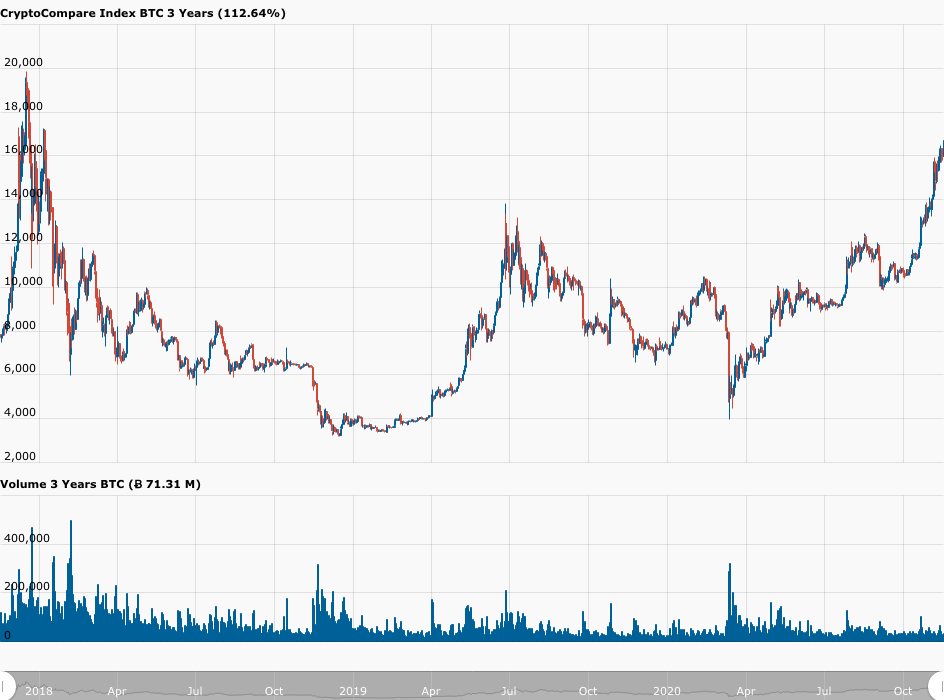

According to data from CryptoCompare, around 19:15 UTC on Monday (November 16), the Bitcoin price surged above $16,800 to a new all-time high, seemingly thanks to three catalysts.

Within 5 minutes (i.e. by 19:20 UTC), the Bitcoin price had reached $16,844, which is the highest it has been since 7 January 2018.

So, what are the catalysts for today’s (roughly) 6% increase in the price of Bitcoin?

First, over the weekend, the crypto community found out that Citibank’s Thomas Fitzpatrick, a Managing Director who is the Global Head of CitiFXTechnicals Product Within the G10 FX Business, had sent out a “CitiFX Wire Market Commentary” titled “Bitcoin: 21st Century Gold” to the bank’s institutional clients. In this research note, Fitzpatrick used technical analysis to determine that the Bitcoin price could go as high as $318,000 by December 2021.

Although a copy of the leaked note got released on CryptoTwitter last Friday evening, it was not until today that most crypto news outlets and major crypto influencers started talking about it.

Second, Mike McGlone, a Senior Commodity Strategist at Bloomberg Intelligence (BI), Bloomberg’s research arm on the Bloomberg Terminal, who had previously predicted that the Bitcoin price could reach $100K by 2025, said today that Bitcoin appears to be in an early price-discovery stage and its market cap is heading toward $1 trillion.

Since Bitcoin’s market cap is currently around $312 billion, for it to reach $1 trillion, the Bitcoin price would have to only reach $54,000 for the market cap to exceed $1 trillion.

Third, at 12:00 UTC, American biotechnology company Moderna announced via a press release that “the independent, NIH-appointed Data Safety Monitoring Board (DSMB) for the Phase 3 study of mRNA-1273, its vaccine candidate against COVID-19, has informed Moderna that the trial has met the statistical criteria pre-specified in the study protocol for efficacy, with a vaccine efficacy of 94.5%.”

This news greatly cheered the U.S. stock market, and when the Dow, the S&P 500, and the Nasdaq Composite all go up on a day where the U.S. dollar index is down, usually a risk asset such as Bitcoin also benefits from the risk-on mood.

As of 20:05 UTC (or 15:05 EST), the Dow, the S&P 500, and the Nasdaq Composite are all trading in the green territory, up 1.06%, 0.67%, and 0.29% respectively.

According to a report by CNBC, Mark Hackett, chief of investment research at Nationwide, wrote in a note:

“Encouraging vaccine news continues to support pro-cyclical and value sectors, which have seen strong relative performance this month after a period of historic underperformance,” said Mark Hackett, chief of investment research at Nationwide, wrote in a note… Supporting this rotation is the prospect for additional stimulus, continued improvement in earnings, a historic valuation gap and the prospect for improving global trade under a Biden administration… By and large, investors are taking a glass-half-full view of the markets right now.”

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.