The strengthening of the U.S. dollar in the past couple of days, as well as the current risk-on environment that is helping U.S. stock indexes continuously set new record highs, seems to be hurting the prices of safe haven assets gold and Bitcoin.

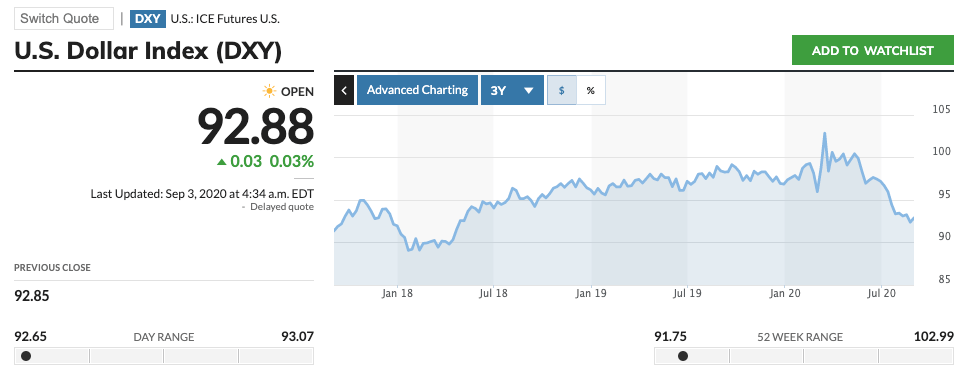

The “U.S. Dollar Index” (DXY)—which is “designed, maintained, and published by ICE (Intercontinental Exchange, Inc.)”—is “an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies”. These other currencies are EUR, GBP, JPY, CAD, SEK, and CHF.

As you can see in the five-day and three-year DXY charts (by MarketWatch) shown below, at 03:55 EDT on Tuesday (September 1), DXY reached 91.78, its lowest value since April 2018:

So, what is behind the dollar’s bounceback and is the dollar likely to continue heading higher in the short term?

According to a Reuters report published earlier today, after EUR-USD reached $1.20 on Tuesday, the European Central Bank (ECB) expressed concern that if this exchange rate (which was as low as 1.08 back in the middle of May) continues to go up, it could hurt the European Union’s exports and “intensify pressure for more monetary stimulus,” and ECB’s chief economist Philip R. Lane was quoted as saying that the euro-dollar rate “does matter” to monetary policy.

Reuters also pointed out that “a stronger currency is disinflationary, making imports less expensive and contributing to tighter financial conditions.”

Boris Schlossberg, managing director for FX strategy at BK Asset Management, told Reuters:

“At this point, the policy makers can do little to control the FX flows but if their jawboning takes effect the EURUSD could retreat towards the $1.1700 figure as medium-term traders take profits from the current rally.”

He later added:

“Euro’s weakness, in turn, would lead to dollar strength and would be yet another reason for equities to turn lower as U.S. assets become more expensive in other currencies.”

As for where DXY is headed next, on Friday, we will have the U.S. non-farm payrolls report, which could have some impact on the dollar’s short-term price action.

