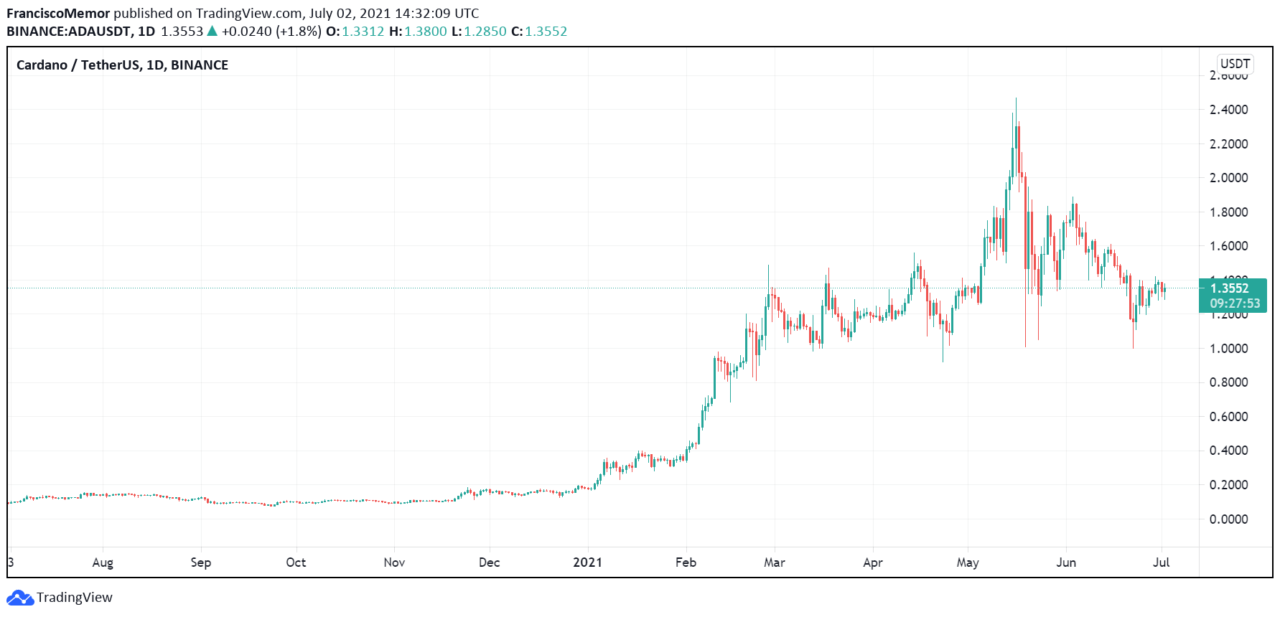

Cryptocurrency asset manager Grayscale Investments has rebalanced its Digital Large Cap Fund (GDLC) to add a new Cardano (ADA) component to the fund, allowing investors to also gain exposure to the cryptocurrency, which moved up over 1,000% in the last 12 months.

According to Grayscale, the fund’s portfolio sold “certain amounts of the existing Fund Components” in proportion to their respective weightings and used the cash proceeds to add Cardano’s ADA to the fund. The move comes after a similar one was made to add Chainlink (LINK) to the fund in April of this year.

Edward McGee, Vice President of Finance at Grayscale, was quoted saying:

We are excited to welcome Cardano to our Digital Large Cap Fund’s portfolio as we work to ensure that our diversified Fund can safely hold assets that collectively comprise 70% of the entire digital asset market

The fund is now composed of a basket of top cryptocurrencies, with 67.47% of it being BTC, 25.39% ETH, 4.26% ADA, 1.03% BCH, 0.99% LTC, and 0.86% LINK. Per share, the funds holds 0.71069603 ADA and it regularly distributes its components to pay for ongoing expenses, meaning “the amount of Fund Components represented by each Share gradually decreases over time.”

As CryptoGlobe reported, Grayscale is reportedly exploring 13 new investment products, including ones tied to the popular Polygon (MATIC) cryptocurrency and to Solana (SOL). It has well over $30 billion worth of assets under management, with the lion’s share being in its Grayscale Bitcoin Trust (GBTC).

Grayscale’s funds allow investors to gain exposure to cryptocurrencies without having to manage any private or public keys. It adds an ADA component to its Digital Large Cap fund after the cryptocurrency moved up over 1,000% in the last 12 months and ahead of a major upgrade to the network.

The cryptocurrency’s price exploded ahead of the widely anticipated Alonzo upgrade, which will bring smart contracts to the Cardano network and allow it to host decentralized finance applications to compete with Ethereum, Binance Smart Chain, Polkadot, and Solana.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.