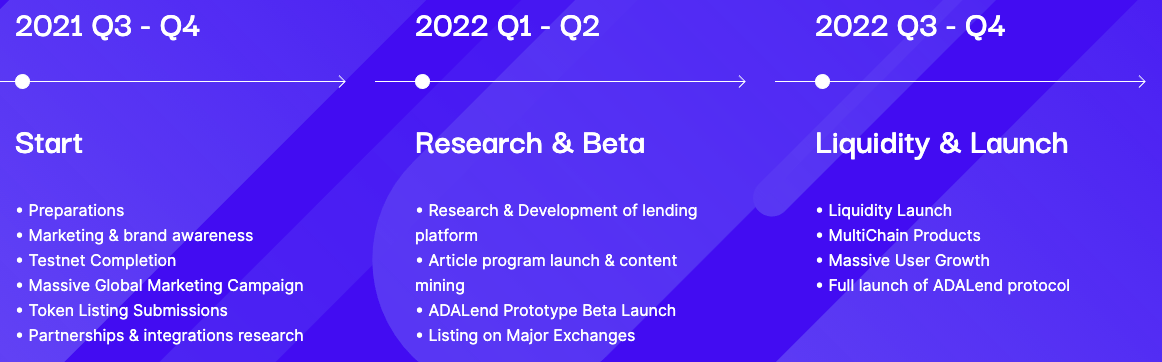

And this is the project’s roadmap:

Liqwid

The Liqwid team describe this project “an open source, algorithmic and non-custodial interest rate protocol built for lenders, borrowers and developers” and they say that users can “securely earn interest on deposits and borrow assets with ease while earning yield on ADA from four yield streams.”

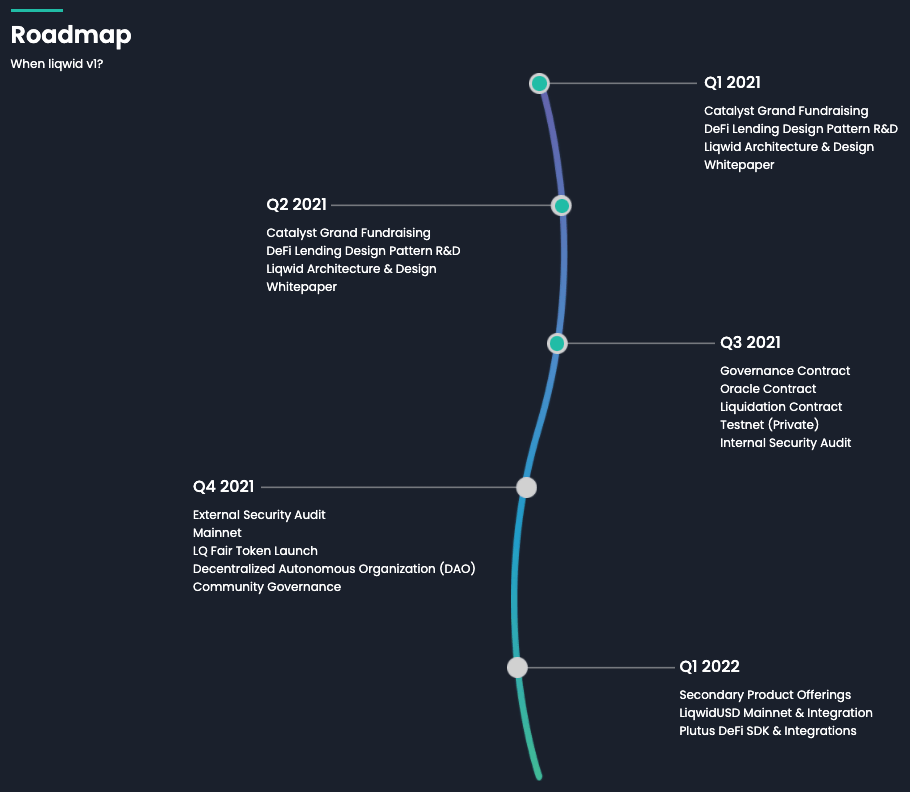

This is the project’s roadmap:

Here are Liqwid’s main features:

- “Assets held within the Liqwid market contracts earn APY’s based on the market demand for that asset; put your crypto to work and earn by the block.”

