Cryptocurrency investment products have seen their assets under management (AUM) hit a new all-time high of $72.3 billion ahead of the launch of the first bitcoin futures exchange-traded fund (ETF) in the United States.

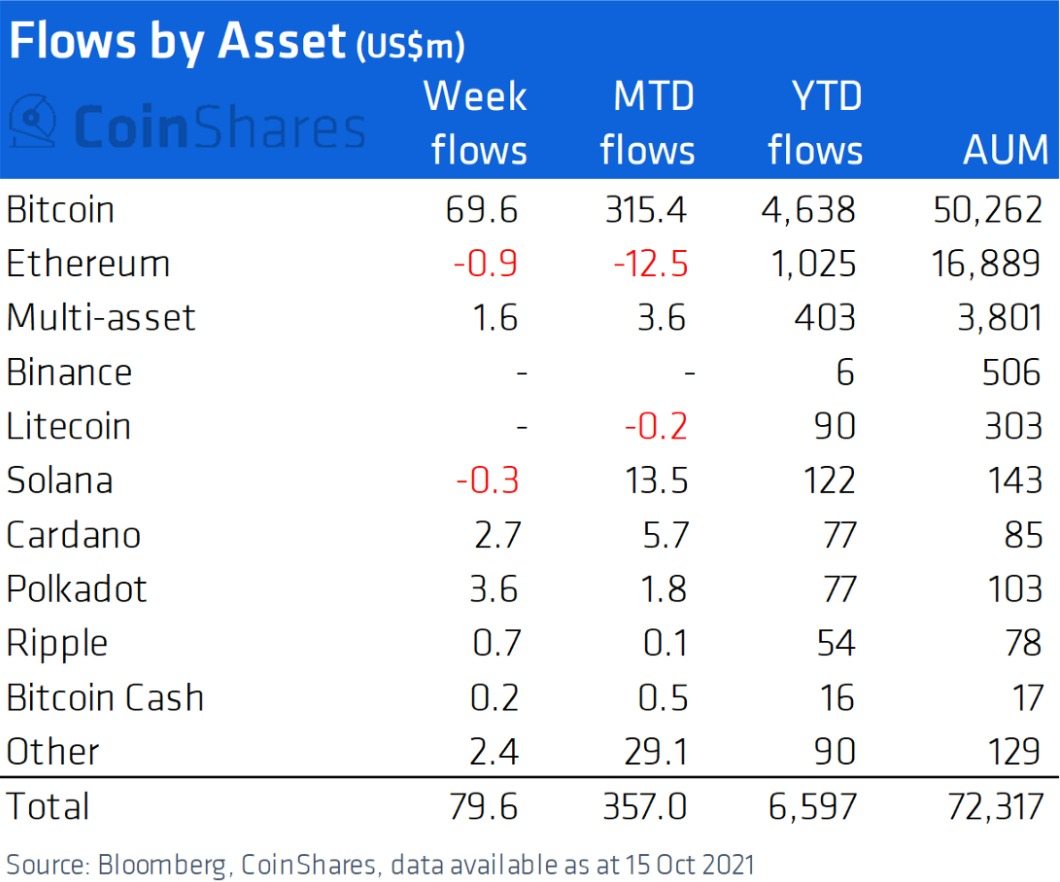

According to a report published by CoinShares, inflows totaling $80 million this past week coupled with cryptocurrency price rises have led to the new all-time high, surpassing the previous all-time high of $71.6 billion in assets under management.

Bitcoin accounted for $70 million of inflows, making it the fifth consecutive week the flagship cryptocurrency has seen inflows, although overall crypto inflows remain “much lower than inflows seen in the first quarter of 2021, where there was much greater participation by US investors.

Etheruem notably saw outflows of $1 million, after seeing $14 million of outflows in the previous week. Altcoins like Cardano ($ADA) and Polkadot ($DOT) contributed to the weekly inflows, with ADA bringing in $2.7 million and DOT $3.6 million.

Bitcoin’s price has climbed over the past week t surpass the $62,000 mark ahead of the launch of the first bitcoin futures ETF, which is officially debuting today, October 19. The much-anticipated ETF will give investors exposure to the cryptocurrency while tracking the bitcoin futures market and will trade on the NYSE under the “BITO” ticker.

Other bitcoin futures ETF applications are hoping to move forward with trading this month, so a second futures-based bitcoin ETF could launch in the near future. A bitcoin ETF being approved in the U.S. is the culmination of a nearly decade-long campaign to list such a product. Crypto advocates have been looking to list an ETF ever since Cameron and Tyler Winklevoss, the founder of the Gemini exchange, filed the first Bitcoin ETF application in 2013.

According to CoinShares, the listing of a bitcoin futures ETF in the U.S. could “prompt further significant inflows in the coming weeks as US investors begin to add positions.”

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Unsplash