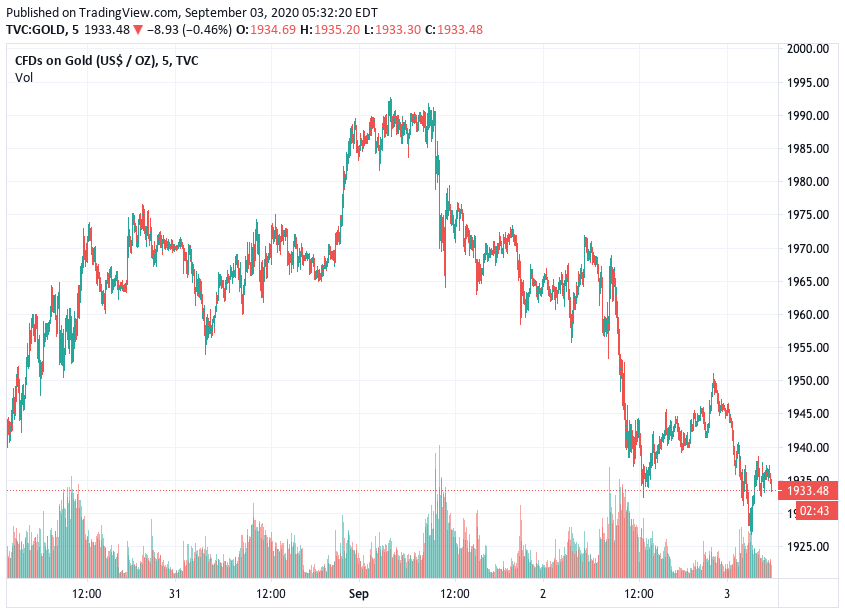

The drop in the prices of both gold and Bitcoin seems to be partly due to the strengthening of the U.S. dollar index and partly due to selling pressure in both markets.

Spot gold is currently (as of 5:20 EDT on September 3) trading around $1,936.20 an ounce, down 0.36% on the day.

As you can see in the five-day price chart below by TradingView, at 04:00 EDT on Tuesday (September 1), CFDs on gold reached $1,992.37 an ounce, its highest price so far this week; this was around the same time that the dollar index was at 91.78, its lowest value so far this year.

Since then, CFDs on gold have gone down to $1,933.48 an ounce, which is a loss of 2.95%. During the same period, the U.S. dollar index has gone from 91.78 to 92.84, which is an increase of 1.15%.

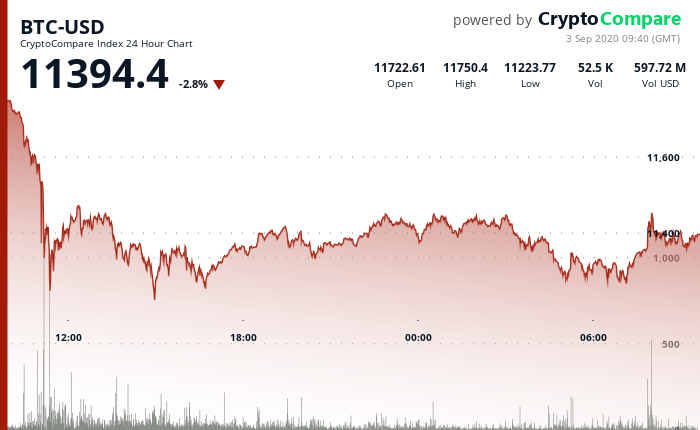

As for Bitcoin, around 04:00 EDT on Tuesday (September 1), when DXY started its bounce-back and gold started to go on a downward trajectory, Bitcoin reached an intraday high of $11,943 (according to data from CryptoCompare).

Currently (as of 09:40 UTC on September 3), Bitcoin is trading around $11,394, down 2.8% vs USD in the past 24-hour period and down 4.6% vs USD since its intraday high on Tuesday.

With the prices of both safe haven assets going lower and prices of equities heading higher, it is clear that investors are in a “risk-on” mood.

On Wednesday (September 2), the U.S. stock market enjoyed another good day, with the Dow going up 454 points (or 1.59%) to close at 29,100.50, above the 29,000 level for the first time since February 20.

The S&P 500 and the Nasdaq managed to close at record highs (3580.84 and 12056.44 respectively).

The optimistic mood in the equities market could partly be due to encouraging news on the COVID-19 vaccine front.

According to Reuters, Italian Health Minister Roberto Speranza telling the Italian parliament on Wednesday that AstraZeneca’s potential COVID-19 vaccine could be on the market before the end of the year:

“We are talking about a potential vaccine so we need to be extremely prudent, but… if the vaccine is confirmed as safe and able to meet its objective it will be already available by the end of 2020.”

Now, coming back to Bitcoin, is interesting to see what blockchain analytics startup CryptoQuant has to say about the big movement of BTC from miners’ wallets to exchange wallets, which could suggest that more selling pressure might be laying ahead:

Dutch crypto analyst/trader “@CryptoMichNL” offered this technical analysis of Bitcoin’s price action:

Featured Image by “NikolayFrolochkin” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.