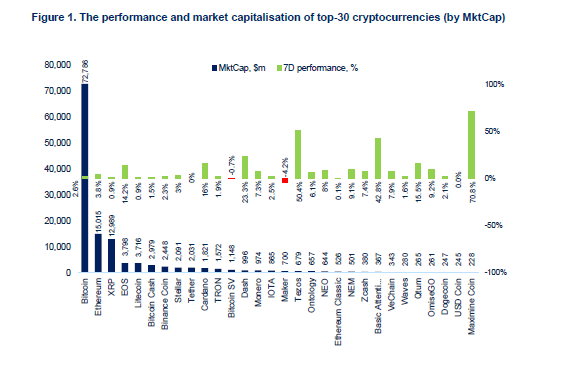

Last week’s performance of digital assets is signaling a clear uptrend, where the total market cap gained more than 6% ($145bn). Bitcoin has broken a long-term channel resistance adding almost 3% ($4140) and continues in a uptrend channel formed in mid-February. ETH ($143), XRP ($0.31) and LTC ($60.7) were also conservatively following a positive trend, adding 3.8%, 1% and 0.8% respectively. EOS ($4.2) is leading a group of the 5 largest assets, with more than 14% gains. The rest of the top-30 coins except Maker (-4.1%) have recorded more significant gains, where Tezos is up by 54% reacting on Coinbase’s staking support, Dash by 24%, BAT by almost 40% and Cardano keeps rising for the second week with a further 16%.

Crypto Market News

Bitmain IPO Cancelled

Cryptocurrency mining giant Bitmain has failed to proceed further with the IPO on the Hong Kong Stock Exchange, as its application expired on March 26th. Despite massive profits in 2017 ($700m), Bitmain lost $400m in 2Q18 and $500m in 3Q18.

BlockFi to Cut Interest Rate for Lenders

Crypto lending start-up BlockFi has announced changes just after a one week after launch. For accounts with more than 25 BTC/500ETH the interest rate will only be 2% instead of the 6% originally announced.

Bithumb $13 Million Hack

Large South Korean crypto exchange Bithumb has lost $13m worth of EOS in a second hack this year, which is suspected to be an insider job. More than 3m EOS coins which were owned by Bithumb were stolen from the exchange’s hot wallet. Customers’ funds have not been affected. Bithumb lost $30m almost a year ago, of which almost $14m was returned.

Rakuten Wins License for Crypto Exchange

Japanese e-commerce giant Rakuten has been granted a license to operate a crypto exchange by the country’s Financial Service Agency (FCA).

Börse Stuttgart Partners with Axel Springer to Launch Crypto Trading Venue

Germany’s second largest stock exchange Börse Stuttgart (€71.2bn volume) is partnering with the digital publishing company Axel Springer and its subsidiary finanzen.net to launch a crypto trading venue. The trading venue is supposedly set for launch in summer 2019.

Ledger Partners with Legacy Trust to Offer Institutional Custody of ERC-20 Tokens

Hardware wallet maker Ledger has partnered with Hong Kong-licensed trust and custody firm Legacy Trust, to offer institutional grade custody of digital assets. According to Legacy Trust’s CEO Vincent Chok, demand for ERC-20 custody is “huge and it’s only growing bigger”. “Since the beginning of 2019, we have basically received around five requests for ERC20 custody per week”, Chok added.

Coinbase Adds Support for Staking Services

Coinbase Custody has announced an expansion of its business, giving institutional investors the option to earn rewards offered by proof-of-stake digital assets. Coinbase’s staking as a service will launch with support for Tezos.

Last Week in Funding

Crypto hedge fund Pantera is close to raising $175m for its third fund; Tron Foundation has acquired app store CoinPlay for an undisclosed amount; Thailand’s largest private company CP Group, has acquired crypto payment company Omise (OMG) for $150m.

Security Token News

tZERO to Launch Bitcoin Trading App

US-based security token exchange tZERO with help in development from Bitsy (the portfolio company of tZERO’s parent company Overstock), will launch a mobile trading app for buying and selling bitcoin this summer. The app will allow its users to hold custody and for key recovery mechanism too.

eToro Acquires Smart Contract Start-up Firmo

Investing platform eToro has acquired smart contract start-up Firmo, which enables the tokenisation of derivatives on any major blockchain. The goal of the acquisition is to tokenise all assets offered on eToro’s platform and accelerate the growth of tokenised offerings.

Smart Contract Firm UMA to Launch S&P 500 Digital Token

Smart contract platform UMA, which is affiliated with Two Sigma Ventures-backed Risk Labs, is bringing the S&P 500 on the blockchain with the launch of a ERC-20 token, that will represent the ownership in 500 largest 500 companies in the US financial markets. The token will initially be available on decentralised exchange DDEX, not tradable for US citizens and only purchasable with stable coin DAI.

AlphaPoint Upgrades Security Token Technology Stack

Blockchain Service firm AlphaPoint has upgraded its security token tech stack, in order to attract institutional-grade issuers of security tokens.

Regulatory News

New York Grants 18th BitLicense

NYDFS has granted its 18th BitLicense to prime broker start-up Tagomi, which offers BTC, ETH, LTC and BCH trading services.

Hong Kong Securities Regulator Issues Detailed Guidance for Security Tokens

The Securities and Futures Commission of Hong Kong has issued official guidance on security tokens which effectively falls under the existing securities laws in Hong Kong. Issuers are obligated to acquire a license and register with the regulator, intermediaries are required to comply with the existing Code of Conduct and STO operators are only allowed to sell digital securities to institutional investors.

SEC Postpones Decision on Bitcoin ETFs

The US SEC has postponed two decisions on bitcoin ETF proposals by VanEck/CBOE and BitWise/NYSE. The extended deadlines are due on May 16th and May 21st respectively. In case of the further extensions, the SEC’s final deadlines will be October 13th and October 18th 2019.