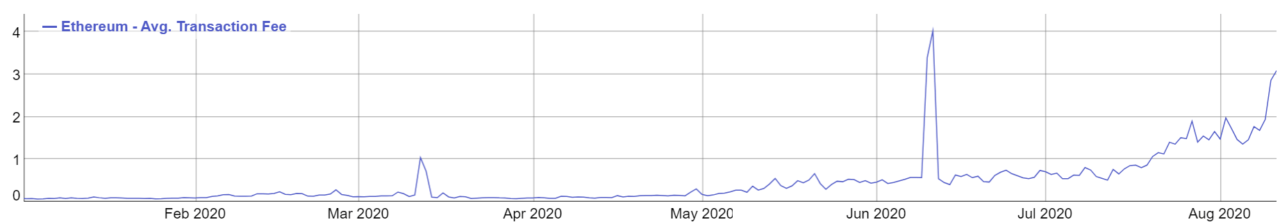

The cost of transacting on the Ethereum network has gone up by 3,500% on average, making it more expensive to send and receive transactions and use decentralized applications and decentralized finance (DeFi) protocols.

According to BitInfoCharts, at the beginning of the year, the average transaction fee paid to move ether on the blockchain was $0.084, but with the growing interest in decentralized finance and the cryptocurrency’s price rising, the average fee is now above the $3 mark.

Ethereum transaction fees are measured in Gas, and used to pay for operations on the cryptocurrency’s network. These don’t just include regular transactions, but also interactions with smart contracts and decentralized applications. Fees going up means that using Ethereum projects is becoming more costly.

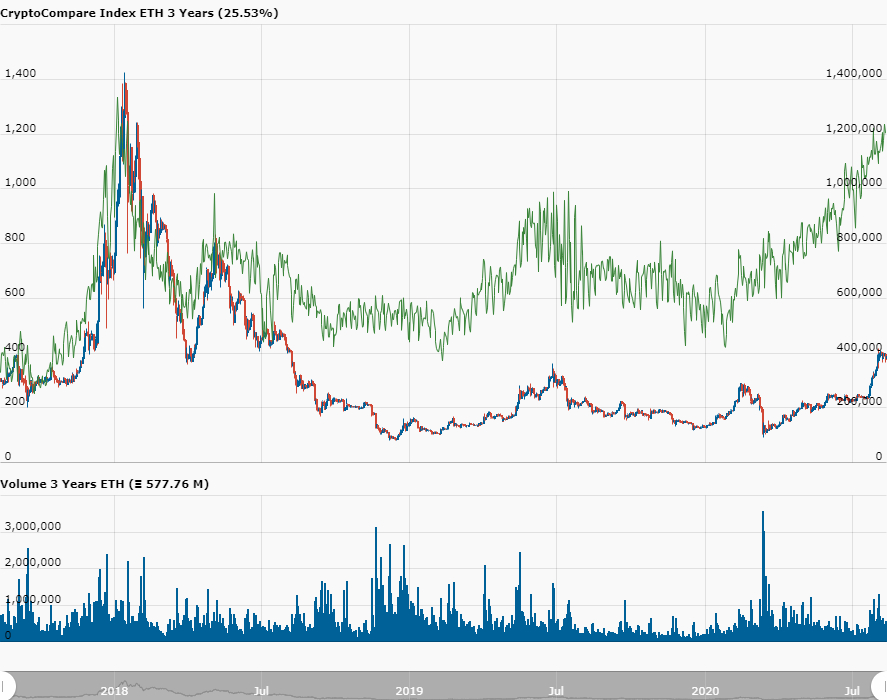

Data from Ethereum blockchain explorer Etherscan shows that the network has been using over 70 billion Gas per day on transactions, with the total number of transactions being confirmed on the network surpassing one million per day since late June, coming close to figures seen in January 2018, when ETH’s price hit a new all-time high above $1,400 per coin.

Fees on the network have been going up partly because of increasing interest in the decentralized finance space, which now has nearly $5 billion worth of cryptoassets locked in it, up from less than $1 million earlier this year.

The growing interest has been such that cryptocurrency trading platforms have rushed to list DeFi-related tokens. OKEx, for example, has listed the Aragon (ANT) token earlier today, and the Aave (LEND) token earlier this week.

There are limits to the transaction fees the network can process, although miners can slowly raise them by increasing the amount of Gas that can be paid per block. Earlier this year, reacting to an increase in fees and network congestion, ETH miners pushed the Gas limit from 10 million to 12.5 million per block, giving the network a 25% boost.

While transaction fees did drop temporarily, they came back up again, and moving funds on the Ethereum blockchain is once again becoming expensive for users. Da Hongfei, the co-founder of Ethereum rival NEO, pointed out increasing gas fees become “a heavy burden to users” on social media.

Ethereum’s Scalability

The biggest spenders on the cryptocurrency’s network, according to EthGasStation, include the popular USD-pegged stablecoin Tether, two alleged Ponzi schemes, and various decentralized exchanges, including Uniswap, IDEX, and the Kyber Network.

The second-largest cryptocurrency by market cap is, however, making progress towards solving its scalability problems on the base layer, through Ethereum 2.0., a network upgrade that will replace the Proof-of-Work (PoW) consensus algorithm with Proof-of-Stake (PoS) among other things, and is expected to deliver a substantial boost to the network’s capacity.

This will be achieved through a feature that will allow transactions to be processed simultaneously instead of consecutively, known as shard chains. Here’s how ConsenSys puts it:

Each shard chain is like adding another lane to upgrade Ethereum from a single lane road to a multiple lane highway. More lanes and parallel processing leads to much higher throughput.

OKEx Pool, a crypto mining pool built upon OKEx, has been a pioneer in supporting the construction of the ETH ecosystem and its development towards Ethereum 2.0, by becoming one of the first large mining pools to join the Ethereum.20 Topaz testnet as a validator.

Featured image via Pixabay.