- “Borrow any asset supported by the protocol against your qToken balance instantly with no trading fees and no slippage at a competitive APR directly on the Cardano blockchain.”

- “Unlock liquidity and remain long by tapping into the value of your crypto holdings to borrow stablecoins or crypto assets against it. This is the HODL way!”

- “The Liqwid protocol is powered by Cardano, a programmable UTXO blockchain built for deterministic, secure, and low-cost transactions for the next evolution of DeFi innovation.”

- “Anybody can access immutable money market smart contracts directly on-chain; participate in non-custodial markets and keep your keys.”

- “Utilizing the Liqwid protocol unlocks access to a global liquidity pool for each asset. A borderless decentralized marketplace for lenders and borrowers built on Plutus smart contracts.”

- “No ISO, no pre-sale, no VC funding. The only way to earn LQ tokens is by using the protocol or receiving grant funds from the DAO Treasury. The LQ token generation event occurred in the 1st block of multi-asset support on Cardano using a timelock minting policy.”

- “Liqwid DAO token holders utilize the governance smart contract to submit proposals and exercise their voting power democratically. LQ is the foundation Liqwid DAO governance and is staked as a reserve asset in the Safety Pool, generating additional yield for LQ holders.”

qTokens, which are Liqwid’s interest bearing tokens, are “minted at the current exchange rate when you supply assets to a market contract and burned when you redeem assets.” Holders “earn interest through the qToken to underlying asset exchange rate, which increases in value when borrowers repay loans plus accrued interest.”

Holding cryptoassets as tokenized qToken balances provides several benefits:

- “Earn interest on the underlying assets”

- “Keep your keys”

- “Stay long”

- “Borrow against qToken collateral”

MELD

The MELD team says that this is “a non-custodial, banking protocol.” You can “securely lend & borrow both crypto and fiat currencies with ease and stake your MELD tokens for APY.”

The following overview of MELD is from its white paper:

“MELD is an open-source, non-custodial liquidity protocol for borrowing fiat (USD and EUR) against crypto collateral and earning yield on deposits. The MELD token is used for governance of the protocol, and you can stake it to earn yield.

“MELD is the first decentralized protocol that incorporates fiat loan capabilities into the crypto ecosystem. This enables low friction transactions between crypto and fiat positions while maintaining control of digital assets.

“Users interact with the MELDapp on iOS, Android and in the browser to easily access their digital assets to lend, borrow and manage the services offered by MELD. Users have peace of mind because they keep the keys to their assets at all times.

“MELD offers significant capital efficiency gains in lending and borrowing compared to both centralized blockchain solutions and traditional fintech. Running on a third generation blockchain, MELD inherits Cardano’s features including low transaction costs, high throughput and Cardano 10 has more than $50 billion in stacked security staked within the blockchain.

“Built on top of the Cardano blockchain, MELD capitalizes on transaction efficiency, which drastically reduces fees by more than 99% as compared to ETH-based solutions.“

This is how MELD works:

- “Using the MELDapp, choose how much cash you’d like to borrow. Add your crypto as collateral (2x the amount you’d like to borrow) and lock it into a MELD smart contract.”

- “Your crypto collateral is added to MELD’s liquidity pools to generate yield and work for you for the entire lifespan of the loan.”

- “Regardless if you are borrowing, lending, staking or Hodling you are always earning yield from the crypto in your MELDapp.”

- “Once the smart contract is in place, your loan is electronically transferred to your bank account anywhere in the world.”

