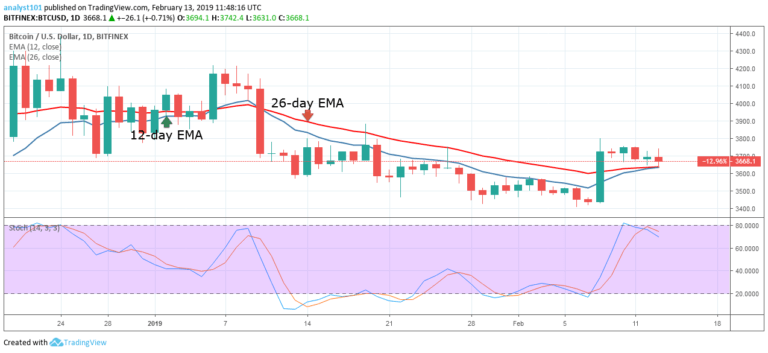

BTCUSD Medium-term Trend: Bullish

- Resistance levels: $7,000, $7,200, $7,400

- Support levels: $3,800, $3,600, $3,400

Last month, February 22, the bulls broke the $4000 resistance level but were resisted the following day at the $4,200 price level. The price fell to a low of $3,831. Last week, March 5, the bulls broke the 12-day EMA and the 26-day EMA as the price reached a high of $3,951.60.

On March 9, the crypto tested the resistance zone at a price of $4,017.20 but was repelled. Today, the bulls failed to break the $4,000 resistance level as the crypto’s price commenced a price retracement. On the downside, if the price retraces and breaks below the EMAs, the crypto’s price will fall to a low of $3,800 .

On the upside, if the crypto’s price is sustained above the EMAs and more buyers are introduced, then the BTC price will break the $4,000 price level and reach the previous high of $4,200. Meanwhile, the stochastic indicator is out of the oversold region but above the 40% range which indicates that the crypto is in a bullish momentum and a buy signal.

BTC/USD Short-term Trend: Bearish

On the 4-hour chart, the price of Bitcoin was in a bearish trend. The resistance at the $4,000 price level has resulted to price breaking the 12-day EMA and the 26-day EMA. The crypto’s price is below the EMAs which indicates that the price will further depreciate.

On the other hand, the bulls are making an attempt to break the EMAs. If the bulls fail to break above the EMAs, the crypto’s price will fall to its previous low at $3,800 price level. Meanwhile, the stochastic band is out of the oversold region but above the 40% range which indicates that the crypto is in a bullish momentum and a buy signal.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.

Bitcoin Chart by TradingView

Bitcoin Chart by TradingView