Bitcoin (BTC) is again retesting the $10,000 price level at time of writing, and this level has become the established centerline of a huge consolidation structure. As this structure grins toward its conclusion, we consider possible outcomes.

First, we look at the 8-hour chart to get a detailed picture. We see that Bitcoin is again in the familiar $10,000 zone, which has been heavily supported during the last two months. But the actual trendline of the structure is below this level, currently at about $9,600, and we are likely to see some kind of retest of this level.

Both trendlines of the structure seem to be shrinking, collapsing in on the $10,000 price level. There is very little volume either way, reflecting the state of Bitcoin at the end of a consolidation.

Moving back to the daily, we see the full structure and its progression. Volume has trickled down to a fraction of its summer levels, as the $10,000 price is established as the agreed-to price for this time period.

It seems that the pattern, if seen generously, could continue well into October if the top trendline is tested and respected. But it’s clear the BTC is now entering the breakout zone, where a break of the structure could come at any time.

Going to the 3-day, we note that the structure most resembles a symmetrical triangle pattern, which is a neutral consolidation pattern. The structure sits atop a general uptrend in the long term, which makes it look like a bull flag or pennant and may give us a slightly more bullish bias. But, in these situations, a fakeout down and then a break up is pretty common.

If price were to break down, we can expect only about 20% of downside from the present position. The knot of support between the high $8,000 and low $7,000 range is likely to hold the leading crypto on the way down, and a test of this area would not even necessarily destroy the long term uptrend.

It is noteworthy also that Bitcoin dominance has got a slight bump after retreating earlier in the month from extreme highs above 70%. It is still not certain if this contraction in the altcoin market is permanent, or if they are due for lengthy uptrends to reclaim their market shares.

Bitcoin has become very boring, and with price compressing into a dense knot around $10k. But as we all (should) know very well, the more boring Bitcoin gets, the closer we get to a return to bit volatility.

The views and opinions expressed here do not reflect those of CryptoGlobe.com and do not constitute financial advice. Always do your own research.

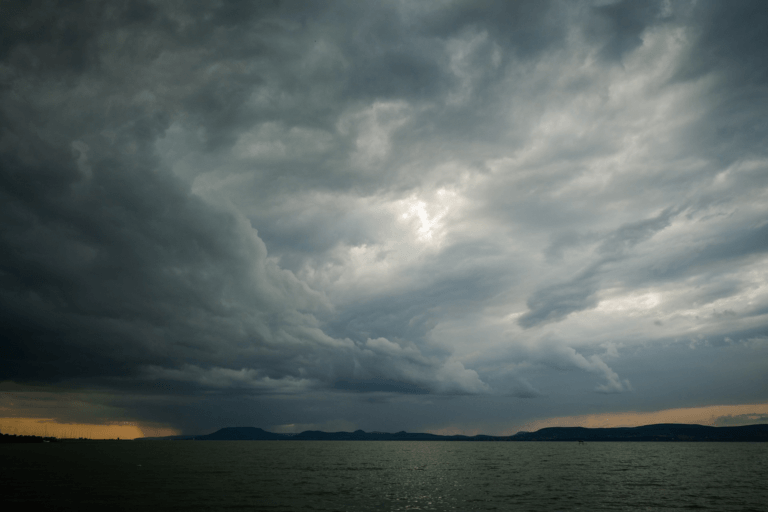

Featured Image Credit: Photo via Pixabay.com