- “Make monthly payments to pay back the interest and principal of your loan. Once the loan is paid off, your collateral is released to you.”

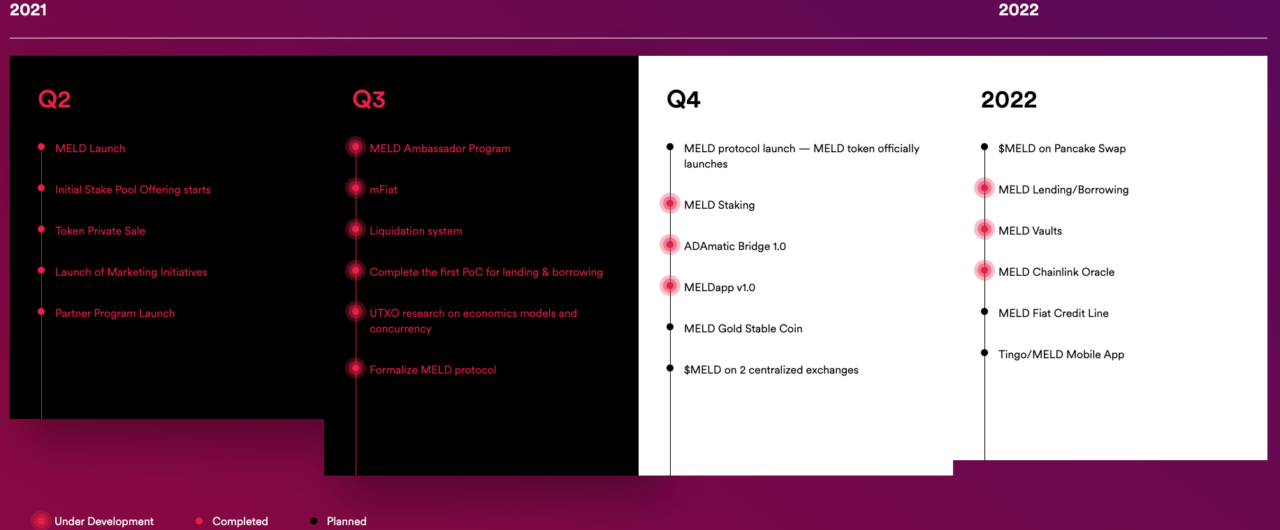

And this is MELD’s roadmap:

Paribus ($PBX)

Paribus describes itself as “a cross-chain borrowing and lending protocol for NFTs, liquidity positions, and synthetic assets, powered by the Cardano blockchain.”

Here are the things you can do with Paribus:

- “Lend, borrow or stake synthetic assets”, thereby “increasing capital efficiency or investment flexibility, across any chain”

- Get “NFT collateral-based loans”; this allows you to “borrow against your investment, freeing up your capital while the underlying NFT appreciates in value”

- Get “LP collateral-based loans”; this allows you to “borrow against your AMM liquidity positions, allowing you to leverage up while staking or earning through LP’ing”

- Participate in “PBX token profit sharing”; this means you can “earn a percentage of fees collected by the network, based on a tiered staking model”

- Participate in “NFT staking”, which means you “pool with other like-NFTs, earning yield on your NFT assets”

- Participate in “LP staking” (this means “market specific staking pools for LP tokens from multiple blockchain based liquidity pools”)

$PBX is “Paribus’ native governance token, allowing holders to create and vote on proposals relating to protocol guidance.” Its goal is “to align the incentives across the Paribus yield protocol, creating a codified harmony between stakeholders, the protocol itself, and the security of the assets contained within it.” $PBX holders are “also entitled to a percentage of fees earned by the protocol, relative their stake. The bigger the stake, the greater the tier, and the larger the percentage

token holders are also entitled to a percentage of fees earned by the protocol, relative their stake. The bigger the stake, the greater the tier, and the larger the percentage earned.”

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Photo by “niekverlaan” via Pixabay