BTCUSD Medium-term Trend: Bullish

- Resistance levels: $7,000, $7,200, $7,400

- Support levels: $3,900, $3,700, $3,300

The price of Bitcoin is in the bullish trend zone. The BTC price is now trading above the $4,000 price level. Yesterday, the crypto’s price was resisted at the $4,145 price level. The BTC price faces resistance at the $4,145 and $4, 200 price levels. The bulls have not been able to break above the $ 4,200 price level since November 24, 2018.

Any price movement will be resisted at the $4,200 price level. The crypto will be compelled to a range bound movement above the $4,000 price level. On the upside, if the bulls have a price breakout, the resistance level will be broken and the crypto will reach the highs of $4,500 and $5,000.

Meanwhile, the stochastic band is at the overbought region but above the 80% range which indicates that the crypto is in a strong bullish momentum and a buy signal.

BTC/USD Short-term Trend: Bullish

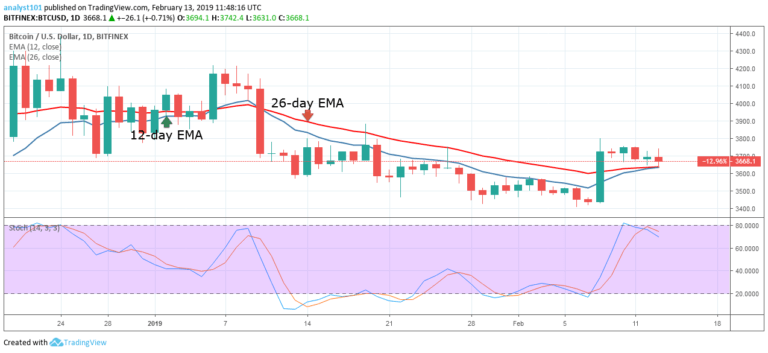

On the 4-hour chart, the price of Bitcoin is in a bullish trend zone. The BTC price reached a high of $4,083.50 and was resisted. The crypto’s price is now ranging and trending above the 12-day EMA. The 12-day EMA and the 26-day EMA are trending northward indicating the bullish trend.

On the downside, if the bears breaks below the EMAs, the crypto will fall and find support at the next low. Meanwhile, the stochastic band is out of the overbought region but above the 40% range which indicates that the crypto is in a bullish momentum and a buy signal.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.