The fallout from the release by the Federal Reserve of the minutes from the Federal Open Market Committee (FOMC) meeting held July 28–29 seems to be continuing to strengthen the dollar and pushing down the price of both gold and Bitcoin.

Around 18:00 UTC (i.e. 14:00 EDT) on Wednesday, the Fed released the minutes of the two-day FOMC meeting it held at the end of last month:

For the purpose of our discussion, we have highlighted below the most interesting part of the minutes:

“Participants observed that uncertainty surrounding the economic outlook remained very elevated, with the path of the economy highly dependent on the course of the virus and the public sector’s response to it…

“With regard to the outlook for monetary policy beyond this meeting, a number of participants noted that providing greater clarity regarding the likely path of the target range for the federal funds rate would be appropriate at some point…

“A majority of participants commented on yield caps and targets—approaches that cap or target interest rates along the yield curve—as a monetary policy tool.

“Of those participants who discussed this option, most judged that yield caps and targets would likely provide only modest benefits in the current environment, as the Committee’s forward guidance regarding the path of the federal funds rate already appeared highly credible and longer-term interest rates were already low.

“Many of these participants also pointed to potential costs associated with yield caps and targets. Among these costs, participants noted the possibility of an excessively rapid expansion of the balance sheet and difficulties in the design and communication of the conditions under which such a policy would be terminated, especially in conjunction with forward guidance regarding the policy rate.

“In light of these concerns, many participants judged that yield caps and targets were not warranted in the current environment but should remain an option that the Committee could reassess in the future if circumstances changed markedly.”

As you can see, the committee decided to hold off on implementing “yield caps and targets”, i.e. yield curve control (YCC).

Here is how Brookings Institution explained YCC in a blog post published on June 5:

“Under yield curve control (YCC), the Fed would target some longer-term rate and pledge to buy enough long-term bonds to keep the rate from rising above its target. This would be one way for the Fed to stimulate the economy if bringing short-term rates to zero isn’t enough.”

The Fed’s “uncertainty surrounding the economic outlook” and its concern over the costs of implementing YCC—among which was “the possibility of an excessively rapid expansion of the balance sheet”—reduces the possibility of further monetary stimulus in the near future.

Also, if the Fed is not going to implement YCC now, it means that it does not need to buy long-term bonds— which would push up bond prices and push down long-term interest rates. Both of these are good news for the U.S. dollar and bad news for gold and Bitcoin since both of these safe haven assets are often bought as hedges against money printing by central banks and weakening of fiat currencies.

As MarketWatch reported on Thursday (August 20), this was “not as dovish a message from the Fed as had been hoped, which nudged the dollar higher and weighed on bullion.”

The “U.S. Dollar Index” (DXY)—which is “designed, maintained, and published by ICE (Intercontinental Exchange, Inc.)”—is “an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies”. These other currencies are EUR, GBP, JPY, CAD, SEK, and CHF.

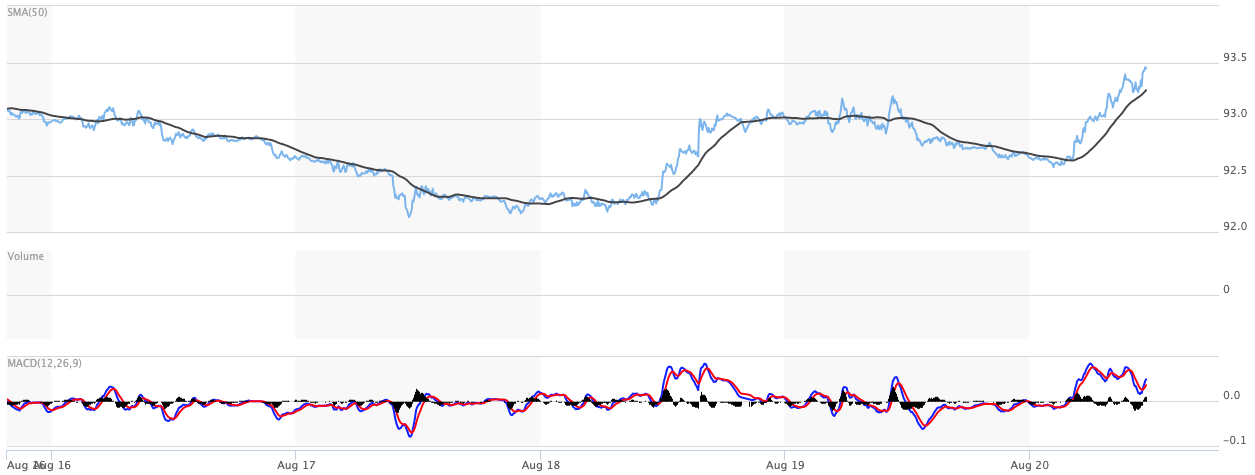

As you can see in the chart (by MarketWatch) shown below, at 14:00 EDT on August 19, when the minutes of last month’s FOMC meeting were released, DXY was at 92.67:

Currently (as of 15:15 UTC or 10:15 EDT on August 21), DXY is at 93.43, up 0.68% today, and up 0.82% since the time of the release of the minutes of the FOMC meeting.

At the time of writing, gold is trading around $1,935, down 0.65%, and Bitcoin is trading around $11,740, down -0.93%.

Popular crypto analyst/trader “Crypto Michaël” agrees that today’s decline in the prices of silver, gold, and Bitcoin are due to the strengthening of the U.S. dollar, which means that, barring any unforeseen circumstances, the current consolidation of the Bitcoin price is likely to last for some time:

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.